- United States

- /

- Banks

- /

- NasdaqGS:PFBC

The Bull Case For Preferred Bank (PFBC) Could Change Following Mixed Q2 2025 Earnings Results - Learn Why

Reviewed by Simply Wall St

- Preferred Bank has announced its second quarter and half-year 2025 earnings, reporting net interest income of US$66.87 million and quarterly net income of US$32.85 million, with earnings per share showing a modest increase compared to the same period last year.

- While the bank managed to grow both basic and diluted earnings per share year-over-year for the quarter, its total net income for both the quarter and six-month period declined slightly.

- We’ll look at how the slight increase in earnings per share amid lower net income could influence Preferred Bank’s investment outlook.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

Preferred Bank Investment Narrative Recap

If you own Preferred Bank shares, you likely believe in the bank's ability to sustainably grow profits despite a challenging credit environment and ongoing uncertainties in the trade finance segment. The latest financial results show a modest uptick in earnings per share, but also reveal a slight drop in both total net income and net interest income for the half-year, this does not materially change the short-term outlook for either the bank’s efforts to resolve nonperforming loans or address risks from weak loan growth. Among recent company announcements, the ongoing share buyback program stands out. With US$23 million still available for repurchases, and a sizable portion already completed earlier this year, this initiative could support earnings per share while the bank works through credit quality issues and subdued lending activity. On the other hand, investors should be aware that, despite a lift in share price, continued concerns about loan performance could...

Read the full narrative on Preferred Bank (it's free!)

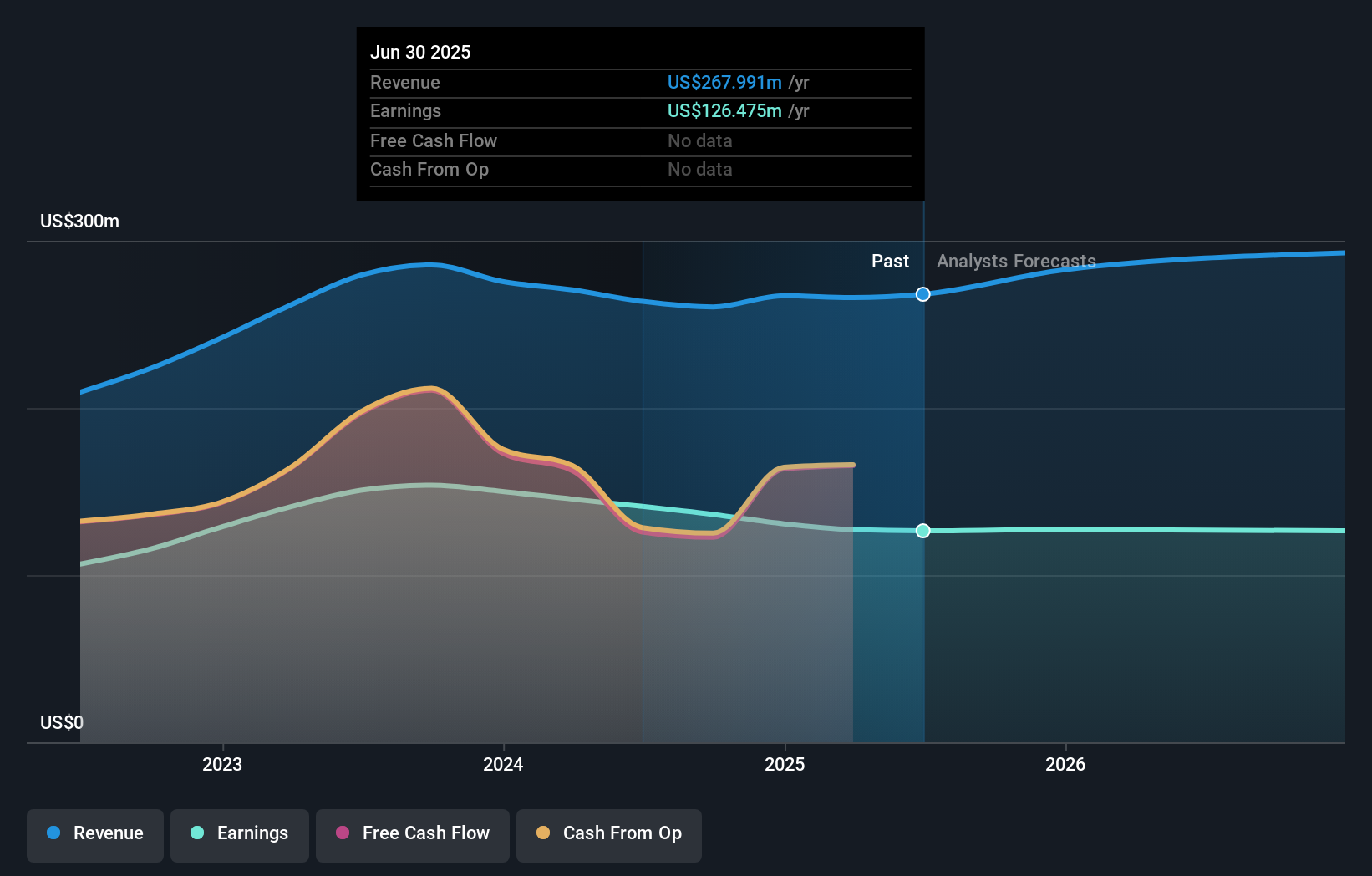

Preferred Bank's narrative projects $314.0 million revenue and $124.7 million earnings by 2028. This requires 5.7% yearly revenue growth and a $2.5 million earnings decrease from $127.2 million.

Uncover how Preferred Bank's forecasts yield a $95.56 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Preferred Bank ranging from US$95.56 to US$246.34. While opinions differ widely, the recurring concern about nonperforming loans could have broader implications for earnings stability, explore how others see this shaping the outlook.

Explore 2 other fair value estimates on Preferred Bank - why the stock might be worth just $95.56!

Build Your Own Preferred Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Preferred Bank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Preferred Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Preferred Bank's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PFBC

Preferred Bank

Provides various banking products and services to small and mid-sized businesses, entrepreneurs, real estate developers, professionals, and high net worth individuals.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives