- United States

- /

- Banks

- /

- NasdaqGS:OCFC

OceanFirst Financial (OCFC): Valuation in Focus as Fed Rate Cut Sparks Optimism for Regional Banks

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 10.1% Undervalued

The most widely followed narrative views OceanFirst Financial as undervalued, with a current share price offering potential upside according to prevailing analyst expectations and assumptions.

Ongoing digital initiatives and technology investments, including fintech partnerships, are enhancing operating leverage by reducing the incremental cost to serve and driving engagement with younger, tech-savvy demographics. This could potentially increase fee-based income and improve net margins over time.

Curious how a classic bank is being valued like a rising tech star? The secret sauce is bolder profit forecasts, evolving customer dynamics, and a pivotal set of financial targets just beneath the surface. Want to uncover the specific numbers and bold assumptions fueling this optimistic outlook? The full narrative reveals the data points that could change how you see OceanFirst’s future.

Result: Fair Value of $20.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower deposit growth or lackluster loan demand could undermine OceanFirst's outlook. This could make it harder for the company to deliver on bullish forecasts.

Find out about the key risks to this OceanFirst Financial narrative.Another View

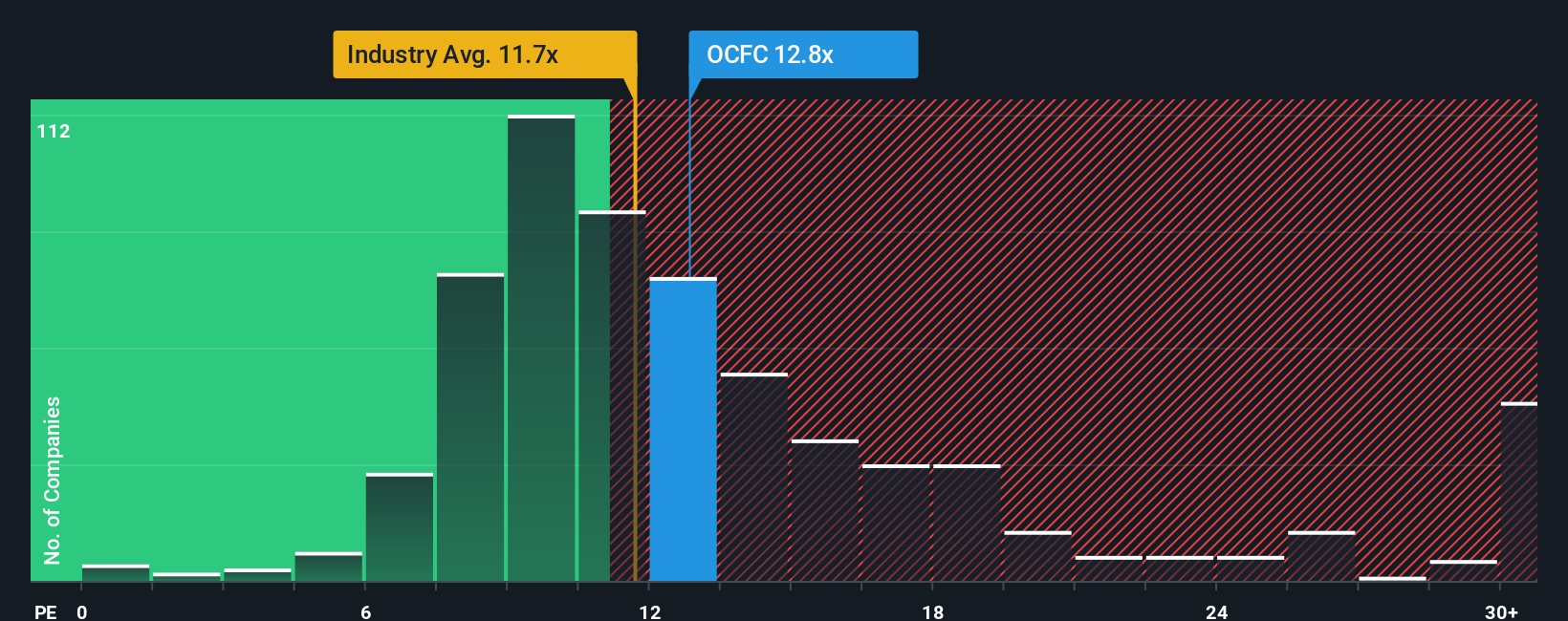

Our valuation using earnings relative to the industry paints a different picture. By this measure, OceanFirst Financial appears more expensive than its banking peers. Could the market be overlooking potential risks, or is it pricing in something unique?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding OceanFirst Financial to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own OceanFirst Financial Narrative

If you have your own perspective or want to dig into the numbers yourself, you can shape your own story in just minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding OceanFirst Financial.

Looking for More Investment Ideas?

Smart investors always keep an eye out for fresh opportunities. Don’t let market moves pass you by. These tailored ideas can put you a step ahead.

- Unlock hidden value by tracking companies that many have overlooked in the hunt for earnings, thanks to our undervalued stocks based on cash flows.

- Tap straight into the excitement of the artificial intelligence revolution with businesses on the leading edge by using our AI penny stocks.

- Capture stable income and growth potential among companies offering robust yields. Check opportunities with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OCFC

OceanFirst Financial

Operates as the bank holding company for OceanFirst Bank N.A.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives