- United States

- /

- Banks

- /

- NasdaqGS:RBCA.A

Republic Bancorp (RBCA.A): Assessing Valuation as Net Interest and Book Value Growth Expectations Cool

Reviewed by Simply Wall St

Republic Bancorp (RBCA.A) is back in the spotlight after fresh analysis flagged weakening trends in its core banking engine, with net interest income expected to slip and tangible book value growth slowing from recent years.

See our latest analysis for Republic Bancorp.

Despite those softer fundamentals, Republic Bancorp’s share price has climbed to $74.31, with a strong 1 month share price return of 14.13% and an impressive 5 year total shareholder return of 134.53%. This suggests momentum is still on its side even as analysts grow more cautious.

If this mix of steady banking returns and valuation questions has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership.

So, with earnings momentum cooling but the stock trading just below its analyst target and at a sizable discount to intrinsic value, is this a smart entry point, or is the market already pricing in future growth?

Price-to-Earnings of 11.4x: Is it justified?

On a price-to-earnings basis, Republic Bancorp looks modestly valued at the current $74.31 share price, trading cheaper than many peer banks.

The price-to-earnings ratio compares the company’s share price to its per share earnings, a key lens for banks where steady profitability is central to the investment case.

Republic Bancorp’s price-to-earnings multiple of 11.4x sits below both the peer average of 13.7x and the broader US banks industry at 12x. This signals that investors are paying less for each dollar of its earnings despite its solid past profit growth. However, relative to an estimated fair price-to-earnings ratio of 9.3x, the current multiple still implies a premium to what the market could eventually normalize toward if expectations cool.

Explore the SWS fair ratio for Republic Bancorp

Result: Price-to-Earnings of 11.4x (UNDERVALUED)

However, softer net income trends and slowing tangible book value growth could quickly undermine the current valuation if credit quality or loan demand weakens.

Find out about the key risks to this Republic Bancorp narrative.

Another View: DCF Points to Deeper Value

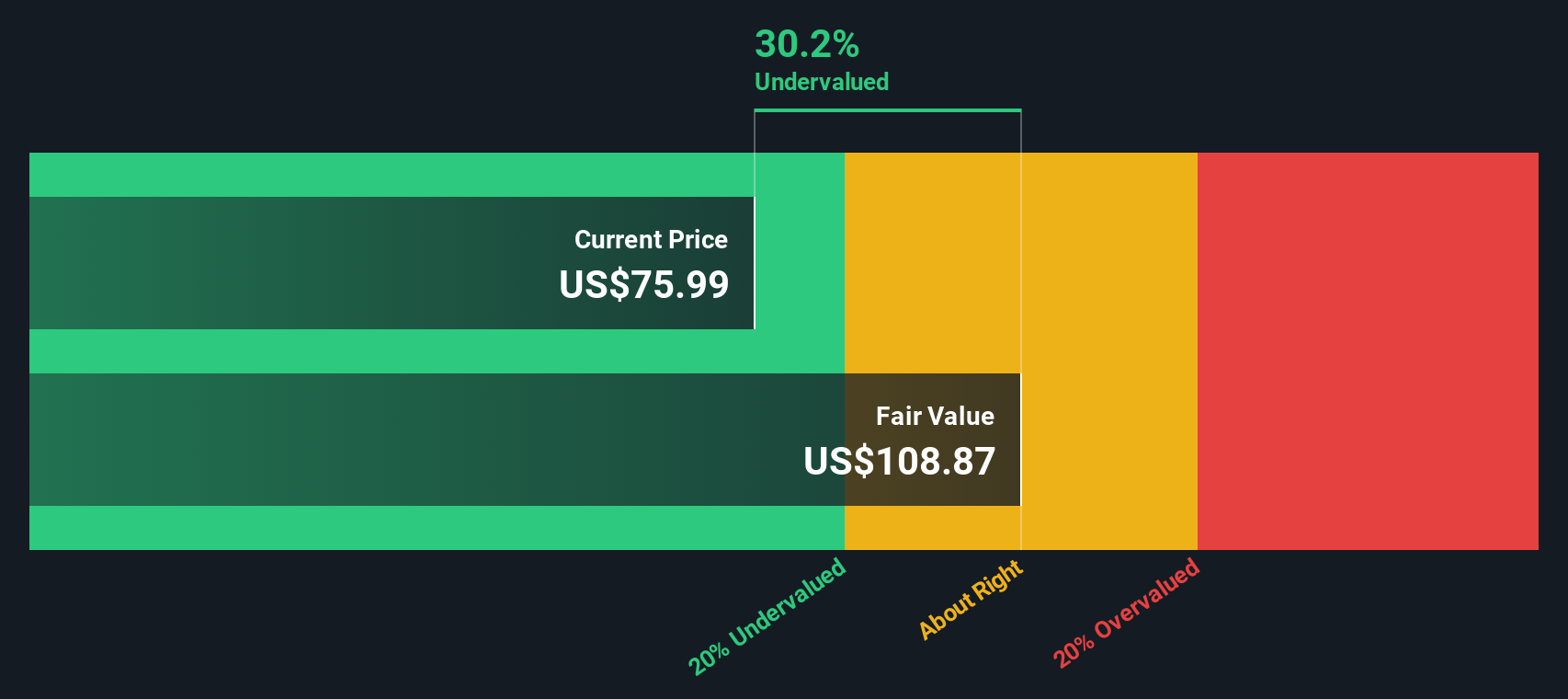

While the price to earnings ratio hints at only modest undervaluation, our DCF model paints a bolder picture, with fair value around $109.46 versus today’s $74.31. That 32% gap suggests the market may be heavily discounting Republic’s long term cash generation, or it may be seeing risks the model cannot reflect.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Republic Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Republic Bancorp Narrative

If you want to dig into the numbers yourself and challenge this view, you can develop a personalized perspective in minutes by starting with Do it your way.

A great starting point for your Republic Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Republic Bancorp might be compelling, but you will stay ahead of the curve only if you constantly refresh your watchlist with other potential opportunities.

- Explore early-stage companies by reviewing these 3642 penny stocks with strong financials that already show stronger fundamentals than many small names.

- Follow structural shifts in medicine by targeting these 29 healthcare AI stocks using data driven innovation that may reshape diagnostics, treatment, and hospital efficiency.

- Seek portfolio income with these 13 dividend stocks with yields > 3% offering yields above 3%, so your capital continues to generate cash flow even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RBCA.A

Republic Bancorp

Operates as a bank holding company for Republic Bank & Trust Company that provides various banking products and services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)