- United States

- /

- Banks

- /

- NasdaqGS:STBA

Regional Bank Credit Concerns Might Change the Case for Investing in S&T Bancorp (STBA)

Reviewed by Sasha Jovanovic

- Recent disclosures by Zions Bancorp and Western Alliance Bancorp regarding credit quality concerns have heightened investor focus on the overall health of the regional banking sector, including S&T Bancorp, in the past week.

- Although S&T Bancorp was not directly involved in these credit events, negative sentiment has spread sector-wide, prompting closer scrutiny of loan quality and risk across regional banks.

- We'll examine how increased sector-wide caution about loan quality may influence S&T Bancorp's investment outlook and risk profile.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

S&T Bancorp Investment Narrative Recap

Shareholders of S&T Bancorp generally need to believe in the company's disciplined risk management, resilient asset quality, and the stability of its core banking franchise in key regional markets. While fresh credit quality disclosures from other regional banks have increased sector scrutiny, there is currently no material indication that S&T Bancorp’s short-term catalysts, such as stable loan growth and deposit momentum, are directly compromised, though investor caution has understandably risen around sector loan books. Among recent announcements, S&T’s report of net loan charge-offs of $1.2 million in Q2 2025 is relevant, as it ties directly to the broader market concerns about regional banks’ loan portfolios. Although this amount is modest in absolute terms for a bank of S&T’s size, management's handling and disclosure of credit costs will be closely watched as the market continues to weigh the impact of external sector headwinds on the bank’s outlook. In contrast, investors should also consider the risk that S&T Bancorp’s geographic concentration could amplify the impact of adverse regional economic or credit shocks...

Read the full narrative on S&T Bancorp (it's free!)

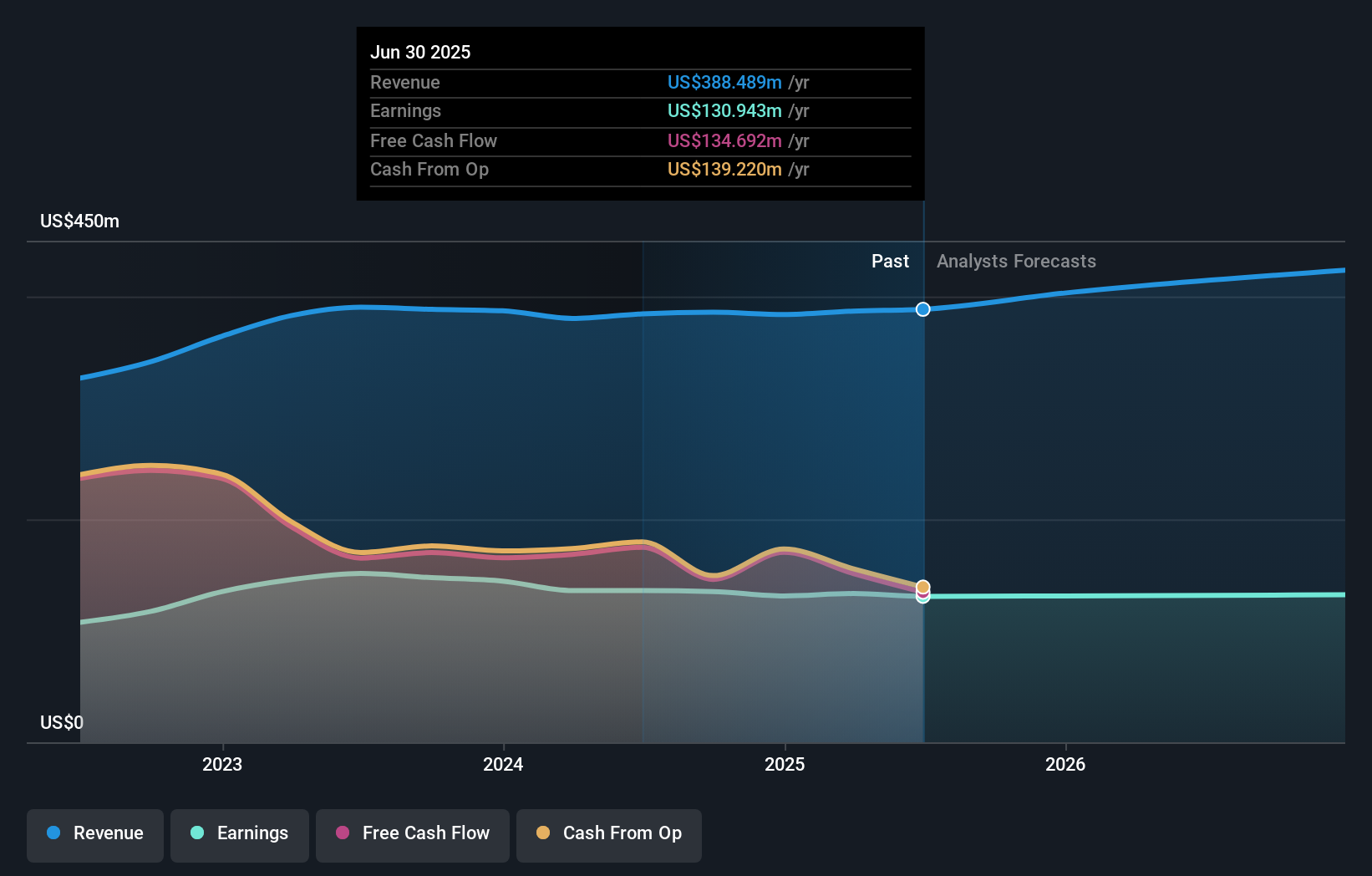

S&T Bancorp's narrative projects $457.8 million revenue and $131.6 million earnings by 2028. This requires 5.6% yearly revenue growth and a slight $0.7 million earnings increase from $130.9 million currently.

Uncover how S&T Bancorp's forecasts yield a $41.17 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Members of the Simply Wall St Community pegged S&T Bancorp’s fair value between US$39.99 and US$41.17 across 2 projections. Still, with regional credit quality in focus following peer disclosures, it is clear that many market participants weigh risks to loan growth very differently.

Explore 2 other fair value estimates on S&T Bancorp - why the stock might be worth just $39.99!

Build Your Own S&T Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your S&T Bancorp research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free S&T Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate S&T Bancorp's overall financial health at a glance.

No Opportunity In S&T Bancorp?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STBA

S&T Bancorp

Operates as the bank holding company for S&T Bank that provides retail and commercial banking products and services to consumer, commercial, and small business in Pennsylvania and Ohio.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives