- United States

- /

- Banks

- /

- NasdaqGM:PNBK

Should You Be Adding Patriot National Bancorp (NASDAQ:PNBK) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Patriot National Bancorp (NASDAQ:PNBK). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Patriot National Bancorp

How Fast Is Patriot National Bancorp Growing Its Earnings Per Share?

Patriot National Bancorp has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Over the last year, Patriot National Bancorp increased its EPS from US$1.28 to US$1.34. That's a modest gain of 4.9%.

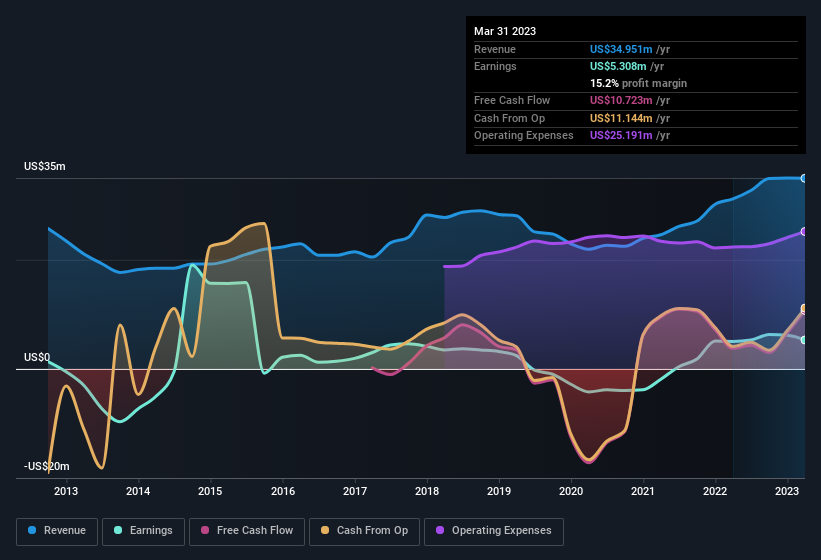

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that Patriot National Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for Patriot National Bancorp remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to US$35m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Patriot National Bancorp is no giant, with a market capitalisation of US$37m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Patriot National Bancorp Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. For companies with market capitalisations under US$200m, like Patriot National Bancorp, the median CEO pay is around US$741k.

The CEO of Patriot National Bancorp only received US$365k in total compensation for the year ending December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Patriot National Bancorp Worth Keeping An Eye On?

One positive for Patriot National Bancorp is that it is growing EPS. That's nice to see. Not only that, but the CEO is paid quite reasonably, which should prompt investors to feel more trusting of the board of directors. So all in all Patriot National Bancorp is worthy at least considering for your watchlist. You still need to take note of risks, for example - Patriot National Bancorp has 2 warning signs we think you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PNBK

Patriot National Bancorp

Operates as the holding company for Patriot Bank, N.A.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives