- United States

- /

- Banks

- /

- NasdaqCM:LNKB

3 US Growth Companies With High Insider Ownership And Up To 85% Earnings Growth

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights, buoyed by strong tech earnings and investor optimism, attention turns to growth companies with substantial insider ownership. These firms often demonstrate a commitment from their leaders, potentially aligning management interests with those of shareholders in a thriving economic environment.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Coastal Financial (NasdaqGS:CCB) | 17.8% | 46.1% |

| Clene (NasdaqCM:CLNN) | 21.6% | 60.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 63.6% |

| Alkami Technology (NasdaqGS:ALKT) | 10.9% | 98.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

Underneath we present a selection of stocks filtered out by our screen.

LINKBANCORP (NasdaqCM:LNKB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LINKBANCORP, Inc. is a bank holding company for The Gratz Bank, offering a range of banking products and services to individuals, families, nonprofits, and businesses in Pennsylvania, with a market cap of $278.04 million.

Operations: The company generates revenue of $86.14 million from its banking operations, catering to a diverse clientele in Pennsylvania.

Insider Ownership: 31.9%

Earnings Growth Forecast: 41.1% p.a.

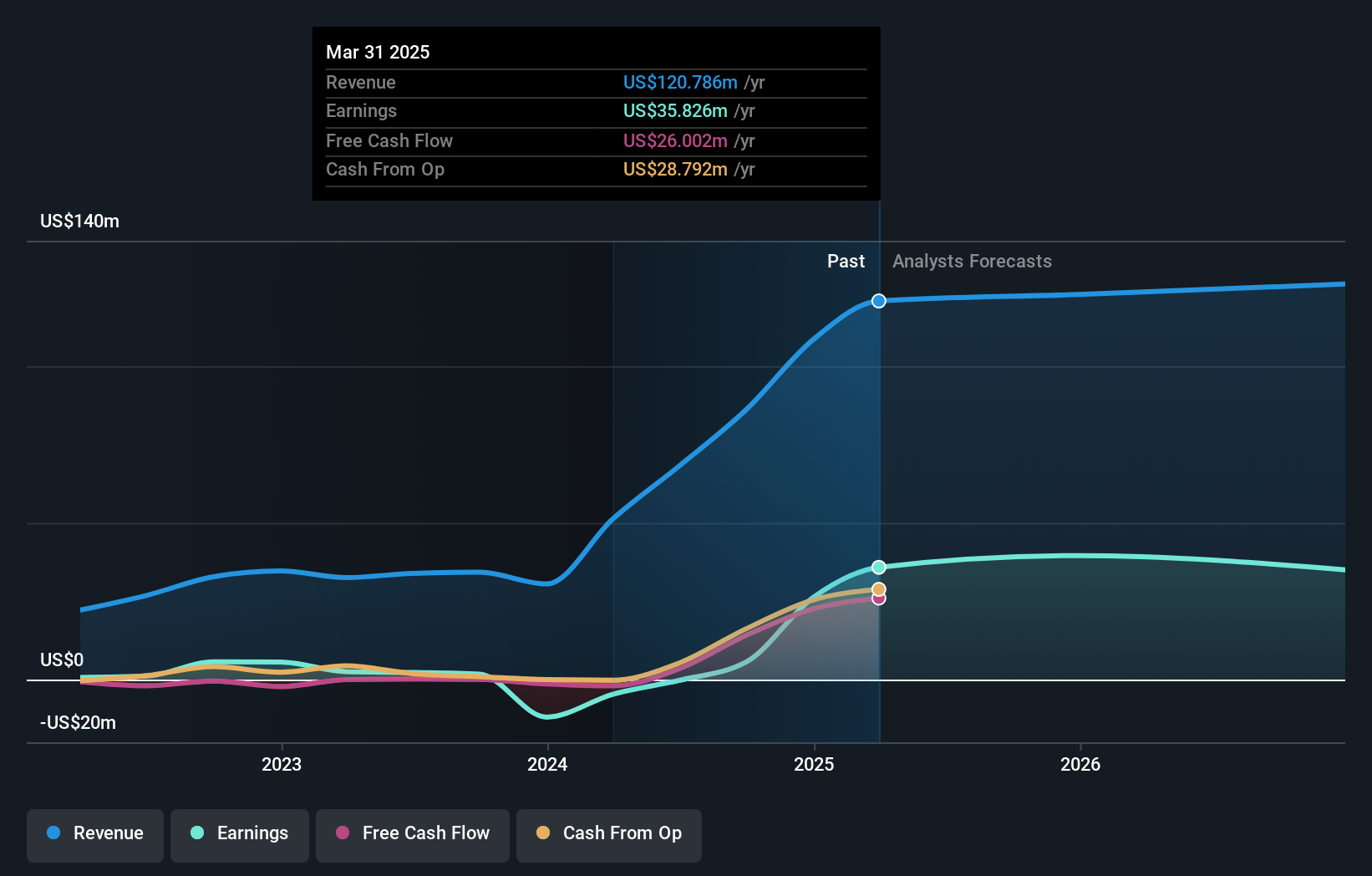

LINKBANCORP's earnings are forecast to grow significantly, at 41.1% annually, outpacing the US market average of 15.4%. Despite substantial insider selling recently, the company reported strong third-quarter results with net income rising to US$7.1 million from US$1.24 million a year ago. Revenue growth is expected at 14.2% per year, above the market average but below high-growth benchmarks. The dividend yield of 3.98% raises sustainability concerns given current earnings coverage issues.

- Delve into the full analysis future growth report here for a deeper understanding of LINKBANCORP.

- Our valuation report here indicates LINKBANCORP may be overvalued.

AirSculpt Technologies (NasdaqGM:AIRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AirSculpt Technologies, Inc. operates as a holding company for EBS Intermediate Parent LLC, offering body contouring procedure services in the United States with a market cap of approximately $400.55 million.

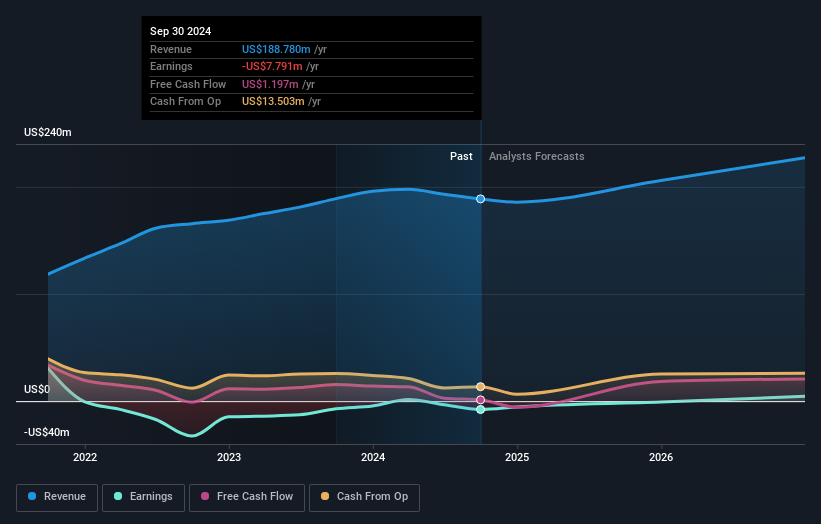

Operations: The company's revenue is primarily generated from Direct Medical Procedure Services, totaling $188.78 million.

Insider Ownership: 27%

Earnings Growth Forecast: 85.9% p.a.

AirSculpt Technologies is forecast to achieve profitability in the next three years, with earnings projected to grow significantly at 85.86% annually, surpassing market averages. Despite recent insider selling and a volatile share price, no substantial insider buying has occurred recently. The company trades at nearly 40% below its estimated fair value. Recent expansions include new clinics in White Plains and Birmingham, enhancing their service offerings amid declining sales and increased net losses reported for Q3 2024.

- Take a closer look at AirSculpt Technologies' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that AirSculpt Technologies is priced higher than what may be justified by its financials.

Carriage Services (NYSE:CSV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Carriage Services, Inc. operates in the United States offering funeral and cemetery services and merchandise, with a market cap of approximately $616.08 million.

Operations: The company's revenue is derived from two main segments: Funeral services, which generated $266.69 million, and Cemetery services, contributing $138.64 million.

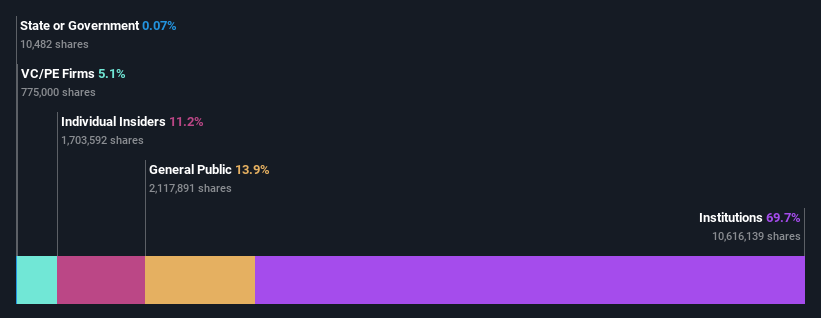

Insider Ownership: 11.2%

Earnings Growth Forecast: 23.8% p.a.

Carriage Services has demonstrated solid earnings growth, with a 21.1% annual increase over the past five years and an expected 23.82% growth annually, outpacing the US market. Despite insider selling in recent months, it trades at a significant discount to its estimated fair value. Recent Q3 results show increased revenue and net income, while updated guidance projects higher full-year revenue between $395 million and $405 million (US$).

- Click here and access our complete growth analysis report to understand the dynamics of Carriage Services.

- Our comprehensive valuation report raises the possibility that Carriage Services is priced lower than what may be justified by its financials.

Next Steps

- Dive into all 210 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LNKB

LINKBANCORP

Operates as a bank holding company for The Gratz Bank, that provides various banking products and services to individuals, families, nonprofit, and business customers in Pennsylvania.

Flawless balance sheet with reasonable growth potential.