- United States

- /

- Banks

- /

- NasdaqGS:STBA

Is S&T Bancorp (STBA) Fairly Priced After Its Recent 9% Share Price Climb?

Reviewed by Simply Wall St

S&T Bancorp (STBA) has quietly climbed about 9% over the past month, outpacing many regional peers as investors warm to its steady revenue and net income growth, as well as its solid longer term total returns.

See our latest analysis for S&T Bancorp.

Zooming out, the roughly 9% 1 month share price return to about $40.43 builds on a solid multi year total shareholder return. This suggests investors are gradually rewarding S&T Bancorp’s consistent, if unspectacular, growth profile.

If this steady banking story has you thinking about where else to put cash to work, it is worth exploring fast growing stocks with high insider ownership for other under the radar opportunities.

With shares now hovering around analyst targets but still trading at a hefty discount to some intrinsic value estimates, the key question is whether S&T Bancorp is a quietly mispriced compounder or a stock fairly reflecting its future growth.

Most Popular Narrative Narrative: 1.8% Undervalued

With S&T Bancorp closing at $40.43 versus a narrative fair value of about $41.17, the market is essentially hugging that projected anchor.

Analysts are assuming S&T Bancorp's revenue will grow by 5.6% annually over the next 3 years. Analysts assume that profit margins will shrink from 33.7% today to 28.8% in 3 years time.

Curious why modest revenue growth, thinner margins, and a higher future earnings multiple still point to upside? The narrative rests on one surprisingly confident profit trajectory. Want to see what it is?

Result: Fair Value of $41.17 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this thesis could be challenged if S&T’s resilient asset quality and steady loan growth sustain margins and earnings beyond current cautious expectations.

Find out about the key risks to this S&T Bancorp narrative.

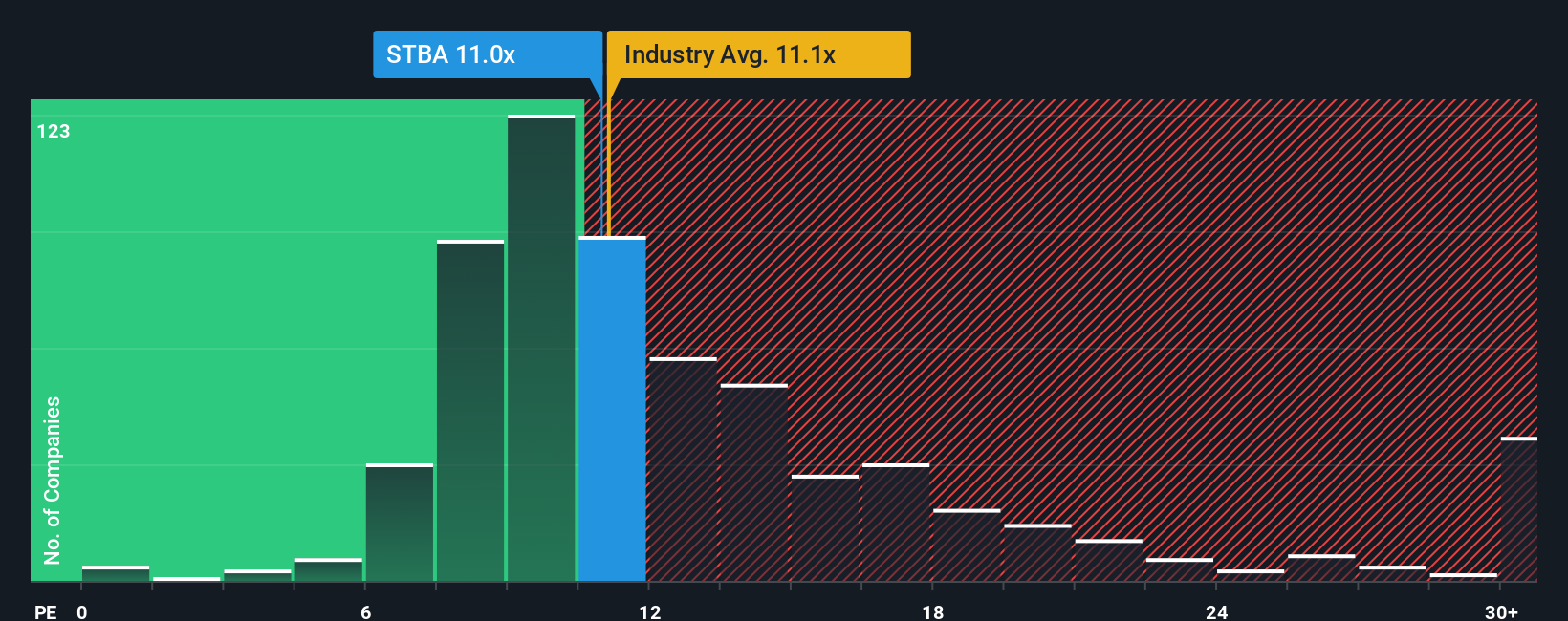

Another View: Earnings Multiple Sends Mixed Signals

Step away from narratives and STBA looks less straightforward on its price to earnings ratio. Shares trade at 11.6 times earnings, slightly richer than the US banks average of 11.5 times, above a 10.4 times fair ratio, yet cheaper than peers on 13.7 times. Is that a margin of safety or a value trap in disguise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own S&T Bancorp Narrative

If you see the story differently or want to put your own assumptions to the test, you can build a custom narrative in just minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding S&T Bancorp.

Ready for your next investment move?

Do not stop with S&T Bancorp, use the Simply Wall St screener now to uncover fresh ideas before other investors spot them and move the market.

- Capture potential mispricings early by targeting these 920 undervalued stocks based on cash flows that strong cash flows suggest the market has overlooked.

- Ride the next wave of innovation by focusing on these 25 AI penny stocks positioned at the intersection of software, data, and automation.

- Strengthen your income stream by zeroing in on these 14 dividend stocks with yields > 3% that can help support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STBA

S&T Bancorp

Operates as the bank holding company for S&T Bank that provides retail and commercial banking products and services to consumer, commercial, and small business in Pennsylvania and Ohio.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026