- United States

- /

- Banks

- /

- NasdaqGS:SYBT

Should Stock Yards Bancorp’s Profitability and Book Value Gains Prompt Action From SYBT Investors?

Reviewed by Sasha Jovanovic

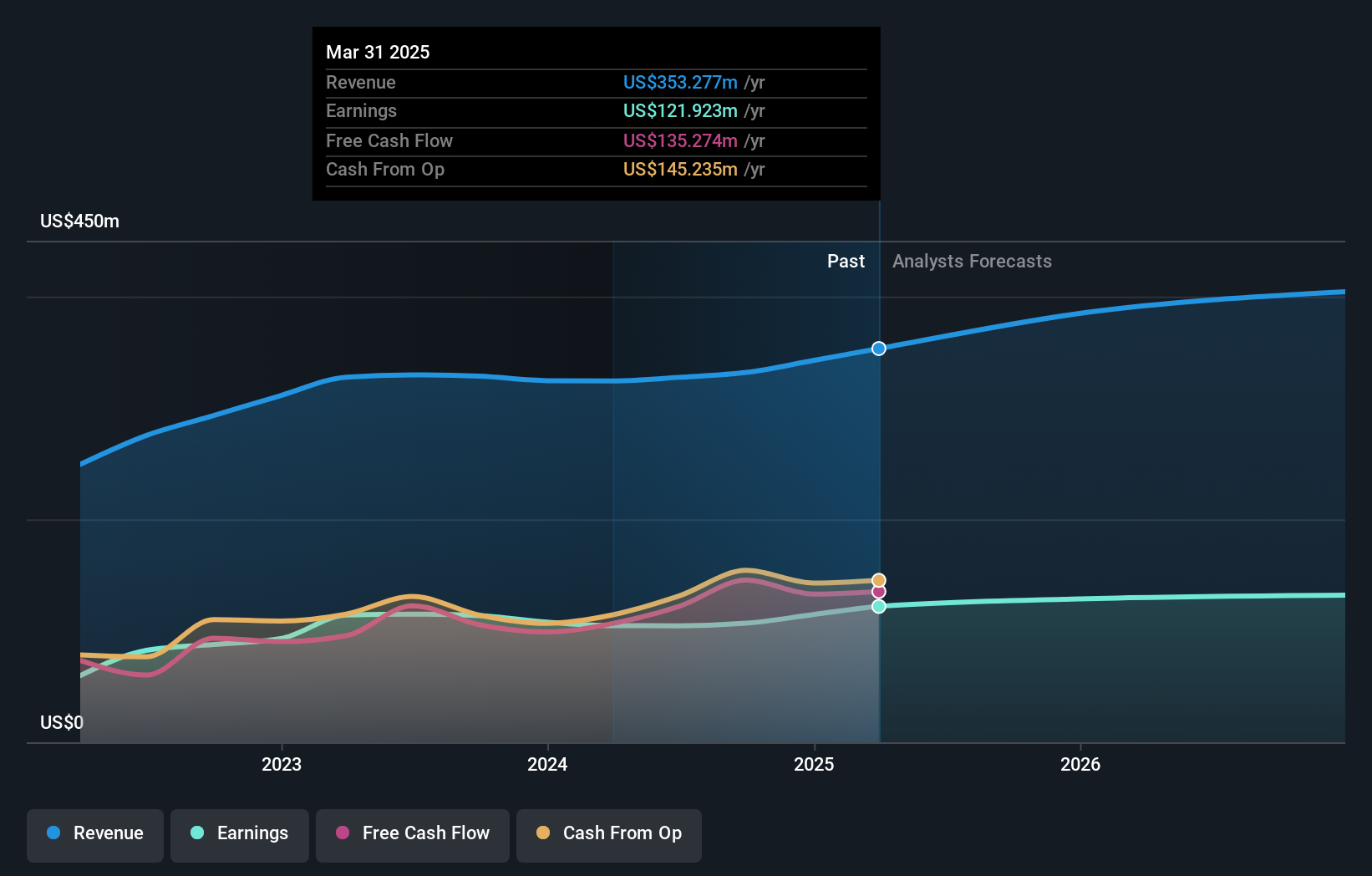

- Recent coverage highlights Stock Yards Bancorp’s robust net interest income growth, greater profitability, and an accelerating tangible book value outlook, underscoring a period of strengthening fundamentals for the company.

- An interesting insight is the tangible book value’s faster growth trajectory, which often signals improving financial strength and operational efficiency within the banking sector.

- We'll look at how Stock Yards Bancorp’s profitability gains underpin the company's evolving investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Stock Yards Bancorp's Investment Narrative?

Owning Stock Yards Bancorp often comes down to a belief in management’s ability to sustain consistent, high-quality earnings along with steady dividend growth, supported by disciplined risk controls and a focus on tangible book value expansion. The latest update highlighting robust net interest income growth and the accelerating pace of tangible book value suggests that underlying fundamentals are gaining momentum, which could strengthen the short-term catalyst around recent index inclusions and a newly authorized buyback program. However, it’s worth considering the recent price weakness and underperformance relative to industry benchmarks, as this could reflect persistent investor concerns about slower forecast profit growth or the risk of further insider selling, both of which have been flagged previously. This news may partially shift the risk narrative, but is unlikely to be materially disruptive to the company’s near-term outlook given the overall direction of its performance data.

In contrast, insider selling is one risk investors should keep front of mind.

Exploring Other Perspectives

Explore 3 other fair value estimates on Stock Yards Bancorp - why the stock might be worth just $69.89!

Build Your Own Stock Yards Bancorp Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stock Yards Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Stock Yards Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stock Yards Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYBT

Stock Yards Bancorp

Operates as a holding company for Stock Yards Bank & Trust Company that provides various financial services for individuals, corporations, and others in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives