- United States

- /

- Banks

- /

- NasdaqGS:MOFG

MidWestOne Financial Group's (NASDAQ:MOFG) Dividend Will Be $0.2425

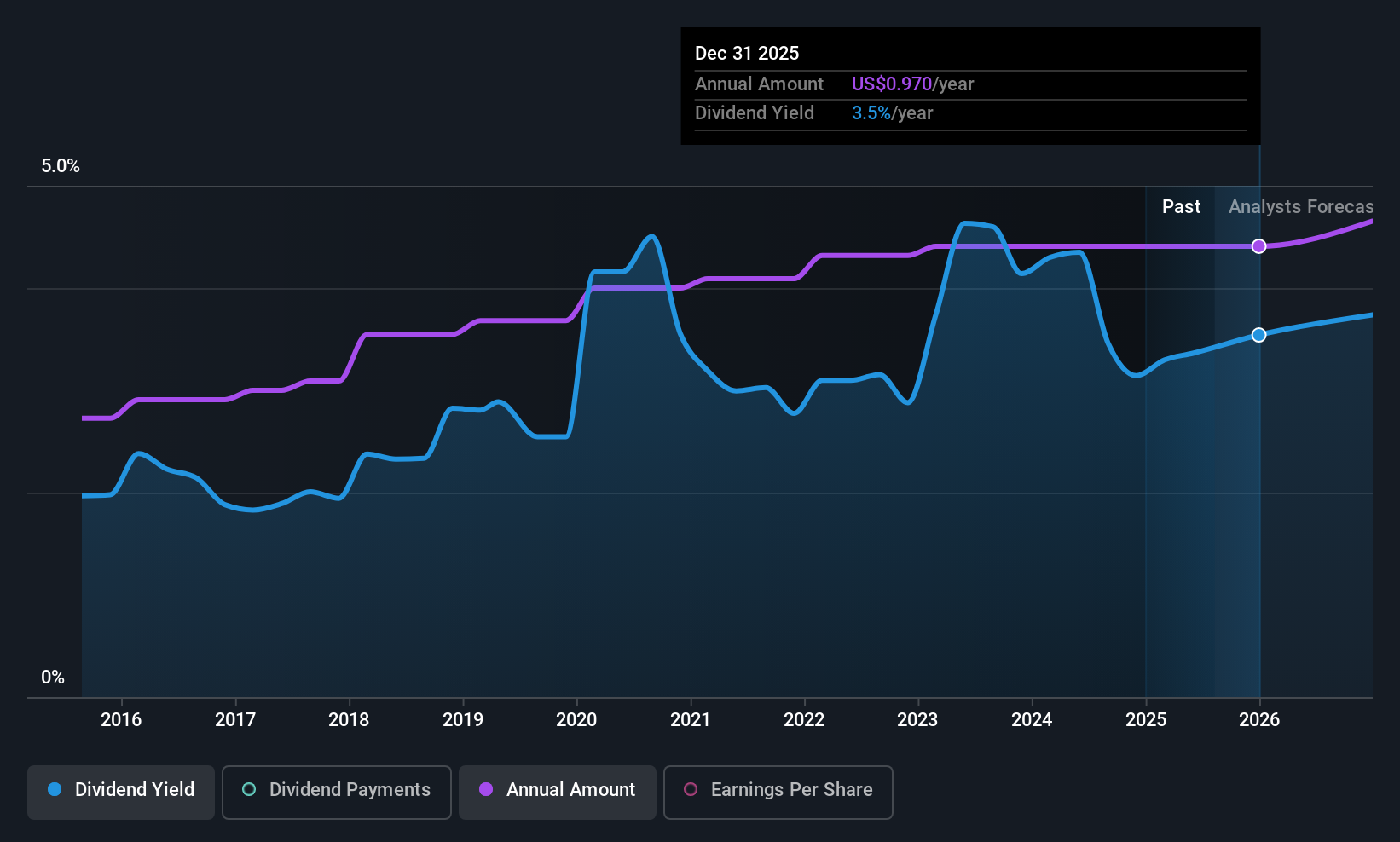

The board of MidWestOne Financial Group, Inc. (NASDAQ:MOFG) has announced that it will pay a dividend of $0.2425 per share on the 16th of September. This means that the annual payment will be 3.5% of the current stock price, which is in line with the average for the industry.

MidWestOne Financial Group Will Pay Out More Than It Is Earning

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important.

MidWestOne Financial Group has a long history of paying out dividends, with its current track record at a minimum of 10 years. But while this history shows that the company was able to sustain its dividend for a decent period of time, its most recent earnings report shows that the company did not make enough earnings to cover its dividend payout. This is an alarming sign that could mean that MidWestOne Financial Group's dividend at its current rate may no longer be sustainable for longer.

Earnings per share is forecast to rise by 121.2% over the next year. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the future payout ratio reaching 185% over the next year.

See our latest analysis for MidWestOne Financial Group

MidWestOne Financial Group Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The annual payment during the last 10 years was $0.58 in 2015, and the most recent fiscal year payment was $0.97. This works out to be a compound annual growth rate (CAGR) of approximately 5.3% a year over that time. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Let's not jump to conclusions as things might not be as good as they appear on the surface. MidWestOne Financial Group's EPS has fallen by approximately 36% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

An additional note is that the company has been raising capital by issuing stock equal to 31% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about MidWestOne Financial Group's payments, as there could be some issues with sustaining them into the future. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, MidWestOne Financial Group has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MOFG

MidWestOne Financial Group

Operates as the bank holding company for MidWestOne Bank that provides commercial and retail banking products and services to individuals, businesses, governmental units, and institutional customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026