- United States

- /

- Banks

- /

- NasdaqGS:PEBO

What Peoples Bancorp (PEBO)'s Dividend and Rising Charge-Offs Reveal About Its Asset Quality Strategy

Reviewed by Sasha Jovanovic

- The Board of Directors of Peoples Bancorp Inc. recently declared a quarterly cash dividend of $0.41 per common share, payable on November 18, 2025, to shareholders of record as of November 4, 2025.

- Alongside this dividend announcement, the company disclosed a year-over-year rise in quarterly net charge-offs, signaling heightened asset quality concerns for investors.

- We'll assess how the increase in net charge-offs influences Peoples Bancorp's investment narrative and outlook for credit quality improvement.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Peoples Bancorp Investment Narrative Recap

To own Peoples Bancorp, investors need confidence in the bank’s ability to manage credit risk and leverage its community banking advantages despite industry headwinds. The recent increase in quarterly net charge-offs signals ongoing credit quality concerns but does not appear to materially shift the short-term narrative, as the company continues to balance robust loan demand and asset quality risks; still, monitoring shifts in charge-offs remains critical, given their direct effect on future earnings. The largest current risk is rising asset quality pressures in the small-ticket leasing portfolio, which could challenge profitability if losses persist beyond management’s expectations.

Peoples Bancorp’s affirmation of the US$0.41 quarterly cash dividend stands out as a signal of ongoing commitment to shareholder returns, especially as investors absorb the rise in charge-offs. While dividend reliability supports the bank’s investment case and attracts income-oriented shareholders, maintaining this payout will depend on how well Peoples can contain credit losses and safeguard its net income during periods of heightened write-offs.

By contrast, investors should be aware that further deterioration in credit quality or persistent charge-off trends could...

Read the full narrative on Peoples Bancorp (it's free!)

Peoples Bancorp's narrative projects $393.5 million revenue and $134.1 million earnings by 2028. This requires a 10.8% yearly revenue decline and an earnings increase of $30.9 million from the current $103.2 million.

Uncover how Peoples Bancorp's forecasts yield a $34.17 fair value, a 19% upside to its current price.

Exploring Other Perspectives

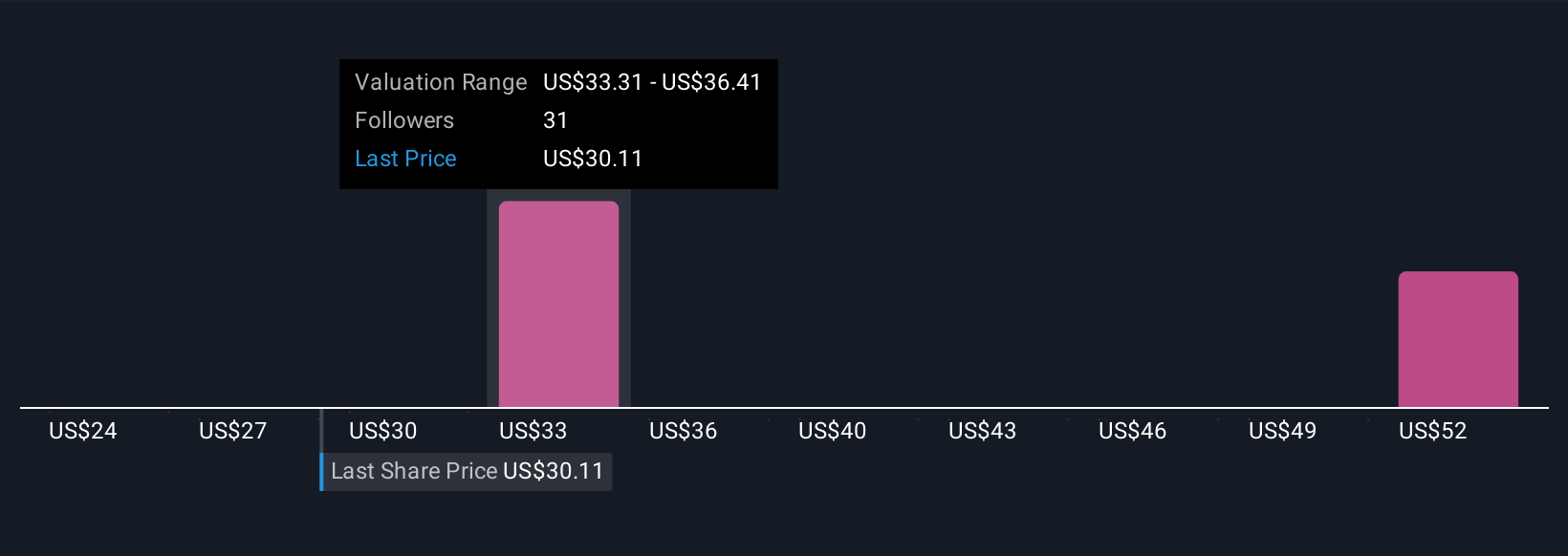

Five fair value estimates from the Simply Wall St Community range widely from US$24 to over US$52 per share. Credit quality concerns remain top of mind, suggesting readers may want to compare multiple viewpoints on risk and potential returns.

Explore 5 other fair value estimates on Peoples Bancorp - why the stock might be worth 16% less than the current price!

Build Your Own Peoples Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peoples Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Peoples Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peoples Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEBO

Peoples Bancorp

Operates as the financial holding company for Peoples Bank that provides commercial and consumer banking products and services.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives