- United States

- /

- Banks

- /

- NasdaqGM:NWFL

Norwood Financial (NWFL) Profit Margin Decline Challenges Defensive Dividend Narrative

Reviewed by Simply Wall St

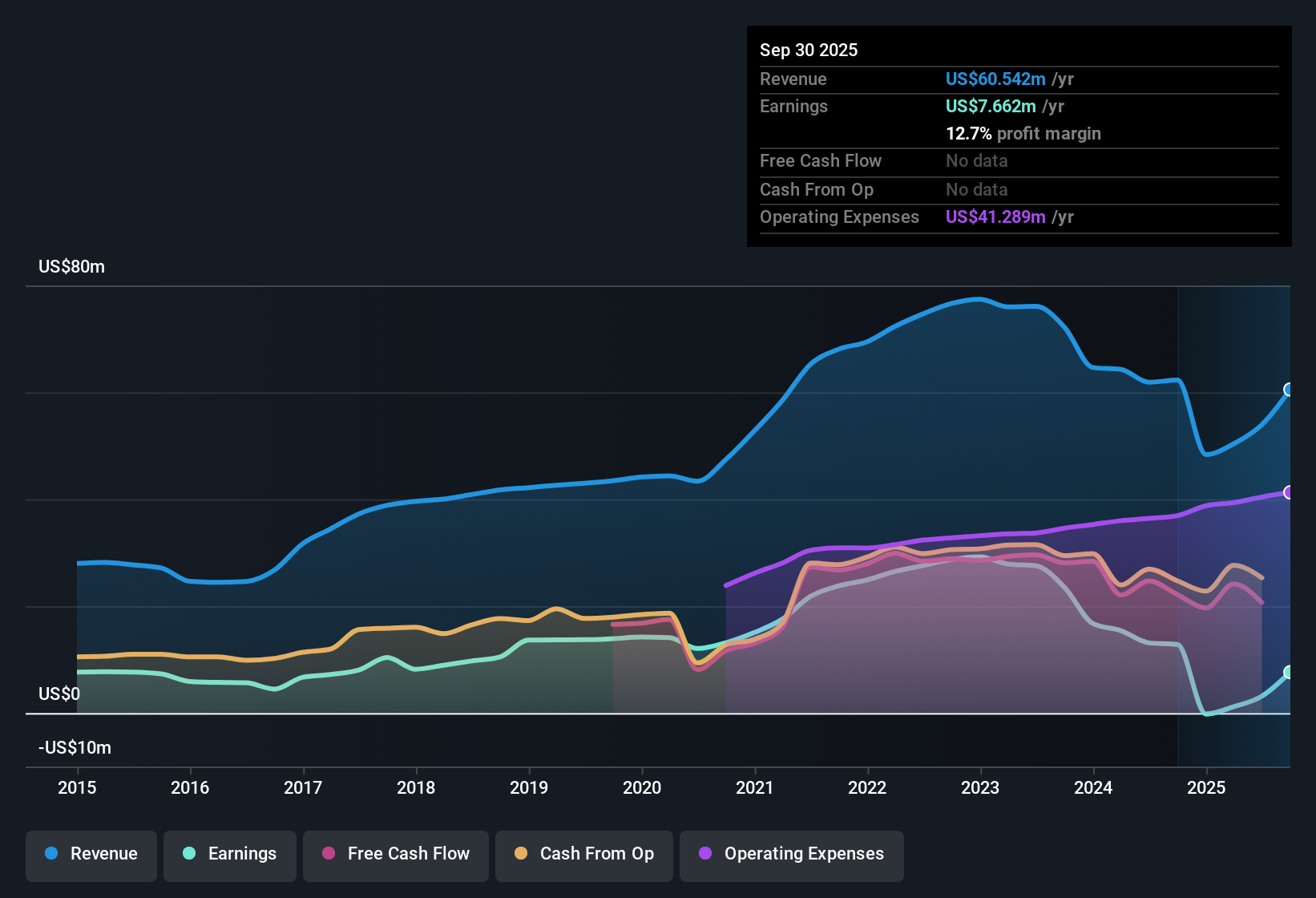

Norwood Financial (NWFL) has reported an 18% annual decline in earnings over the past five years, with its net profit margin dropping to 5.9% from 21.2% a year ago. This signals a clear pullback in profitability. The company is currently trading at a lofty 76.7x price-to-earnings ratio, which is well above both peer and industry averages. Shares are priced below an estimated fair value at $26.41. While some investors may see the high-quality earnings and discounted stock price as a potential upside, the shrinking margins and elevated valuation multiples present a mixed picture for now.

See our full analysis for Norwood Financial.Now, let's see how the numbers compare with the broader market narrative. This includes where the latest earnings fit the story and where they call it into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Compression Undermines Dividend Stability

- Net profit margin decreased sharply to 5.9% from 21.2% in the previous year, showing a steep drop in profitability despite high-quality earnings.

- Recent analysis points out that, while many investors appreciate Norwood Financial for its steady dividends and stable fundamentals, the margin decline raises questions about how much longer the company can maintain its reputation for reliability.

- Steady net income had been a core reason the stock was seen as a “safe haven.” The reduced margin now creates a contrast with its historical strengths.

- Bulls looking for consistent, risk-averse returns may need to watch for further weakness if margin pressures persist.

Trading at a Steep Premium to Peers

- Norwood Financial’s price-to-earnings ratio has soared to 76.7x, far above its peer average of 14x and the US Banks industry average of 11.2x. This puts the stock at a significant valuation premium.

- Prevailing market expectations often justify paying up for high-quality names, but this gap to sector multiples is hard to ignore.

- For investors who use peer comparisons, the massive premium is a clear warning flag that future growth expectations may be too high relative to recent financial trends.

- The high multiple is usually supported by outperformance. Recent earnings and margin declines signal caution about overpaying even for a “quality” bank stock.

Shares Trade at a Discount to DCF Fair Value

- The current share price of $26.41 sits below Norwood Financial’s DCF fair value estimate of $33.75, indicating potential long-term upside despite headline challenges.

- The value angle stands out because, even with falling profitability and high multiples, some investors may see the discount to intrinsic value as a rare window.

- Risk-averse investors might find this gap appealing. The stock’s premium to peers and softening earnings can limit conviction for a quick rebound.

- Any improvement in net margins or a return to industry-average multiples could help close part of the valuation gap in the future.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Norwood Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Norwood Financial faces margin compression and a steep valuation premium. These challenges impact the company's historical strengths and raise doubts about its ability to deliver steady, reliable returns.

If you want to sidestep these profit pressures and valuation risks, check out stable growth stocks screener (2094 results) delivering consistent performance regardless of market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norwood Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NWFL

Norwood Financial

Operates as the bank holding company for Wayne Bank that provides various banking products and services in the United States.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives