Last Update 01 May 25

Fair value Decreased 1.73%Key Takeaways

- Rising competition from fintechs and non-bank lenders threatens S&T Bancorp's customer base, fee income, and long-term revenue growth.

- Geographic concentration and heightened regulatory burdens increase credit risk, operating costs, and pressure on earnings and margins.

- S&T Bancorp's disciplined risk management, strong deposit and loan growth, capital flexibility, and favorable regional trends position it for sustained earnings stability and revenue expansion.

Catalysts

About S&T Bancorp- Operates as the bank holding company for S&T Bank that provides retail and commercial banking products and services to consumer, commercial, and small business in Pennsylvania and Ohio.

- Investors may be overlooking the threat posed by digital-first fintech competitors, which are rapidly gaining market share and could erode S&T Bancorp's customer acquisition rates and fee income growth, ultimately putting downward pressure on future revenue and margins.

- S&T Bancorp's geographic concentration in Pennsylvania and Ohio exposes the company to localized economic or demographic downturns, which may impair sustainable long-term loan growth and increase credit risk, potentially leading to higher loan loss provisions and lower earnings.

- The long-term trend towards greater regulatory scrutiny and compliance obligations is likely to drive up S&T's operating costs and put continued pressure on net margins, particularly as the company exceeds the $10 billion asset threshold and incurs the Durbin amendment impact.

- The shift away from brick-and-mortar banking and toward branch consolidation could disproportionately impact S&T, as its community-driven relationship banking model depends on local market presence, risking declines in non-interest income and customer loyalty.

- Growing competition from big tech and non-bank lenders threatens to siphon off both consumer and small business deposits, as well as lending opportunities, undermining S&T's revenue growth trajectory and long-term franchise value.

S&T Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming S&T Bancorp's revenue will grow by 5.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 33.7% today to 28.8% in 3 years time.

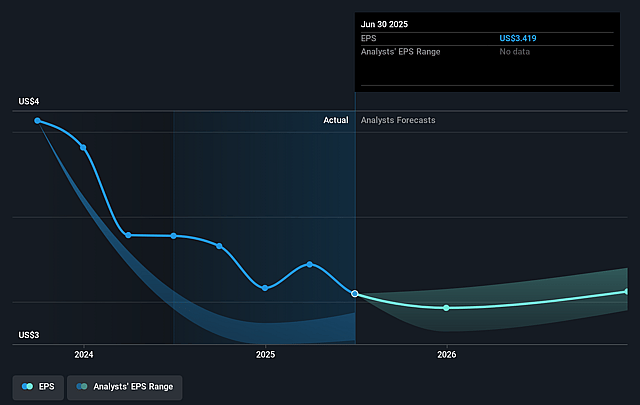

- Analysts expect earnings to reach $131.6 million (and earnings per share of $3.41) by about July 2028, up from $130.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from 11.0x today. This future PE is greater than the current PE for the US Banks industry at 11.3x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

S&T Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- S&T Bancorp's strong historical and ongoing asset quality-reflected by exceptionally low nonperforming assets, modest charge-offs, and disciplined credit risk management-supports earnings stability and resilience through cycles, potentially preventing material deterioration in net margins or earnings.

- Robust, consistent loan growth across core business lines (including commercial real estate, mortgage, and home equity) and an expanding commercial banking team signal durable revenue momentum and organic asset expansion, which can underpin higher revenues over the long term.

- Ongoing deposit franchise strength, evidenced by eight consecutive quarters of deposit growth, a healthy mix with nearly 28% noninterest-bearing deposits, and a disciplined approach to pricing, positions the company for strong net interest margin support even in volatile funding environments, countering risks to profitability.

- Ample capital (tangible common ratio above 11%) provides flexibility for both organic growth and strategic acquisitions, with management committed to disciplined M&A and expansion into adjacent markets; this could accelerate top-line growth and drive efficiency improvements that enhance future earnings.

- Secular regional economic factors-like substantial infrastructure investments and population growth in Pennsylvania, Ohio, and contiguous Mid-Atlantic markets, especially in Western Pennsylvania-create tailwinds for regional banks like S&T Bancorp, supporting long-term demand for loans and financial services, thus strengthening revenue and potential share price appreciation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $41.167 for S&T Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $457.8 million, earnings will come to $131.6 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 6.4%.

- Given the current share price of $37.63, the analyst price target of $41.17 is 8.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on S&T Bancorp?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.