- United States

- /

- Banks

- /

- OTCPK:SBNY

Is Signature Bank (NASDAQ:SBNY) Expensive For A Reason? A Look At The Intrinsic Value

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

Valuing SBNY, a bank stock, can be daunting since these financial companies have cash flows that are impacted by regulations that are not imposed upon other industries. For instance, banks must hold a certain level of cash reserves on the books as a safety precaution. Examining line items like book values, in addition to the return and cost of equity, is practical for gauging SBNY’s true value. Today I will take you through how to value SBNY in a fairly useful and simple method.

Check out our latest analysis for Signature Bank

What Model Should You Use?

Two main things that set financial stocks apart from the rest are regulation and asset composition. United States's financial regulatory environment is relatively strict. In addition, banks generally don't possess significant amounts of tangible assets as part of total assets. Excess Returns overcome some of these issues. Firstly, it doesn't focus on factors such as capex and depreciation - relevant for tangible asset firms - but rather emphasize forecasting stable earnings and book values.

The Calculation

The key assumption for this model is, the value of the company is how much money it can generate from its current level of equity capital, in excess of the cost of that capital. The returns above the cost of equity is known as excess returns:

Excess Return Per Share = (Stable Return On Equity – Cost Of Equity) (Book Value Of Equity Per Share)

= (0.13% – 12%) x $93.03 = $1.63

Excess Return Per Share is used to calculate the terminal value of SBNY, which is how much the business is expected to continue to generate over the upcoming years, in perpetuity. This is a common component of discounted cash flow models:

Terminal Value Per Share = Excess Return Per Share / (Cost of Equity – Expected Growth Rate)

= $1.63 / (12% – 2.7%) = $18.26

Putting this all together, we get the value of SBNY’s share:

Value Per Share = Book Value of Equity Per Share + Terminal Value Per Share

= $93.03 + $18.26 = $111.29

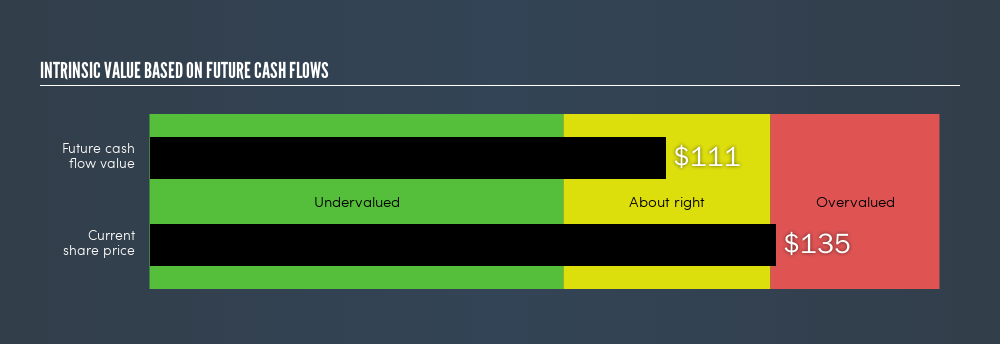

This results in an intrinsic value of $111.29. Relative to today's price of US$135, SBNY is , at this time, trading above what it's actually worth. This means SBNY isn't an attractive buy right now. Pricing is only one aspect when you're looking at whether to buy or sell SBNY. There are other important factors to keep in mind when assessing whether SBNY is the right investment in your portfolio.

Next Steps:

For banks, there are three key aspects you should look at:

- Financial health: Does it have a healthy balance sheet? Take a look at our free bank analysis with six simple checks on things like bad loans and customer deposits.

- Future earnings: What does the market think of SBNY going forward? Our analyst growth expectation chart helps visualize SBNY’s growth potential over the upcoming years.

- Dividends: Most people buy financial stocks for their healthy and stable dividends. Check out whether SBNY is a dividend Rockstar with our historical and future dividend analysis.

For more details and sources, take a look at our full calculation on SBNY here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:SBNY

Signature Bank

Signature Bank provides digital assets banking business and comprises of certain loan portfolios.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)