- United States

- /

- Banks

- /

- NasdaqCM:ORRF

If You Like EPS Growth Then Check Out Orrstown Financial Services (NASDAQ:ORRF) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Orrstown Financial Services (NASDAQ:ORRF), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Orrstown Financial Services

Orrstown Financial Services's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Orrstown Financial Services has managed to grow EPS by 34% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

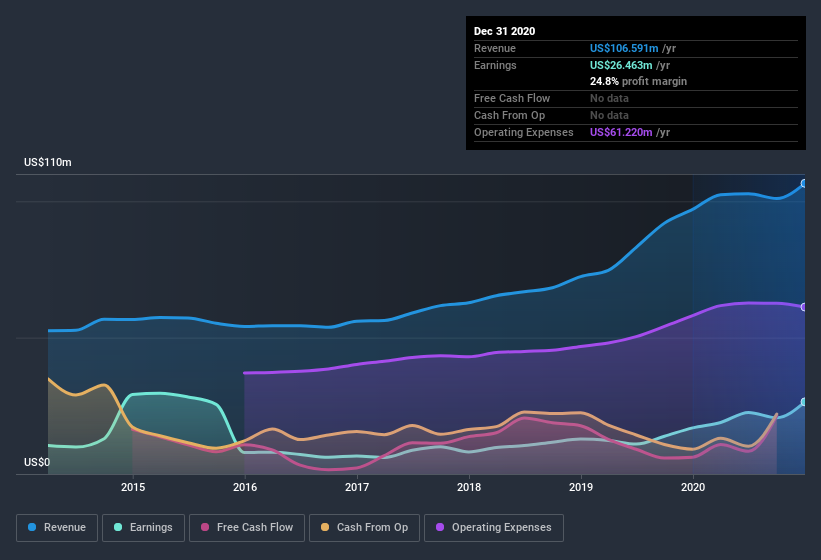

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Orrstown Financial Services's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Orrstown Financial Services maintained stable EBIT margins over the last year, all while growing revenue 9.8% to US$107m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Orrstown Financial Services's future profits.

Are Orrstown Financial Services Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Over the last 12 months Orrstown Financial Services insiders spent US$116k more buying shares than they received from selling them. On balance, that's a good sign. Zooming in, we can see that the biggest insider purchase was by Executive VP & CFO Thomas Brugger for US$68k worth of shares, at about US$13.60 per share.

The good news, alongside the insider buying, for Orrstown Financial Services bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$12m worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 4.8% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Orrstown Financial Services Deserve A Spot On Your Watchlist?

You can't deny that Orrstown Financial Services has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Orrstown Financial Services (1 shouldn't be ignored) you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Orrstown Financial Services, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Orrstown Financial Services, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:ORRF

Orrstown Financial Services

Operates as the financial holding company for Orrstown Bank that provides commercial banking and financial advisory services to retail, commercial, non-profit, and government clients in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives