- United States

- /

- Banks

- /

- NasdaqGM:LARK

What Can We Learn About Landmark Bancorp's (NASDAQ:LARK) CEO Compensation?

This article will reflect on the compensation paid to Michael Scheopner who has served as CEO of Landmark Bancorp, Inc. (NASDAQ:LARK) since 2014. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Landmark Bancorp

Comparing Landmark Bancorp, Inc.'s CEO Compensation With the industry

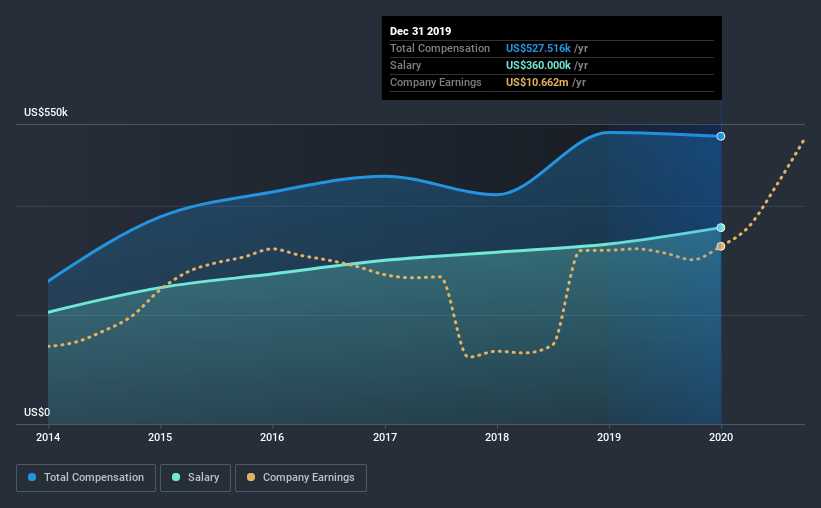

According to our data, Landmark Bancorp, Inc. has a market capitalization of US$113m, and paid its CEO total annual compensation worth US$528k over the year to December 2019. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at US$360.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$609k. From this we gather that Michael Scheopner is paid around the median for CEOs in the industry. Furthermore, Michael Scheopner directly owns US$2.8m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$360k | US$330k | 68% |

| Other | US$168k | US$205k | 32% |

| Total Compensation | US$528k | US$535k | 100% |

Speaking on an industry level, nearly 43% of total compensation represents salary, while the remainder of 57% is other remuneration. Landmark Bancorp is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Landmark Bancorp, Inc.'s Growth Numbers

Landmark Bancorp, Inc. has seen its earnings per share (EPS) increase by 62% a year over the past three years. It achieved revenue growth of 30% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Landmark Bancorp, Inc. Been A Good Investment?

Landmark Bancorp, Inc. has generated a total shareholder return of 8.6% over three years, so most shareholders wouldn't be too disappointed. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

As previously discussed, Michael is compensated close to the median for companies of its size, and which belong to the same industry. However, it's admirable that over the last three years, EPS growth for the company has been impressive, though the same can't be said for investor returns. As a result of these considerations, we would suggest the compensation is reasonable, but looking ahead shareholders will likely want to see healthier returns.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Landmark Bancorp that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Landmark Bancorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Landmark Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:LARK

Landmark Bancorp

Operates as the financial holding company for Landmark National Bank that provides various financial and banking services to its local communities.

Excellent balance sheet with proven track record and pays a dividend.