- United States

- /

- Banks

- /

- NasdaqGS:NWBI

Does Northwest Bank Offer Long-Term Value After Recent Regulatory Developments?

Reviewed by Bailey Pemberton

If you are on the fence about Northwest Bancshares, you are definitely not alone. The stock sits at an interesting crossroads, with a price of $12.46 at the latest close and a mixed bag of returns that might have you scratching your head. Over the past week, shares are up just 0.6%, and they have slipped by 2.0% in the last month. Year-to-date, the stock is off by 3.9%. Looking at the bigger picture, Northwest Bancshares is up 2.7% in the past year and a striking 70.8% over five years. That long-term trajectory is hard to ignore and it hints at underlying resilience even amid shorter-term volatility.

Some of these swings echo broader trends impacting the banking sector. Investors seem to be rethinking their appetite for regional banks as changes in interest rates and regulatory chatter make headlines. This shift in risk perception has kept some would-be buyers cautious. But has the market overreacted, or is Northwest Bancshares truly reflecting its fair value?

To start answering that, let’s look at one of the most useful numbers: the valuation score. Northwest Bancshares scores a 4 out of 6, meaning it is considered undervalued in four of the six methods analysts use for these sorts of checks. Pretty compelling, right? But valuation is all about context and comparison, so next we will walk through these valuation methods. At the end, I will show you a smarter way to make sense of what it all means for your decision.

Why Northwest Bancshares is lagging behind its peers

Approach 1: Northwest Bancshares Excess Returns Analysis

The Excess Returns model evaluates how much value a company is generating over the minimum return investors require for holding its equity. In other words, it looks at whether Northwest Bancshares earns more on its investments than its cost of equity, which is a key measure of value creation for shareholders.

For Northwest Bancshares, the numbers paint a clear picture. The stock’s book value stands at $12.84 per share, with a stable expected earnings per share (EPS) of $1.28 according to weighted future Return on Equity estimates from five analysts. The average return on equity sits at 9.72%, while the cost of equity is $0.89 per share. This leaves an excess return of $0.39 per share, which suggests the company consistently produces profit over and above what is required to satisfy its shareholders. Analysts also expect the stable book value to gradually rise to $13.13 per share, based on their projections.

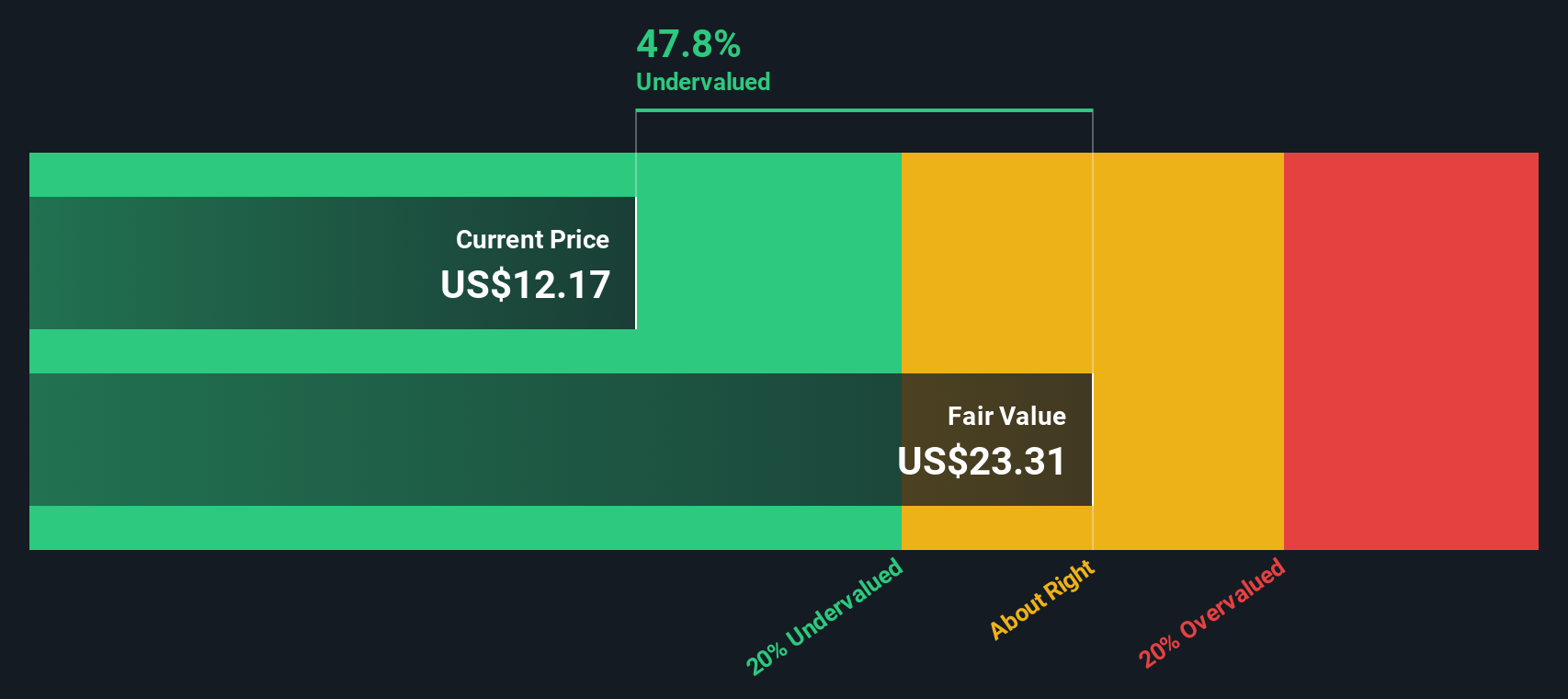

According to this model, the intrinsic value of Northwest Bancshares is meaningfully higher than its current trading price. The analysis points to the stock being 47.2% undervalued, indicating significant potential upside for patient investors who prioritize long-term value creation.

Result: UNDERVALUED

Our Excess Returns analysis suggests Northwest Bancshares is undervalued by 47.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Northwest Bancshares Price vs Earnings

For companies like Northwest Bancshares that are consistently profitable, the Price-to-Earnings (PE) ratio is a go-to valuation metric. The PE ratio allows investors to quickly gauge how much they are paying for each dollar of earnings, and is especially relevant when considering stable businesses with predictable profits.

Interpreting whether a PE is “fair” or cheap, however, is a bit of an art. A higher expected growth rate or lower perceived risk can justify a higher PE, while more risk or slower growth usually pulls it down. So, it is important not just to compare Northwest Bancshares’ PE in a vacuum, but to see how it stacks up against its industry and typical peers.

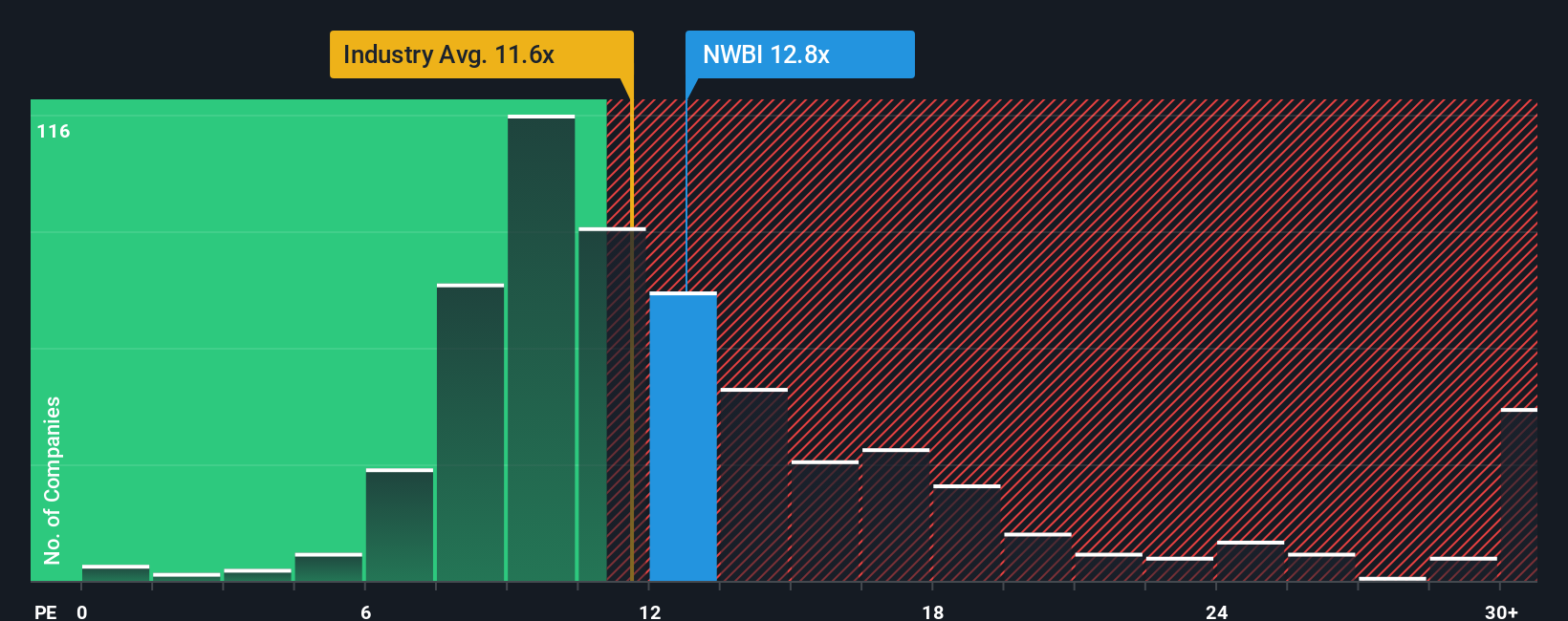

Right now, Northwest Bancshares trades at 12.7x earnings. That is just above the industry average PE of 11.7x, but noticeably below the peer average of 17.2x. On the surface, this might make the stock look attractively priced compared to peers, but context matters.

That is where Simply Wall St’s “Fair Ratio” comes in. It is a tailored figure that factors in Northwest Bancshares’ unique growth forecasts, risk profile, profit margin, industry context, and market capitalization. Rather than relying solely on broad comparisons, the Fair Ratio (calculated at 14.6x) gives a more individualized benchmark for what a fair valuation should be.

Comparing the Fair Ratio of 14.6x to Northwest Bancshares’ actual PE of 12.7x, the current pricing looks to be well below what would be considered fair value, signaling that the stock is undervalued based on this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Northwest Bancshares Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your story about a company; it is your personal view, translated into numbers, on where Northwest Bancshares is headed and what that means for its fair value. With Narratives, you connect your expectations for things like revenue growth, profit margins, and future earnings directly to a fair value estimate, so your investment thesis is built on both story and substance.

Narratives are available on Simply Wall St’s platform, trusted by millions and accessible right now within each company’s Community page. They make it easy for any investor to test different scenarios, compare fair value to today’s price, and see how your view stacks up. Plus, Narratives are dynamic, so when new earnings, news, or industry shifts appear, your assumptions and fair value update instantly.

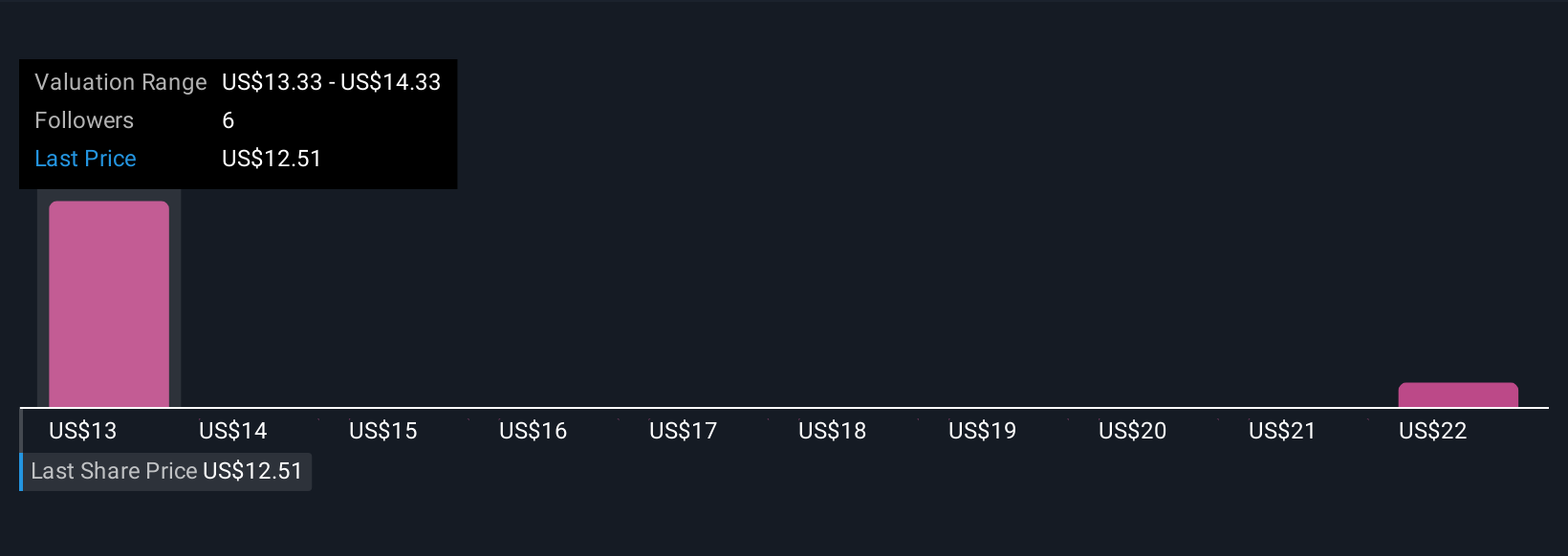

For example, one Northwest Bancshares Narrative projects a fair value of $13.38 if earnings reach $249.6 million by 2028, while another sees more risk and suggests a lower value around $11.62. With Narratives, you can quickly see a range of possible outcomes and decide when to buy, hold, or sell, all based on your own logic and the latest data.

Do you think there's more to the story for Northwest Bancshares? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northwest Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWBI

Northwest Bancshares

Operates as the bank holding company for Northwest Bank, a state-chartered savings bank that provides personal and business banking solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.