- United States

- /

- Banks

- /

- NasdaqGS:ONB

Old National Bancorp (ONB): Recent 9.1% Earnings Growth Lags Long-Term Trend, Challenges Bullish Narrative

Reviewed by Simply Wall St

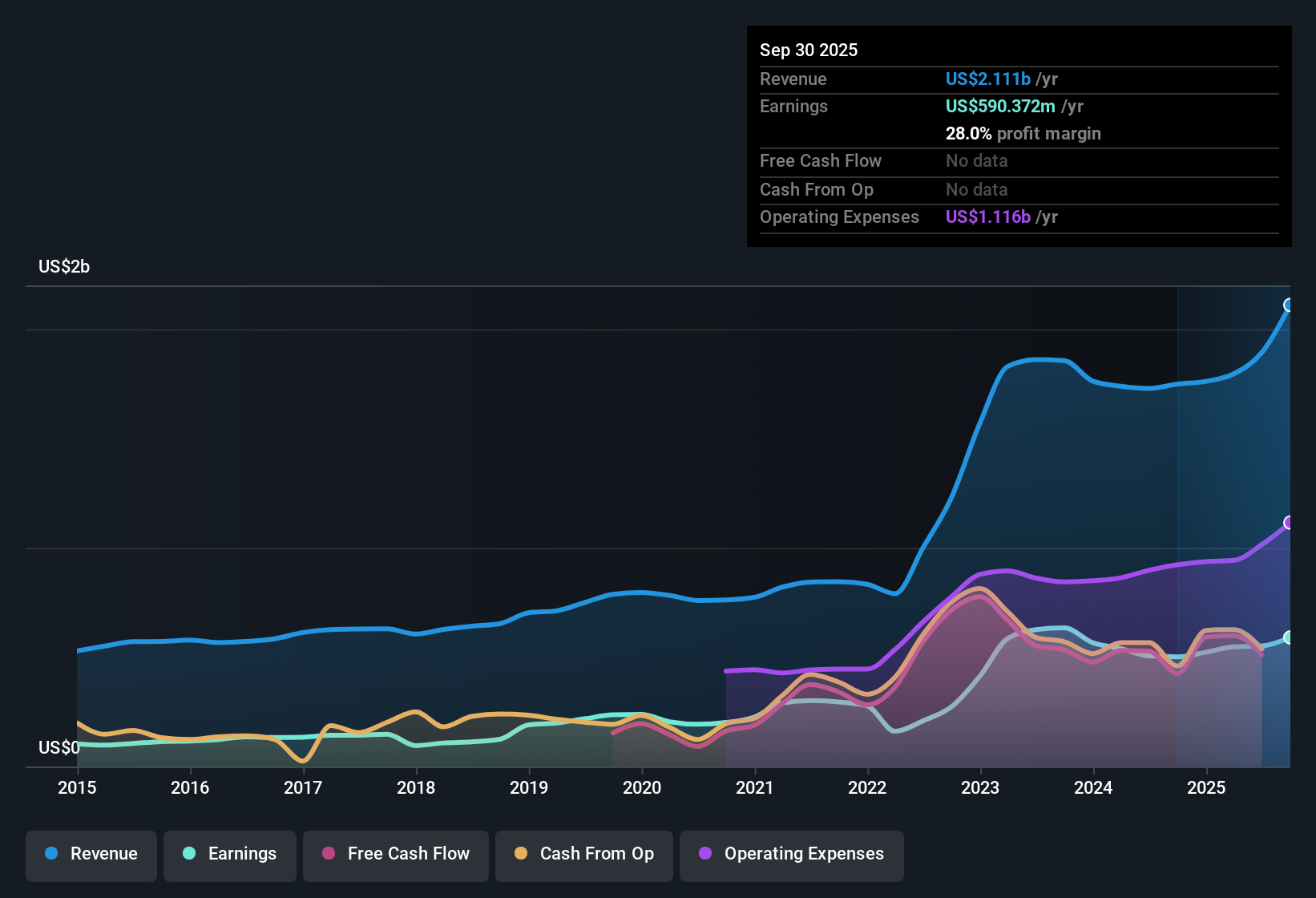

Old National Bancorp (ONB) posted an average annual earnings growth of 21.2% over the past five years, with its latest yearly increase at 9.1%. Net profit margins held at 29.1%, just off last year’s 29.2%. Looking ahead, forecasts call for ONB’s earnings to rise 22.5% per year and revenue to climb 9.5% annually, both stacking up well against broader U.S. market expectations.

See our full analysis for Old National Bancorp.Now it’s time to see how these headline numbers compare with the big-picture narratives that investors are following. Let’s look at where the data fits and where it pushes back against the prevailing market story.

See what the community is saying about Old National Bancorp

Acquisitions and Noninterest Income Fuel Upside

- The recent Bremer Bank partnership, completed ahead of schedule, has significantly expanded ONB’s balance sheet and capital position. This has strengthened both current earnings momentum and capacity for future loan growth.

- Analysts' consensus view highlights that ongoing integration of recent acquisitions, growing fee-based businesses, and demographic-driven demand for wealth services all point toward more stable and recurring noninterest income.

- Expansion in fee segments such as wealth, mortgage, and capital markets bolsters earnings stability beyond core loan growth numbers.

- Analysts expect profit margins to climb from 29.1% now to 40.4% in three years, indicating that these moves could produce substantial operating leverage if successful.

Valuation Premium Versus Peers Remains

- ONB trades on a Price-to-Earnings ratio of 14.8x, which is higher than the US banks industry average of 11.2x and also above key peers at 12.6x. This signals a valuation premium noticed by value-focused investors.

- Analysts' consensus narrative notes that, despite positive signals from discounted cash flow and analyst valuation models, the higher current P/E ratio means some upside may already be priced in.

- At the recent share price of $20.81, ONB still sits below the consensus analyst target of $26.17, suggesting possible room to run if earnings grow as forecast and valuation multiples contract.

- However, to hit consensus expectations, ONB would need to meet ambitious 2028 earnings targets and see its P/E drop to just 10.8x, below current industry levels. This would require both execution and a market re-rating.

Margin Compression Despite Profitability

- Net profit margins held steady at 29.1% this year, only a slight dip from last year’s 29.2%. This signals consistency but also hints at mild recent compression versus the high profits investors have come to expect.

- According to the consensus narrative, margin resiliency is anchored by ongoing digital investment and disciplined credit management. Yet, the risk of further compression remains if regulatory costs or regional economic headwinds rise.

- ONB’s cautious stance on loan growth, partly driven by heightened competition and continued exposure to commercial real estate, supports stable earnings today but could weigh on future margin expansion.

- Strategic digital upgrades and operational efficiencies are expected to help widen margins over the next three years, but actual improvement will depend on balancing growth with evolving cost pressures.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Old National Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something others might miss? Share your perspective and craft a unique narrative in just a few minutes. Do it your way

A great starting point for your Old National Bancorp research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite ONB's strong profit margins and growth forecasts, its valuation premium and risk of further margin compression could limit future upside if conditions tighten.

If you want more value for your investment, focus on opportunities with stronger upside and reasonable multiples by using our these 872 undervalued stocks based on cash flows to spot better-priced companies today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONB

Old National Bancorp

Operates as the bank holding company for Old National Bank that provides consumer and commercial banking services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives