- United States

- /

- Banks

- /

- NasdaqGS:PEBO

What Peoples Bancorp (PEBO)'s Insider Buying and Outperforming Core EPS Mean for Shareholders

Reviewed by Sasha Jovanovic

- Peoples Bancorp recently saw Director Smith Dwight Eric purchase 200 shares of its common stock, and DA Davidson initiated coverage with a positive analyst rating, highlighting that core earnings per share outperformed forecasts for the quarter.

- Insider buying activity, paired with favorable analyst commentary, is drawing increased attention to the company’s performance and outlook following its third quarter earnings report, where earnings per share met expectations despite a slight revenue miss.

- We’ll explore how recent insider stock purchases could influence Peoples Bancorp’s overall investment narrative and analyst sentiment going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Peoples Bancorp Investment Narrative Recap

To be a shareholder in Peoples Bancorp, you likely want to believe in the resiliency of community-focused banking, ongoing demand for loans in regional markets, and the company's ability to manage credit quality risks even as economic headwinds persist. While recent insider buying and analyst coverage have provided a boost to sentiment, these developments do not materially alter the biggest near-term catalyst, potential stabilization of credit costs, or the key risk of ongoing asset quality pressure from elevated charge-offs in the small-ticket leasing portfolio.

Among the recent announcements, the third quarter earnings report stands out for its relevance. Peoples Bancorp reported stable earnings per share, even as revenues slightly missed analyst projections and net charge-offs increased again. Results like these underscore the importance of how management handles credit challenges, especially as loan portfolios in secondary and tertiary Midwest markets may continue to face pressure if broader economic conditions soften.

But it's worth contrasting this with the risk that persistently elevated charge-offs, especially within the leasing portfolio, could limit profitability even as...

Read the full narrative on Peoples Bancorp (it's free!)

Peoples Bancorp's outlook projects $393.5 million in revenue and $134.1 million in earnings by 2028. This forecast assumes a yearly revenue decline of 10.8% and a $30.9 million increase in earnings from the current $103.2 million.

Uncover how Peoples Bancorp's forecasts yield a $34.17 fair value, a 15% upside to its current price.

Exploring Other Perspectives

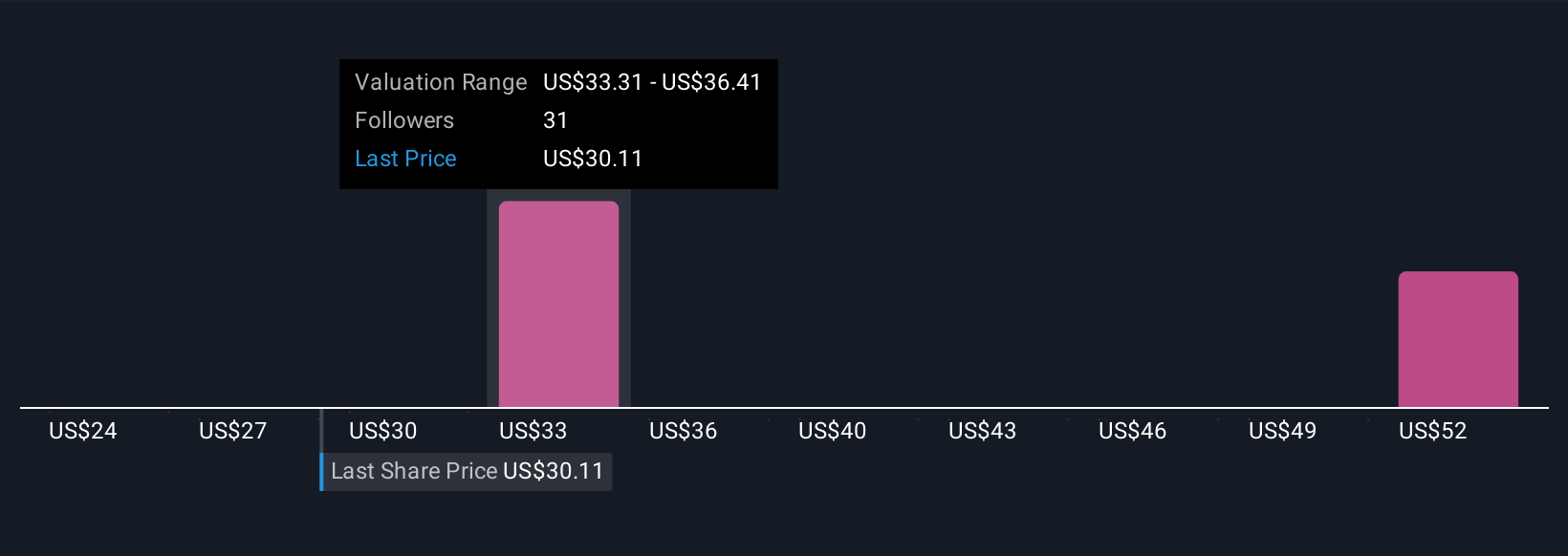

Five members of the Simply Wall St Community set fair value estimates for Peoples Bancorp ranging from US$24 to US$54.12 per share. With such differing views, it is important to consider ongoing credit quality risk and how it could affect future performance before forming your own outlook.

Explore 5 other fair value estimates on Peoples Bancorp - why the stock might be worth as much as 82% more than the current price!

Build Your Own Peoples Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peoples Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Peoples Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peoples Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEBO

Peoples Bancorp

Operates as the financial holding company for Peoples Bank that provides commercial and consumer banking products and services.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.