Key Takeaways

- Expansion into high-growth markets and core demographic trends underpin revenue growth and expanding client base.

- Conservative financial management and targeted stock buybacks support profitability, efficiency, and shareholder value.

- Geographic and sector exposure, competitive funding pressures, limited digital advancement, and regulatory challenges combine to threaten Preferred Bank's revenue growth, profitability, and long-term stability.

Catalysts

About Preferred Bank- Provides various banking products and services to small and mid-sized businesses, entrepreneurs, real estate developers, professionals, and high net worth individuals.

- Expansion into new high-growth markets, especially with new branches in Manhattan and Silicon Valley, positions Preferred Bank to capture a growing client base and increase loan originations, likely driving above-peer revenue growth.

- Continued demographic growth and rising wealth in the Asian-American community-Preferred Bank's core client segment-supports sustained demand for commercial lending and banking services, leading to a larger and more profitable revenue base.

- Persistent focus on relationship-driven banking and superior asset quality, with declining nonaccrual and criticized loan balances, will help maintain net interest margin stability and minimize future credit losses-positively impacting net margins.

- Conservative deposit pricing and disciplined expense management allow the bank to navigate industry-wide funding cost pressures, preserving high efficiency ratios and supporting strong pre-provision earnings.

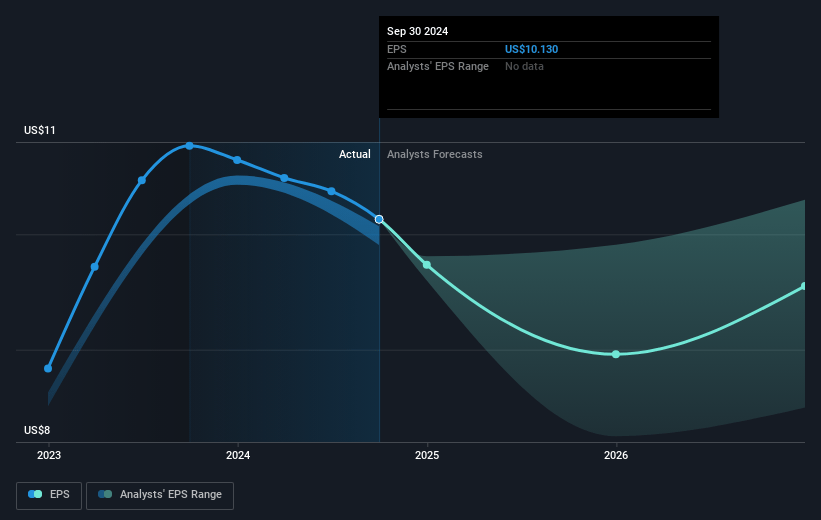

- Ongoing targeted stock buybacks, backed by strong capital levels, are set to enhance EPS growth even in moderate loan-growth environments, creating further value for shareholders.

Preferred Bank Future Earnings and Revenue Growth

Assumptions

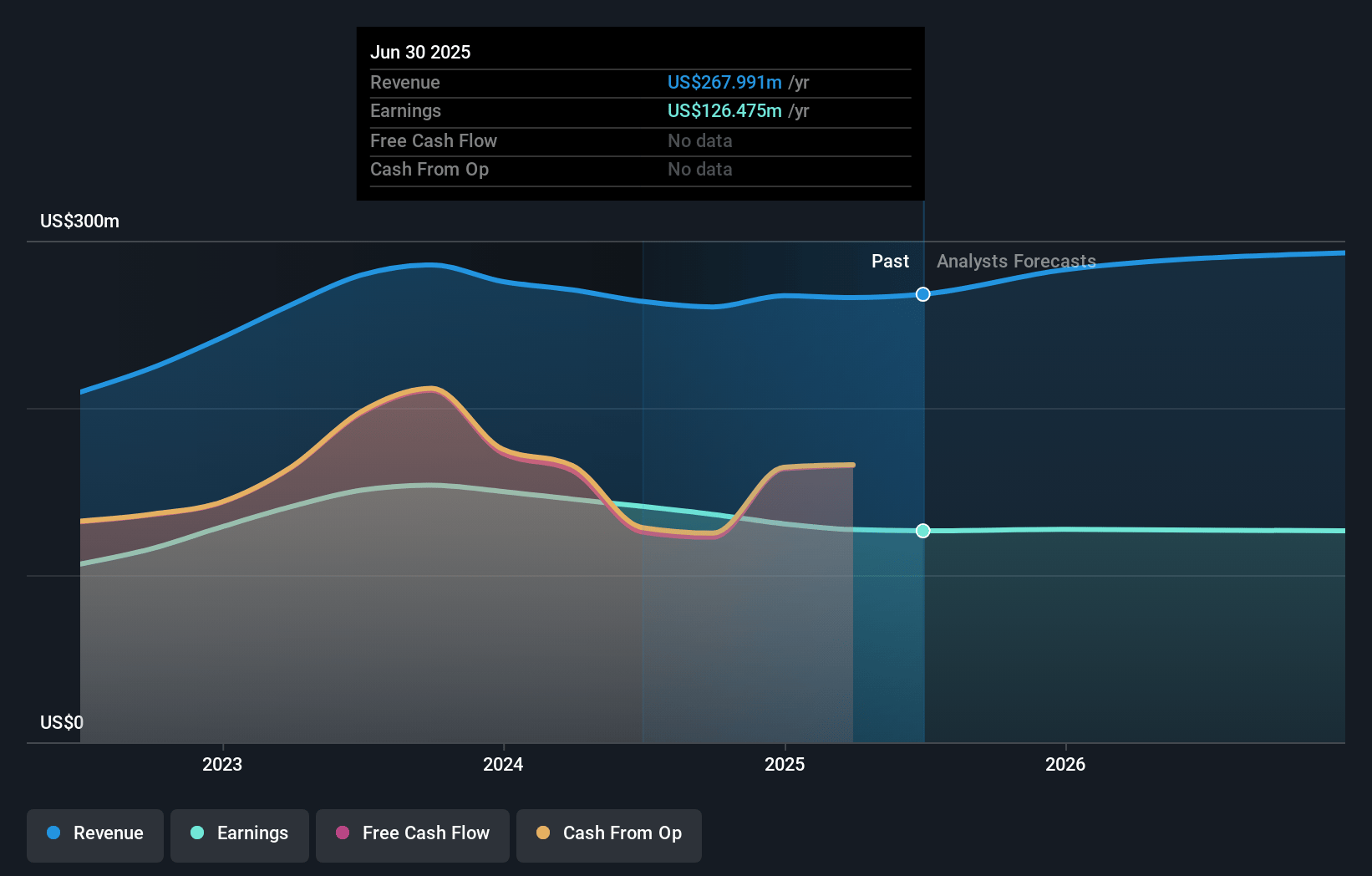

How have these above catalysts been quantified?- Analysts are assuming Preferred Bank's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 47.2% today to 39.5% in 3 years time.

- Analysts expect earnings to reach $126.6 million (and earnings per share of $10.29) by about July 2028, up from $126.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.2x on those 2028 earnings, up from 9.5x today. This future PE is lower than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 6.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Preferred Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High loan and deposit concentration in California, as well as heavy exposure to commercial construction and C&I lending, make Preferred Bank's revenue and asset quality vulnerable to localized economic downturns or sector-specific shocks.

- Reliance on maintaining strict cost control over deposits in a competitive environment could squeeze net interest margin and limit deposit growth, potentially eroding net interest income and earnings stability if competition intensifies or funding needs increase.

- Ongoing uncertainty from tariff policies, supply chain disruptions, and broader macroeconomic headwinds introduce risks to customer performance and future loan demand, undermining both revenue growth and credit quality over the long term.

- Limited scale and slower adoption of digital technologies compared to larger or digital-first banks leave Preferred Bank exposed to rising industry costs and customer attrition, which could pressure long-term net margins and non-interest income.

- Continued regulatory and compliance risks (including resolving OREO assets and monitoring customer exposure to international trade issues) could increase operational expenses and create downside risk to profitability and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $107.0 for Preferred Bank based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $320.3 million, earnings will come to $126.6 million, and it would be trading on a PE ratio of 10.2x, assuming you use a discount rate of 6.4%.

- Given the current share price of $96.86, the analyst price target of $107.0 is 9.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.