- United States

- /

- Banks

- /

- NasdaqGM:SMBC

Here's Why I Think Southern Missouri Bancorp (NASDAQ:SMBC) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Southern Missouri Bancorp (NASDAQ:SMBC). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Southern Missouri Bancorp

Southern Missouri Bancorp's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, Southern Missouri Bancorp's EPS has grown 19% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

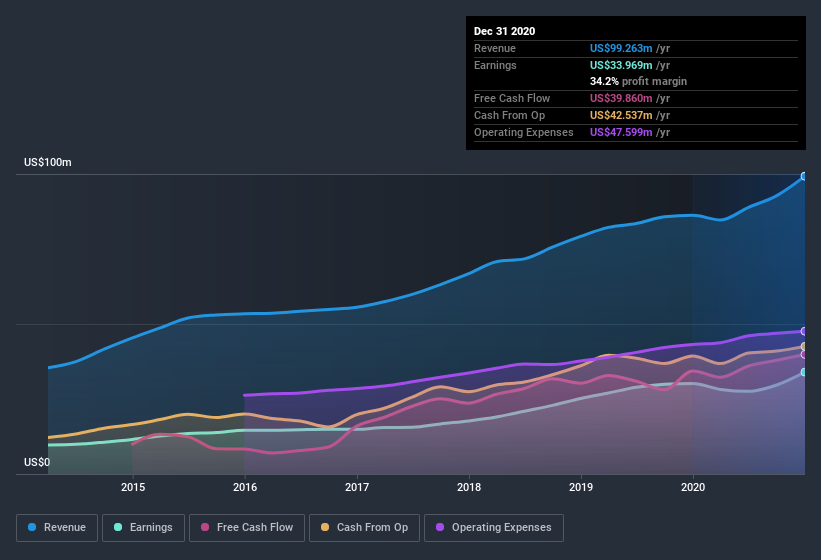

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Southern Missouri Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Southern Missouri Bancorp's EBIT margins were flat over the last year, revenue grew by a solid 15% to US$99m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Southern Missouri Bancorp's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Southern Missouri Bancorp Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Southern Missouri Bancorp insiders refrain from selling stock during the year, but they also spent US$196k buying it. That's nice to see, because it suggests insiders are optimistic. We also note that it was the Executive VP & Chief Legal Officer, Martin Weishaar, who made the biggest single acquisition, paying US$50k for shares at about US$24.81 each.

Along with the insider buying, another encouraging sign for Southern Missouri Bancorp is that insiders, as a group, have a considerable shareholding. With a whopping US$63m worth of shares as a group, insiders have plenty riding on the company's success. That holding amounts to 17% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Greg Steffens, is paid less than the median for similar sized companies. For companies with market capitalizations between US$200m and US$800m, like Southern Missouri Bancorp, the median CEO pay is around US$1.5m.

The CEO of Southern Missouri Bancorp only received US$565k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Southern Missouri Bancorp Worth Keeping An Eye On?

For growth investors like me, Southern Missouri Bancorp's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. You still need to take note of risks, for example - Southern Missouri Bancorp has 1 warning sign we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Southern Missouri Bancorp, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Southern Missouri Bancorp, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:SMBC

Southern Missouri Bancorp

Operates as the bank holding company for Southern Bank that provides banking and financial services to individuals and corporate customers in the United States.

Flawless balance sheet, undervalued and pays a dividend.