- United States

- /

- Insurance

- /

- NasdaqGS:SAFT

Discovering 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

In the wake of a volatile trading session marked by a steep decline in major stock indices, including the tech-heavy Nasdaq and the Dow Jones Industrial Average, investors are navigating an uncertain landscape. The recent end of a prolonged government shutdown has done little to stabilize market sentiment, leaving many to question where opportunities might lie. In such turbulent times, identifying stocks with strong fundamentals and growth potential can be crucial for those looking to uncover hidden gems in the U.S. market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Unity Bancorp (UNTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Unity Bancorp, Inc. is the bank holding company for Unity Bank, offering commercial and retail banking services with a market capitalization of $482.60 million.

Operations: Unity Bancorp generates revenue primarily through its commercial banking segment, which brought in $121.97 million.

Unity Bancorp, with total assets of US$2.9 billion and equity of US$334 million, showcases a robust financial profile. The bank's net interest margin stands at 4.2%, supported by deposits totaling US$2.3 billion and loans amounting to US$2.4 billion. Its allowance for bad loans is sufficient at 0.9% of total loans, indicating prudent risk management practices, while earnings have surged by 35.9% over the past year, outpacing industry growth of 18.2%. Trading at an attractive valuation compared to peers and with primarily low-risk funding sources comprising 89% of liabilities, Unity presents a compelling investment case in the banking sector landscape.

- Click here and access our complete health analysis report to understand the dynamics of Unity Bancorp.

Examine Unity Bancorp's past performance report to understand how it has performed in the past.

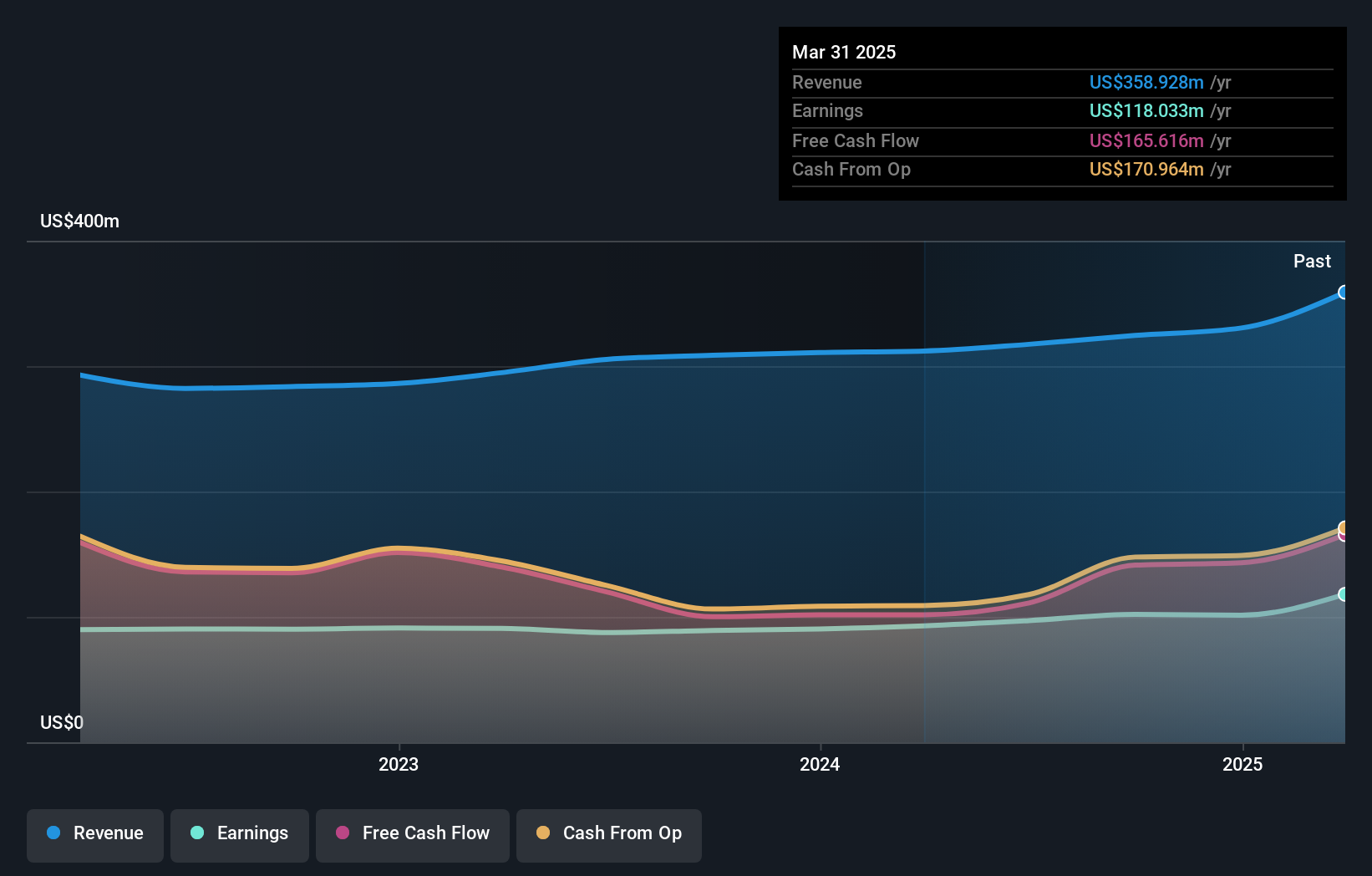

Republic Bancorp (RBCA.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Republic Bancorp, Inc. is a bank holding company for Republic Bank & Trust Company, offering a range of banking products and services in the United States, with a market capitalization of approximately $1.30 billion.

Operations: Republic Bancorp generates revenue through its Core Banking and Republic Processing Group (RPG) segments, with Traditional Banking contributing $267.14 million and Tax Refund Solutions adding $32.66 million. The company also earns from Warehouse Lending at $14.15 million, Republic Credit Solutions at $47.90 million, and Republic Payment Solutions at $16.43 million.

Republic Bancorp, with total assets of US$7 billion and equity of US$1.1 billion, stands out for its robust financial health. The bank's deposits amount to US$5.3 billion against loans totaling US$5.2 billion, demonstrating a well-balanced loan-to-deposit ratio. It has a commendable net interest margin of 4.9% and boasts a sufficient allowance for bad loans at 0.4% of total loans, ensuring stability in uncertain times. Earnings grew by 25% over the past year, surpassing the industry average growth rate of 18%. Trading at nearly 39% below estimated fair value suggests potential upside for investors considering this financial entity's strong fundamentals and low-risk funding profile comprising mostly customer deposits.

- Click to explore a detailed breakdown of our findings in Republic Bancorp's health report.

Understand Republic Bancorp's track record by examining our Past report.

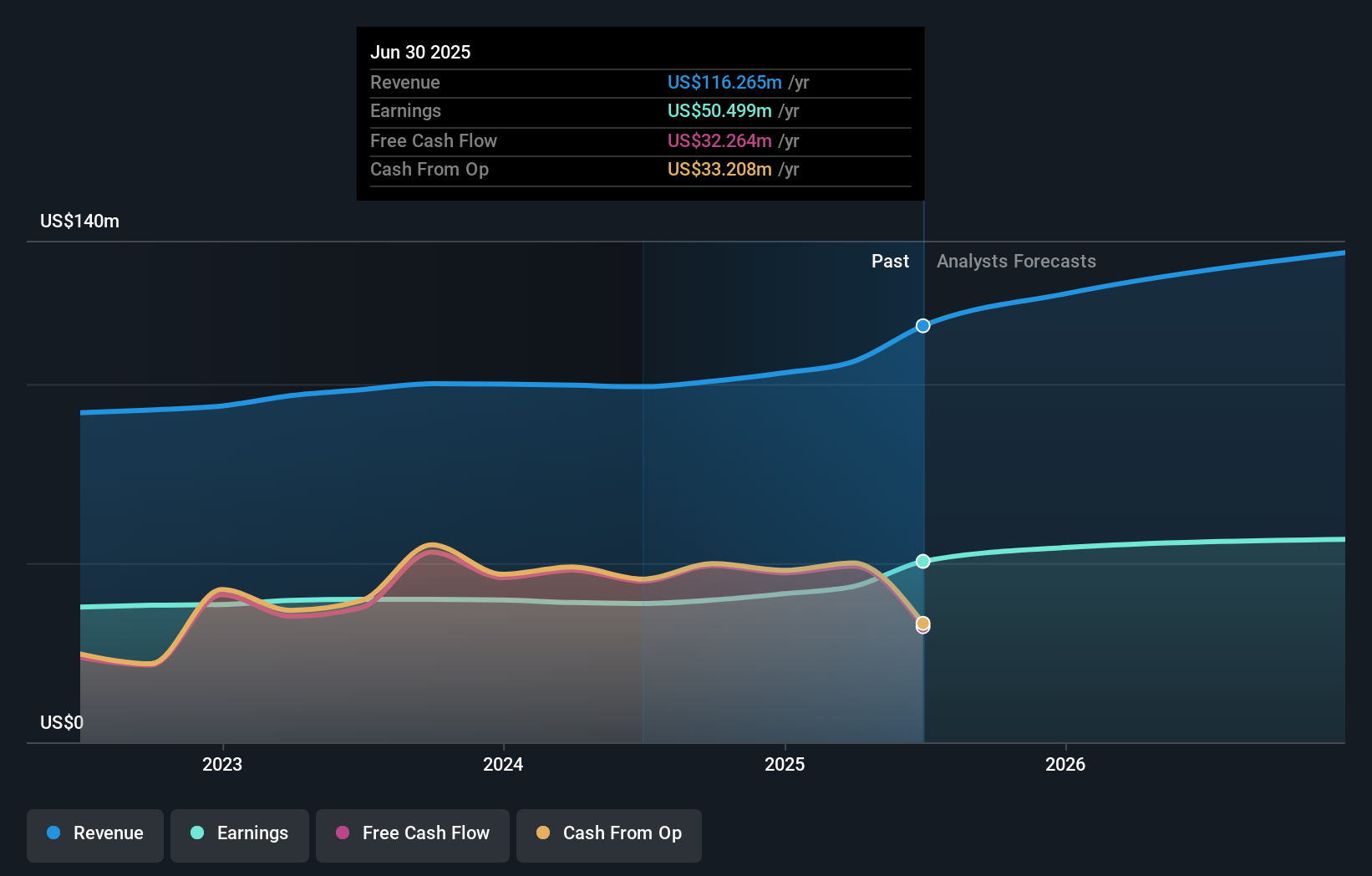

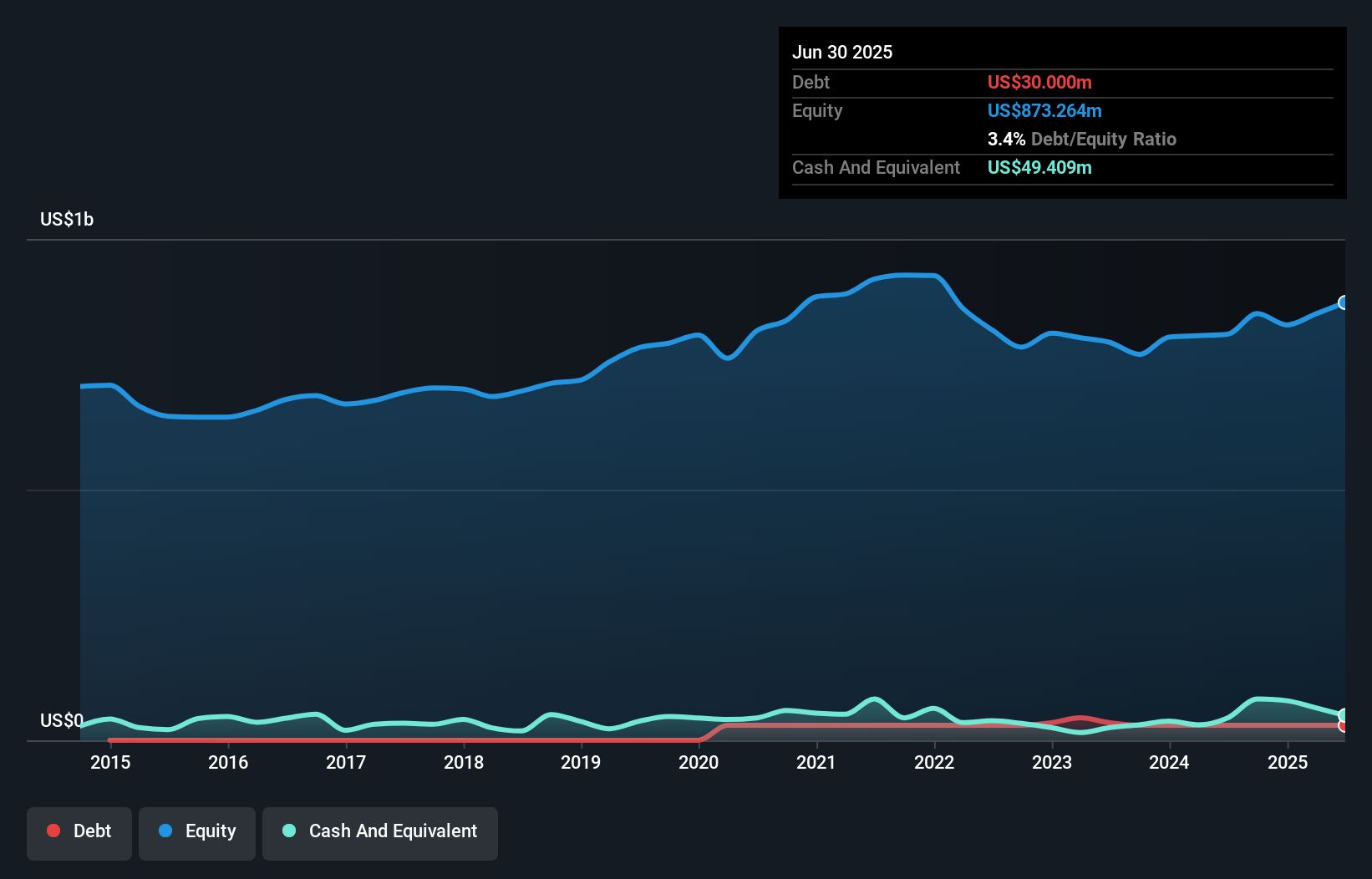

Safety Insurance Group (SAFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Safety Insurance Group, Inc. offers private passenger and commercial automobile, as well as homeowner insurance in the United States with a market capitalization of approximately $1.14 billion.

Operations: Safety Insurance Group generates revenue primarily from its property and casualty insurance operations, totaling approximately $1.23 billion. The company's financial performance is influenced by various factors, including the net profit margin, which reflects its profitability after accounting for expenses.

Safety Insurance Group, a notable player in the insurance sector, has demonstrated solid financial performance despite its small cap status. Over the past year, earnings surged by 16.5%, outpacing the industry's 10.9% growth rate. The company's price-to-earnings ratio stands at 13.2x, which is attractive compared to the US market average of 18.4x, suggesting potential value for investors seeking opportunities in smaller firms. Impressively, Safety Insurance's debt management is robust with interest payments well covered by EBIT at a multiple of 102.6x and more cash than total debt on hand—indicative of sound fiscal health and operational efficiency.

- Navigate through the intricacies of Safety Insurance Group with our comprehensive health report here.

Assess Safety Insurance Group's past performance with our detailed historical performance reports.

Where To Now?

- Investigate our full lineup of 295 US Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAFT

Safety Insurance Group

Provides private passenger and commercial automobile, and homeowner insurance in the United States.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives