- United States

- /

- Banks

- /

- NasdaqCM:ORRF

Broker Revenue Forecasts For Orrstown Financial Services, Inc. (NASDAQ:ORRF) Are Surging Higher

Orrstown Financial Services, Inc. (NASDAQ:ORRF) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The revenue forecast for this year has experienced a facelift, with analysts now much more optimistic on its sales pipeline.

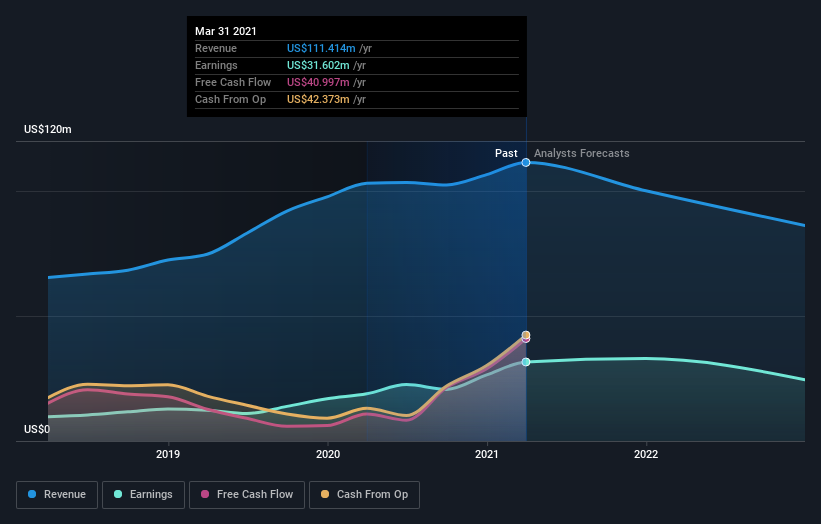

Following the latest upgrade, the current consensus, from the four analysts covering Orrstown Financial Services, is for revenues of US$100m in 2021, which would reflect a chunky 10% reduction in Orrstown Financial Services' sales over the past 12 months. Statutory earnings per share are supposed to shrink 3.4% to US$2.79 in the same period. Previously, the analysts had been modelling revenues of US$87m and earnings per share (EPS) of US$2.78 in 2021. It seems analyst sentiment has certainly become more bullish on revenues, even though they haven't changed their view on earnings per share.

See our latest analysis for Orrstown Financial Services

Even though revenue forecasts increased, there was no change to the consensus price target of US$26.50, suggesting the analysts are focused on earnings as the driver of value creation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Orrstown Financial Services analyst has a price target of US$29.00 per share, while the most pessimistic values it at US$25.00. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 13% by the end of 2021. This indicates a significant reduction from annual growth of 17% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 3.9% per year. It's pretty clear that Orrstown Financial Services' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with analysts reconfirming that earnings per share are expected to continue performing in line with their prior expectations. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Orrstown Financial Services.

Analysts are clearly in love with Orrstown Financial Services at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as recent substantial insider selling. For more information, you can click through to our platform to learn more about this and the 2 other concerns we've identified .

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade Orrstown Financial Services, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Orrstown Financial Services, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:ORRF

Orrstown Financial Services

Operates as the financial holding company for Orrstown Bank that provides commercial banking and financial advisory services to retail, commercial, non-profit, and government clients in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives