- United States

- /

- Banks

- /

- NasdaqCM:LMST

Here's Why We Think Limestone Bancorp, Inc.'s (NASDAQ:LMST) CEO Compensation Looks Fair for the time being

The share price of Limestone Bancorp, Inc. (NASDAQ:LMST) has been growing in the past few years, however, the per-share earnings growth has been lacking, suggesting something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 19 May 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out our latest analysis for Limestone Bancorp

How Does Total Compensation For John Taylor Compare With Other Companies In The Industry?

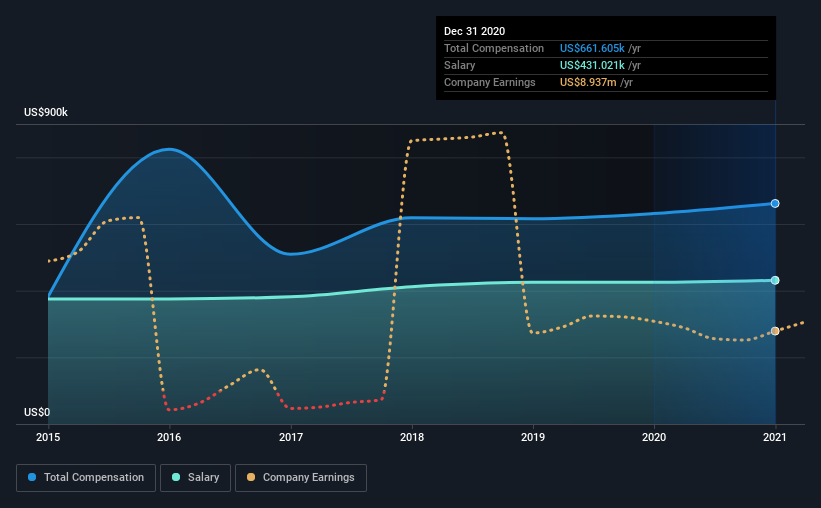

At the time of writing, our data shows that Limestone Bancorp, Inc. has a market capitalization of US$117m, and reported total annual CEO compensation of US$662k for the year to December 2020. That's a fairly small increase of 4.8% over the previous year. In particular, the salary of US$431.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$573k. This suggests that Limestone Bancorp remunerates its CEO largely in line with the industry average. Moreover, John Taylor also holds US$2.3m worth of Limestone Bancorp stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$431k | US$425k | 65% |

| Other | US$231k | US$206k | 35% |

| Total Compensation | US$662k | US$631k | 100% |

Talking in terms of the industry, salary represented approximately 42% of total compensation out of all the companies we analyzed, while other remuneration made up 58% of the pie. Limestone Bancorp is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Limestone Bancorp, Inc.'s Growth

Over the last three years, Limestone Bancorp, Inc. has shrunk its earnings per share by 39% per year. In the last year, its revenue is up 8.1%.

The decline in EPS is a bit concerning. The fairly low revenue growth fails to impress given that the EPS is down. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Limestone Bancorp, Inc. Been A Good Investment?

Limestone Bancorp, Inc. has generated a total shareholder return of 16% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 1 warning sign for Limestone Bancorp that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Limestone Bancorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:LMST

Limestone Bancorp

Limestone Bancorp, Inc. operates as the bank holding company for Limestone Bank, Inc.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026