Stock Analysis

- United States

- /

- Banks

- /

- NasdaqGS:SBCF

Seacoast Banking Corporation of Florida (NASDAQ:SBCF) Has Affirmed Its Dividend Of $0.18

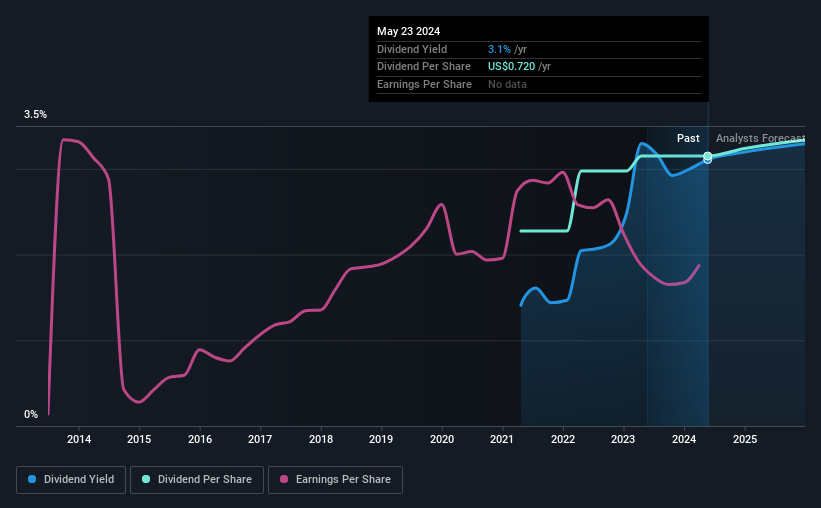

The board of Seacoast Banking Corporation of Florida (NASDAQ:SBCF) has announced that it will pay a dividend on the 28th of June, with investors receiving $0.18 per share. Based on this payment, the dividend yield will be 3.1%, which is fairly typical for the industry.

View our latest analysis for Seacoast Banking Corporation of Florida

Seacoast Banking Corporation of Florida's Payment Expected To Have Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important.

Having paid out dividends for only 3 years, Seacoast Banking Corporation of Florida does not have much of a history being a dividend paying company. Diving into the company's earnings report, the payout ratio is set at 52%, which is a decent ratio of dividend payout to earnings, and may sustain future dividends if the company stays at its current trend.

The next year is set to see EPS grow by 8.9%. Assuming the dividend continues along recent trends, we think the future payout ratio could be 47% by next year, which is in a pretty sustainable range.

Seacoast Banking Corporation of Florida Doesn't Have A Long Payment History

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2021, the dividend has gone from $0.52 total annually to $0.72. This works out to be a compound annual growth rate (CAGR) of approximately 11% a year over that time. Seacoast Banking Corporation of Florida has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Seacoast Banking Corporation of Florida May Find It Hard To Grow The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. However, initial appearances might be deceiving. Unfortunately, Seacoast Banking Corporation of Florida's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year.

Our Thoughts On Seacoast Banking Corporation of Florida's Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments Seacoast Banking Corporation of Florida has been making. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Seacoast Banking Corporation of Florida that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're helping make it simple.

Find out whether Seacoast Banking Corporation of Florida is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SBCF

Seacoast Banking Corporation of Florida

Operates as the bank holding company for Seacoast National Bank that provides integrated financial services to retail and commercial customers in Florida.

Flawless balance sheet with solid track record.