- United States

- /

- Banks

- /

- NasdaqGS:PEBO

Peoples Bancorp (PEBO) Margin Decline Reinforces Cautious Growth Narratives

Reviewed by Simply Wall St

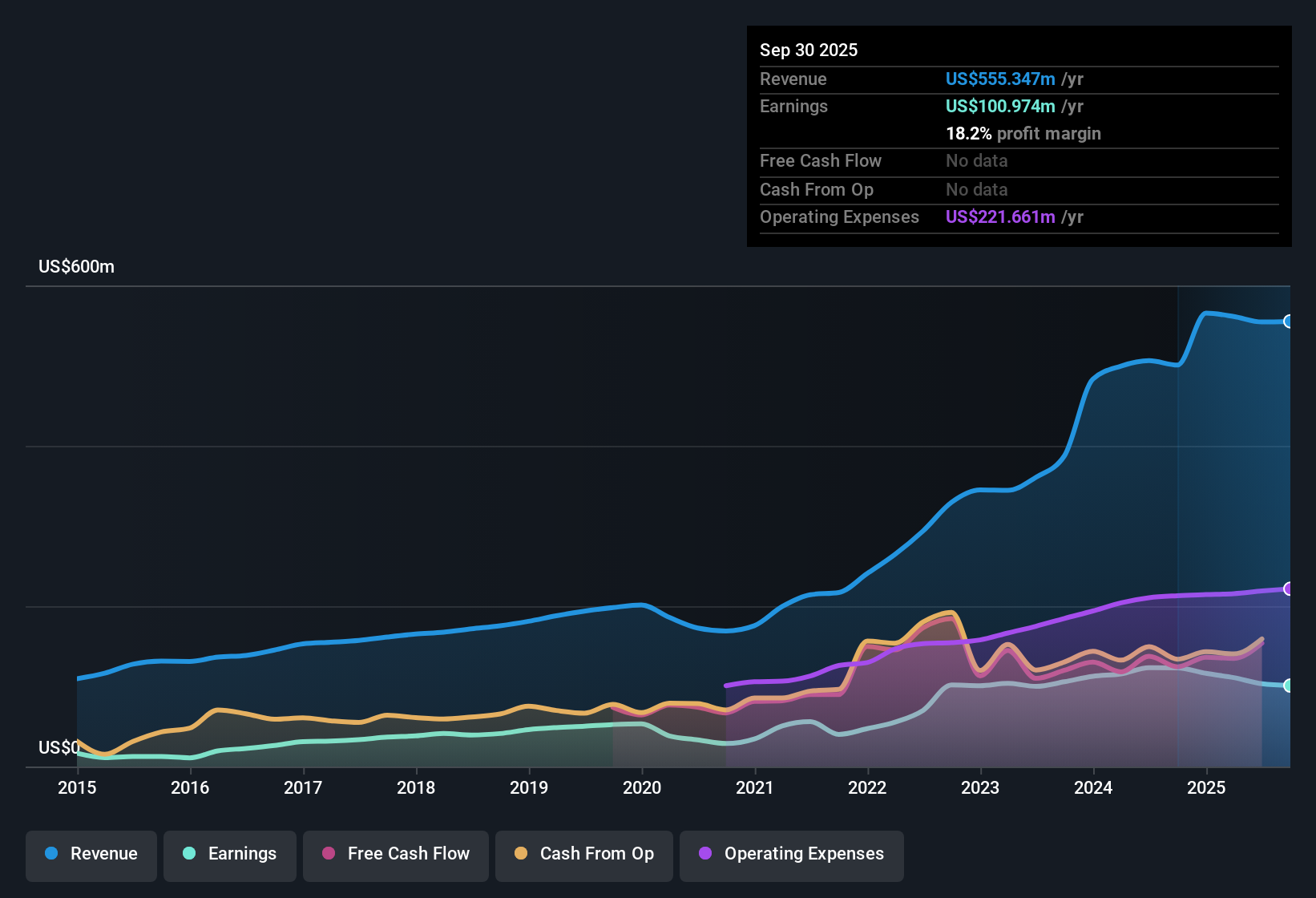

Peoples Bancorp (PEBO) reported net profit margins of 18.6%, a drop from last year’s 24.4%, and is forecasting earnings growth of 8.8% per year compared to the US market’s 15.5% average. Over the past five years, earnings have climbed at a strong 23.6% annual rate. However, the most recent period showed negative year-over-year growth. A compelling valuation, high-quality earnings, and established long-term growth support sentiment, but slower forecast growth and compressed margins may give investors pause.

See our full analysis for Peoples Bancorp.Next up, we’ll see how these numbers stack up against the narratives shaping market expectations. Some long-held views may be confirmed, while others could be upended.

See what the community is saying about Peoples Bancorp

Cost Discipline Counters Margin Pressure

- Noninterest expenses increased by 3% year-over-year in the first half of 2025, while the efficiency ratio worsened due to higher compensation and software costs.

- Analysts' consensus view underscores that proactive investments in digital banking and automation could further trim operating costs and ultimately help restore margin expansion.

- Digital innovation is already producing more stable noninterest expense and has potential to lower deposit and borrowing costs further.

- Less reliance on accretion income and improving efficiency ratios are expected to support net margins, if technology adoption continues as planned.

Loan and Deposit Growth Meets Local Headwinds

- Robust loan growth across varied categories is supported by population and business migration to the bank’s markets, but deposit balances slipped 1% in the quarter due to seasonal and competitive factors.

- Analysts' consensus view notes that Peoples Bancorp remains well-positioned to benefit from renewed local loan demand, yet its heavy focus on Midwest secondary and tertiary markets exposes earnings to concentrated regional risks.

- While customer preference for community-focused banking could drive deposit stability, geographic concentration leaves the bank vulnerable to local downturns or demographic shifts.

- Management’s strategy to deepen client relationships and reduce underperforming portfolios could offset some of these pressures, but ongoing funding costs and regional exposure are watchpoints.

Valuation Stays Attractive Versus Peers

- Peoples Bancorp trades at a Price-to-Earnings ratio of 10x, below both the US banks industry average of 11.2x and its peer group’s 14.4x, with the $29.64 share price sitting well below its DCF fair value of $55.99.

- Analysts' consensus view points out that the analyst price target of $33.08 is 11.6% above the current share price, reflecting confidence in long-term revenue and book value growth.

- Favorable relative valuations and high-quality earnings back the consensus that the stock’s fundamentals are not yet fully recognized by the market.

- Investors are encouraged to compare these valuation signals against their own profit growth and margin expectations to sense-check the upside case.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Peoples Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these results? Shape your insights into a unique narrative and share your view in just a few minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Peoples Bancorp.

See What Else Is Out There

While Peoples Bancorp offers a compelling valuation, its slower earnings growth, compressed margins, and regional risks could limit upside potential compared to broader market peers.

If you want more consistent results, use stable growth stocks screener (2094 results) to discover companies with steadier revenue and earnings expansion across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEBO

Peoples Bancorp

Operates as the financial holding company for Peoples Bank that provides commercial and consumer banking products and services.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives