- United States

- /

- Banks

- /

- NasdaqGS:OSBC

Old Second Bancorp (OSBC) Margin Decline Reinforces Debates Around Premium Valuation and Growth Narratives

Reviewed by Simply Wall St

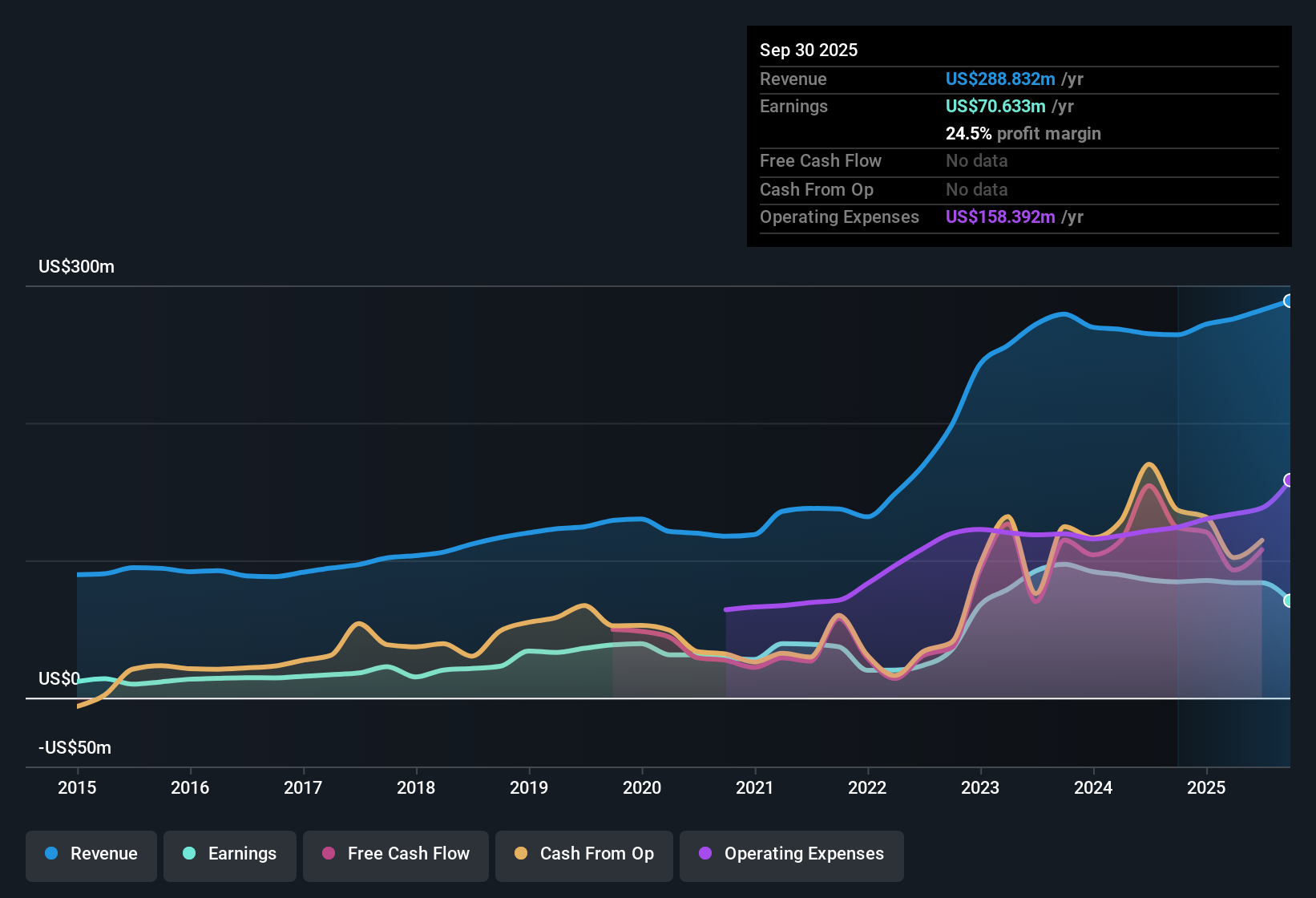

Old Second Bancorp (OSBC) saw its net profit margin slip to 24.5%, down from 32% last year, even as its five-year earnings growth rate averaged an impressive 24.2% per year. Looking ahead, analysts expect earnings to accelerate by about 35% annually, outpacing the broader US market forecast of 15.5% per year. Revenue growth is expected at 9% per year compared to the market's 10% average. As investors weigh a share price of $17.86, which is still below certain fair value estimates but trades at a premium to peers on a price-to-earnings basis, the strong future earnings outlook and lower current margins remain key focal points this earnings season.

See our full analysis for Old Second Bancorp.Now, let’s see how these headline results match up against the most widely followed narratives on Simply Wall St. Sometimes the numbers confirm the story, and sometimes they turn it upside down.

See what the community is saying about Old Second Bancorp

Efficiency Ratios Signal Improved Operations

- Efficiency ratios have been improving, reflecting successful integration of acquisitions and technology upgrades to expense management, as noted in the consensus narrative. This indicates that operating leverage should continue to support net margins over time.

- Analysts’ consensus view highlights that ongoing technology investments and cost controls are making the core banking business more profitable.

- Core banking services have benefited from expense management via digital and technology upgrades, driving higher margins despite a drop in net profit margin to 24.5% this year compared to 32% the previous year.

- Consensus narrative points out that further synergies from the recent Evergreen Bank acquisition are expected to incrementally strengthen net interest margin and return on assets (ROA).

- Consensus narrative notes that increasing demand for wealth management is providing double-digit non-interest income growth, and management remains open to strategic acquisitions, which may further expand scale and synergies over time.

Illinois Market Concentration Raises Exposure

- Old Second Bancorp’s loan and deposit growth outlook remains tied to suburban and exurban Midwest markets, leaving revenue and risk exposure highly concentrated in Illinois, as the consensus narrative emphasizes.

- Consensus narrative explains how limited geographic diversification increases vulnerability to local downturns and regional competition.

- Analysts flag concentration risk, noting that persistent regional challenges or rising compliance costs could eat into efficiency gains and profitability, especially if digital innovation efforts stall or lag competitors.

- Structural headwinds in commercial real estate, especially for regional players, are called out as a potential risk for non-performing assets and future credit losses.

Valuation Tension: Discount vs Peers, Premium to Sector

- Old Second’s share price of $17.86 is below the DCF fair value of $41.13 and 16% under the $21.75 analyst price target, but the company trades at a 13.3x price-to-earnings multiple, higher than both the US banks industry average of 11.3x and peer average of 10x.

- Consensus narrative weighs good value claims against these metrics, especially noting that continued earnings growth above market averages would help justify premium multiples.

- Strong growth expectations, with earnings projected to climb 35% annually compared to the US market’s 15.5%, offer some rationale for the higher valuation, but investors will be watching if margin recovery keeps pace with forecasts.

- Bulls might point to the share price discount to fair value and analyst targets, while skeptics watch for evidence that margin expansion and efficiency initiatives are sustainable.

- See where the consensus narrative sees opportunity and risk in Old Second’s premium valuation and local exposure. Read the full view for broader context. 📊 Read the full Old Second Bancorp Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Old Second Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your insights and shape your perspective into a narrative in just a few minutes: Do it your way.

A great starting point for your Old Second Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Old Second Bancorp’s concentrated presence in Illinois and recent margin decline highlight its exposure to regional market risks and profitability challenges.

If you want to focus on companies offering steady, reliable expansion rather than volatility, use our stable growth stocks screener (2090 results) to discover those delivering consistent growth through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OSBC

Old Second Bancorp

Operates as the bank holding company for Old Second National Bank that provides community banking services in the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives