- United States

- /

- Banks

- /

- NasdaqGS:RBCA.A

Republic Bancorp (RBCAA) Margin Expansion Challenges Cautious Narratives as Profitability Strengthens

Reviewed by Simply Wall St

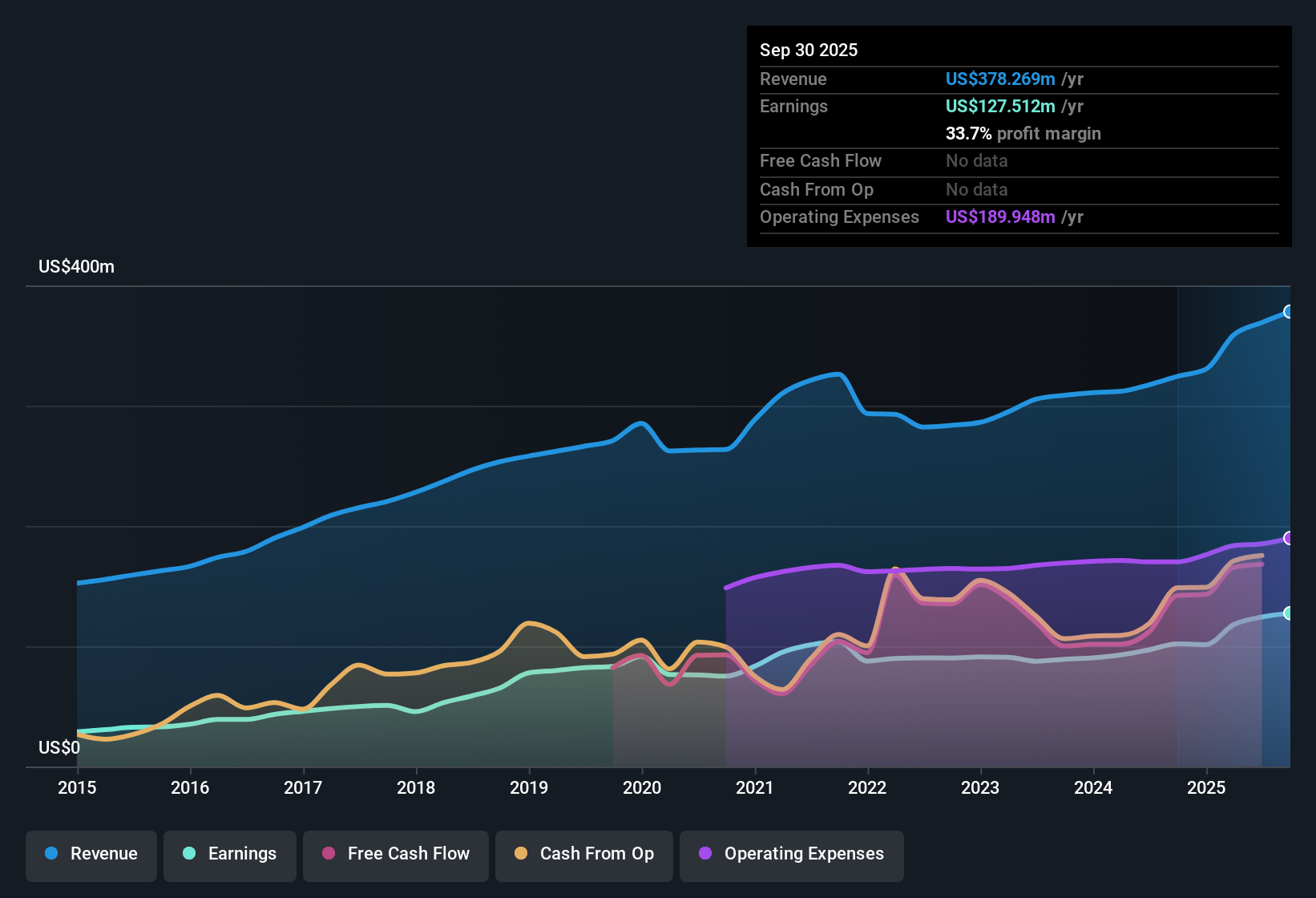

Republic Bancorp (RBCAA) reported a net profit margin of 33.7%, an improvement from last year's 30.6%, as profitability continued to strengthen. EPS growth was impressive at 28.1% over the past year, far outpacing the company’s five-year average of 5.4% annual growth. Despite these gains, shares currently change hands at $70.99, which is below the estimated fair value of $113.02 and puts the Price-To-Earnings ratio at 11.2x, closely matching the industry average. Investors now face the tradeoff between Republic Bancorp's trial of sustained profit growth and the forward outlook for modest revenue gains and declining earnings. This combination sets a complex stage for the stock’s next chapter.

See our full analysis for Republic Bancorp.The next part dives into how these new earnings numbers compare with the broader narratives shaping community sentiment, highlighting where consensus is confirmed and where surprises might shift the story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Top Industry Peers

- Net profit margin stands at 33.7%, exceeding last year's 30.6% and notably outpacing many regional banks operating at tighter margins.

- Investors looking for conservative stability will find support in this strong margin, as it reinforces the stock’s reputation for weathering sector volatility.

- This level of profitability lends weight to the idea that Republic Bancorp can serve as a “safe haven” regional bank, especially when sector peers are pressured by credit or regulatory headwinds.

- What's surprising is that this margin expansion comes despite a challenging macro backdrop. This points to disciplined cost control or a favorable business mix not always seen in smaller competitors.

Growth Track Record Beats Its 5-Year Pace

- Earnings grew 28.1% in the last year, surpassing the company’s own five-year average of 5.4% per year and highlighting a clear acceleration in performance.

- While bulls may argue that this surge positions the bank for further upside, the reported outlook forecasts a reversal, with earnings projected to decline by 3.1% per year over the next three years.

- Bulls can point to this blowout year as validation for the bank’s ability to outperform during disruptive periods, but the shift toward lower forecast growth challenges hopes for a repeat.

- This tension between short-term strength and a less optimistic future trajectory forces investors to decide whether they believe the next few years are an aberration or the start of a new normal.

Valuation Discount Versus DCF Fair Value

- Shares trade at $70.99, representing a sizable gap to the DCF fair value of $113.02. This suggests a roughly 37% discount even as the Price-To-Earnings ratio of 11.2x matches industry averages.

- This discount heavily supports arguments that the market is underpricing recent profit expansion, but the forecast for revenue growth at 4% per year, much slower than the US market’s 10.1% pace, limits the case for a rapid re-rating.

- On one hand, the valuation gap signals room for upside if results keep outpacing expectations or market sentiment improves.

- On the other, muted top-line expectations explain why the stock has not closed this discount despite robust profitability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Republic Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Republic Bancorp’s standout year is overshadowed by forecasts for sluggish revenue growth and a potential decline in earnings over the next three years.

If dependable performance and upward momentum matter most to you, consider steadier options with stable growth stocks screener (2084 results) and find companies more likely to deliver consistent growth each year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RBCA.A

Republic Bancorp

Operates as a bank holding company for Republic Bank & Trust Company that provides various banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives