- United States

- /

- Banks

- /

- NasdaqCM:CZNC

US Market's Hidden Gems: 3 Undiscovered Stocks to Watch

Reviewed by Simply Wall St

As U.S. stock indexes experience a pullback ahead of key inflation data, investors are keenly observing economic indicators that suggest resilience in consumer spending and a robust GDP growth rate. Amidst this backdrop, identifying hidden gems in the market becomes crucial, as these stocks may offer unique opportunities due to their potential for growth and innovation that align with current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Elron Ventures | 5.70% | 13.72% | 25.56% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Citizens & Northern (CZNC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Citizens & Northern Corporation is the bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate clients, with a market capitalization of $306.58 million.

Operations: Citizens & Northern generates revenue primarily from its community banking segment, which totals $108.31 million. The company's financial performance can be further analyzed by examining its net profit margin trends over time.

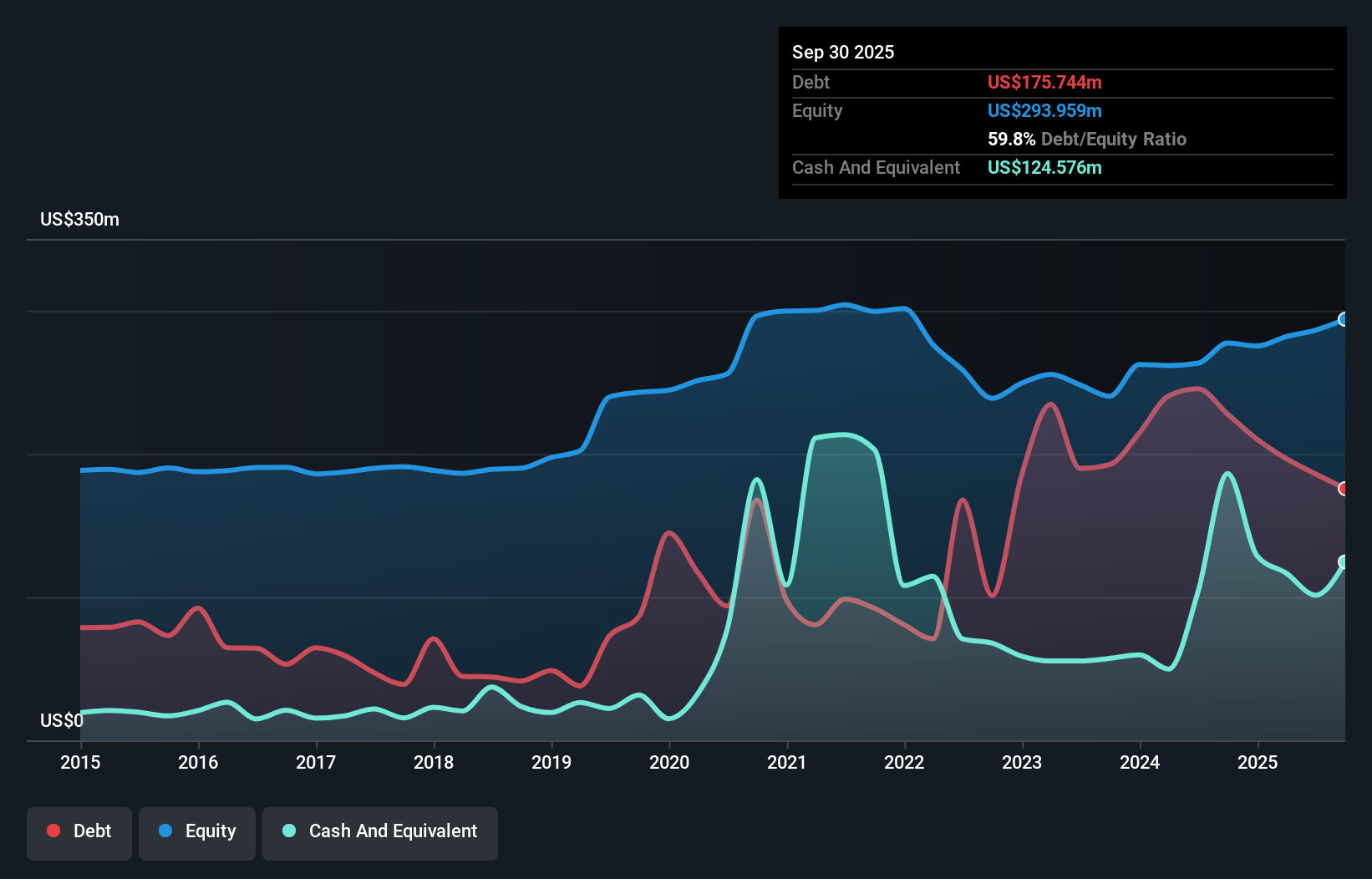

Citizens & Northern, with total assets of $2.6 billion and equity of $286.4 million, showcases a robust financial profile. The bank's deposits stand at $2.1 billion against loans of $1.9 billion, reflecting a solid net interest margin of 3.3%. Despite an allowance for bad loans being low at 86%, the non-performing loan ratio remains appropriate at 1.3%. Earnings surged by 15% over the past year, outpacing industry growth rates, and it trades significantly below its estimated fair value by about 40%. With primarily low-risk funding sources making up 91% of liabilities, Citizens & Northern appears well-positioned in its sector.

- Unlock comprehensive insights into our analysis of Citizens & Northern stock in this health report.

Explore historical data to track Citizens & Northern's performance over time in our Past section.

John Marshall Bancorp (JMSB)

Simply Wall St Value Rating: ★★★★★★

Overview: John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank, offering a range of banking products and financial services in the United States with a market capitalization of $287.35 million.

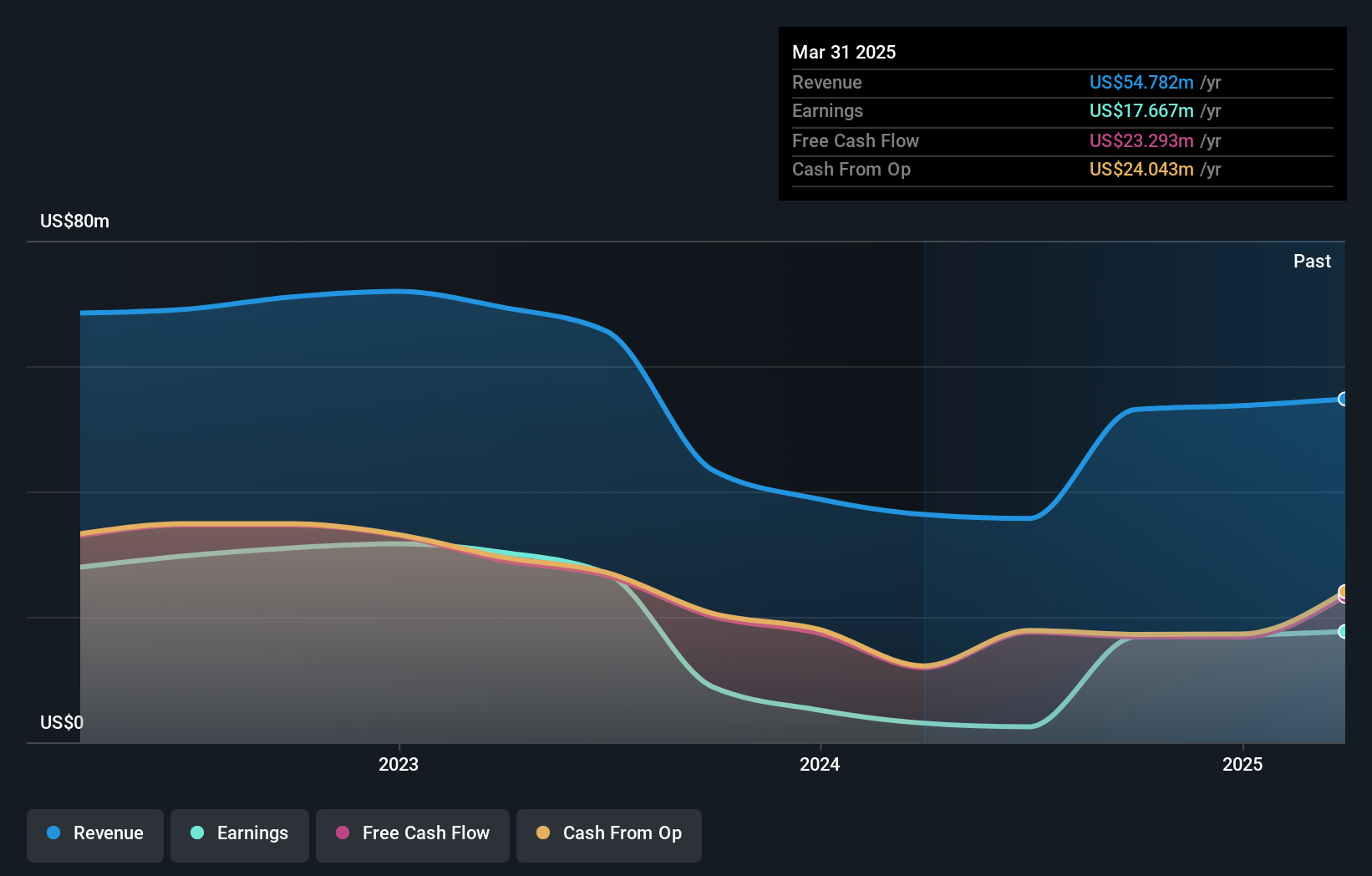

Operations: The company generates revenue primarily from its banking segment, totaling $56.75 million.

John Marshall Bancorp, with assets totaling $2.3 billion and equity of $253.7 million, stands out for its robust financial health and quality earnings. The bank's liabilities are 94% funded by low-risk customer deposits, reducing external borrowing risks. Over the past year, earnings surged 664%, vastly outperforming the banking industry's average growth of 13%. With a price-to-earnings ratio of 15.4x below the US market average of 19.3x, it seems attractively valued. Total deposits and loans each stand at $1.9 billion, while its allowance for bad loans is sufficient at 0.5% of total loans, reflecting prudent risk management practices.

Guaranty Bancshares (GNTY)

Simply Wall St Value Rating: ★★★★★★

Overview: Guaranty Bancshares, Inc. operates as the bank holding company for Guaranty Bank & Trust, N.A., with a market cap of $560.46 million.

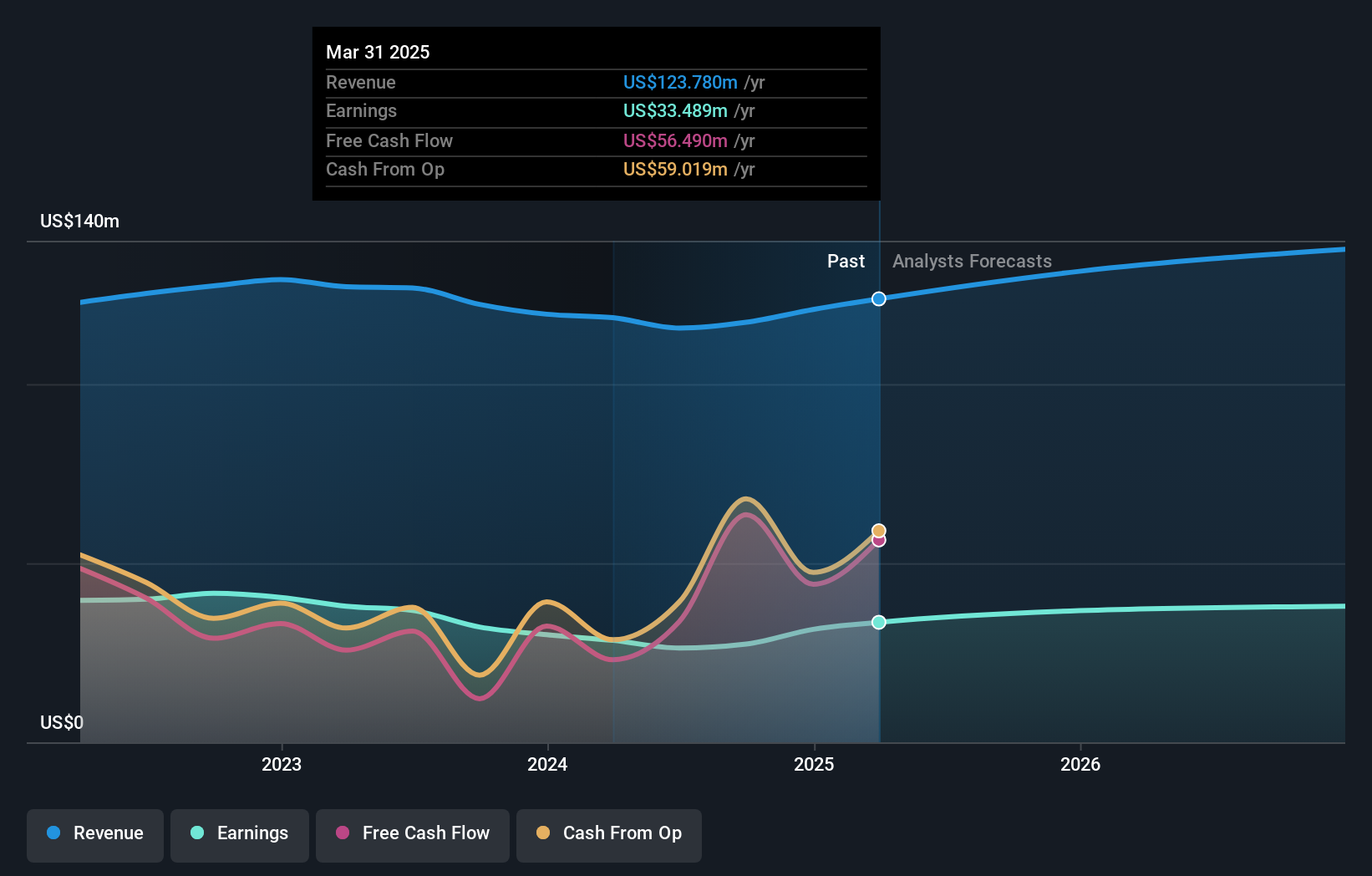

Operations: Guaranty Bancshares generates revenue primarily from its banking segment, totaling $127.33 million. The company's financial performance is reflected in its net profit margin, which stands at 27%.

Guaranty Bancshares, with assets of US$3.1 billion and equity of US$331.8 million, stands out in the financial sector due to its strong fundamentals and strategic moves. It boasts a robust loan portfolio of US$2.1 billion against deposits totaling US$2.7 billion, supported by a sufficient allowance for bad loans at 268% and non-performing loans at just 0.5%. The bank's earnings surged by 37% last year, surpassing industry growth rates significantly, while maintaining primarily low-risk funding sources (96%). Trading below estimated fair value by nearly 28%, it presents an intriguing opportunity for investors seeking stability and growth potential in the banking sector.

Key Takeaways

- Embark on your investment journey to our 287 US Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZNC

Citizens & Northern

Operates as the bank holding company for Citizens & Northern Bank that provides various banking and related services to individual and corporate customers.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success