- United States

- /

- Banks

- /

- NasdaqCM:NECB

With EPS Growth And More, Northeast Community Bancorp (NASDAQ:NECB) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Northeast Community Bancorp (NASDAQ:NECB). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Northeast Community Bancorp

How Fast Is Northeast Community Bancorp Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Northeast Community Bancorp has achieved impressive annual EPS growth of 57%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

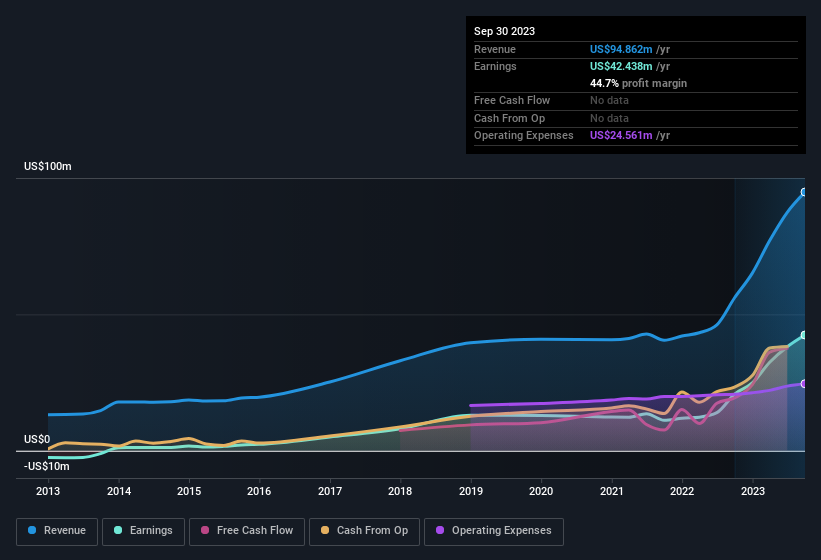

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Northeast Community Bancorp's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Northeast Community Bancorp maintained stable EBIT margins over the last year, all while growing revenue 69% to US$95m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Northeast Community Bancorp is no giant, with a market capitalisation of US$227m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Northeast Community Bancorp Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

With strong conviction, Northeast Community Bancorp insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Independent Director, Charles Cirillo, paid US$62k to buy shares at an average price of US$15.48. Strong buying like that could be a sign of opportunity.

Should You Add Northeast Community Bancorp To Your Watchlist?

Northeast Community Bancorp's earnings per share growth have been climbing higher at an appreciable rate. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And may very well signal a significant inflection point for the business. If that's the case, you may regret neglecting to put Northeast Community Bancorp on your watchlist. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Northeast Community Bancorp that you should be aware of.

The good news is that Northeast Community Bancorp is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Northeast Community Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NECB

Northeast Community Bancorp

Operates as the holding company for NorthEast Community Bank that provides financial services for individuals and businesses.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives