- United States

- /

- Banks

- /

- NasdaqCM:JMSB

Undiscovered Gems in the United States to Explore This October 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight dip of 1.0%, yet it has shown remarkable resilience with a 38% rise over the past year and an optimistic forecast of 15% annual earnings growth. In this dynamic environment, identifying stocks that combine strong fundamentals with growth potential can uncover promising opportunities for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Franklin Financial Services | 219.05% | 5.55% | -1.86% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

John Marshall Bancorp (NasdaqCM:JMSB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: John Marshall Bancorp, Inc. is the bank holding company for John Marshall Bank, offering a range of banking products and financial services, with a market cap of $301.85 million.

Operations: John Marshall Bancorp generates revenue primarily through interest income from loans and investments, as well as fees from its banking services. The company incurs costs related to interest expenses on deposits and borrowings, along with operational expenses. Net profit margin trends can provide insight into the company's efficiency in managing these costs relative to its revenue generation.

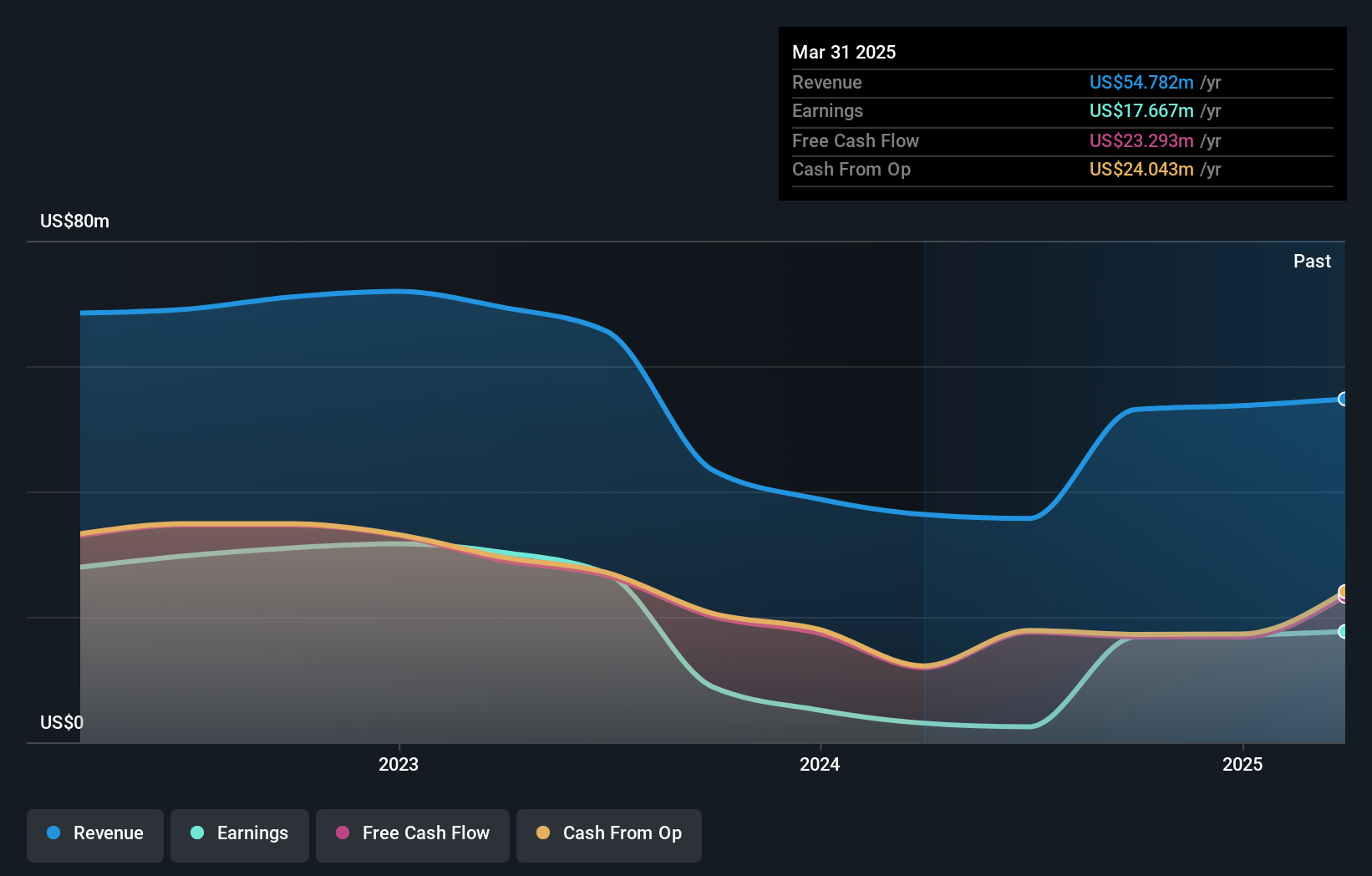

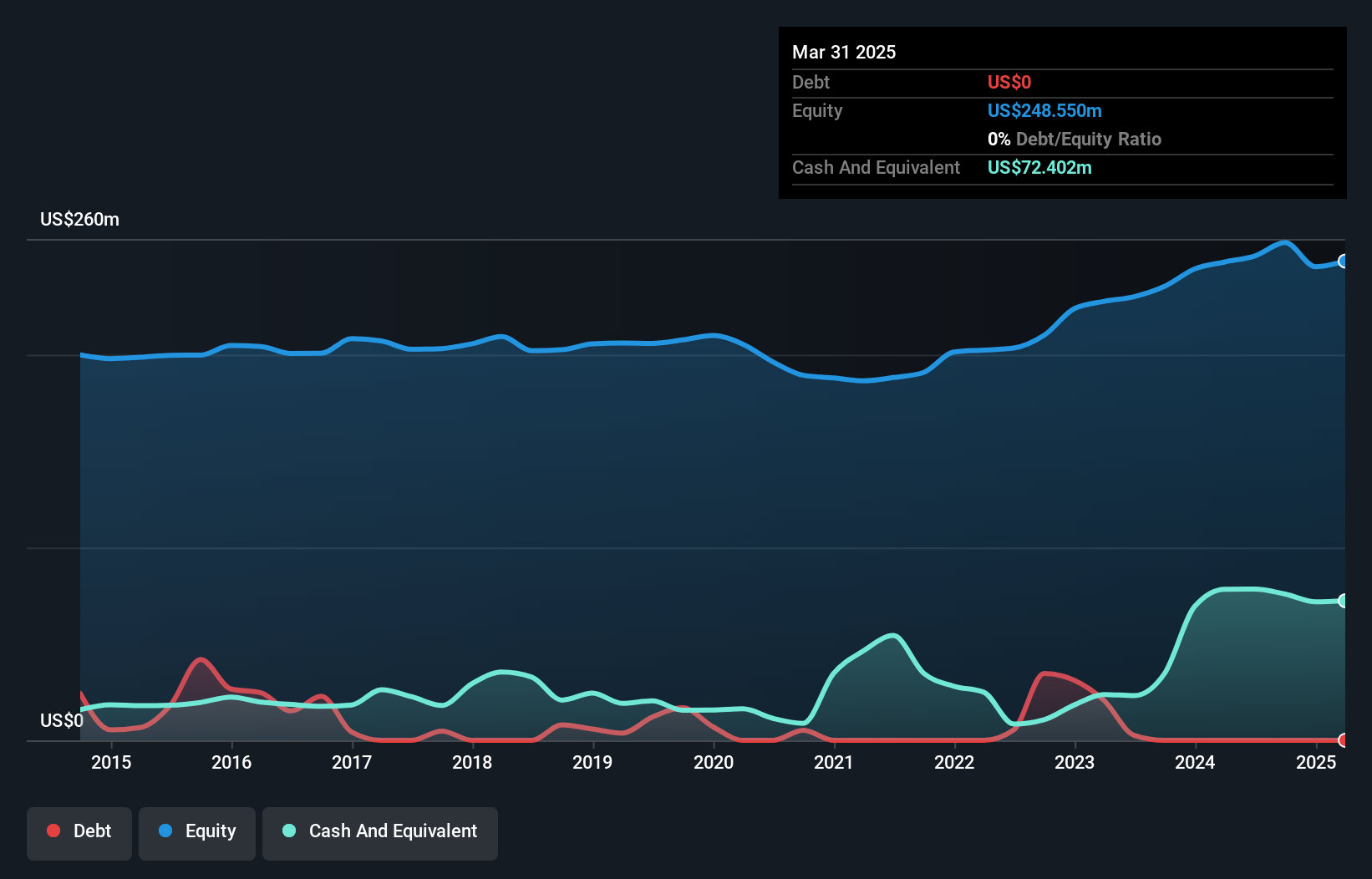

With total assets of US$2.3 billion and equity of US$243.1 million, John Marshall Bancorp seems to be an intriguing player in the financial landscape. Its earnings have surged by 90.7% over the past year, outpacing the broader banks industry which saw a decrease of 15%. Total deposits stand at US$1.9 billion against loans totaling US$1.8 billion, indicating a solid funding base with 95% sourced from low-risk customer deposits. Despite trading at nearly half its estimated fair value, it's noteworthy that earnings have decreased by an average of 5.6% annually over five years, suggesting potential challenges ahead despite recent performance improvements.

- Get an in-depth perspective on John Marshall Bancorp's performance by reading our health report here.

Evaluate John Marshall Bancorp's historical performance by accessing our past performance report.

Weyco Group (NasdaqGS:WEYS)

Simply Wall St Value Rating: ★★★★★★

Overview: Weyco Group, Inc. designs and distributes footwear for men, women, and children with a market capitalization of approximately $319.72 million.

Operations: The company generates revenue primarily through its wholesale segment, contributing $235.54 million, and its retail segment, adding $38.88 million.

Weyco Group, a US-based footwear company, has shown resilience despite industry challenges. Over the past year, it reported earnings growth of -9.5%, which is better than the Retail Distributors' average of -17.9%. The firm boasts a debt-free status now compared to five years ago when its debt-to-equity ratio was 5.8%. Recent financial maneuvers include repurchasing 17,813 shares for $0.51 million and extending its credit facility's maturity to September 2025 with a $40 million borrowing limit. Trading at 95% below estimated fair value suggests potential upside for investors seeking value in under-the-radar stocks.

China Yuchai International (NYSE:CYD)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Yuchai International Limited is engaged in the manufacturing, assembling, and selling of diesel and natural gas engines for various applications including trucks, buses, passenger vehicles, marine, industrial, construction, agriculture, and generator sets both in China and internationally with a market cap of $454.60 million.

Operations: China Yuchai generates revenue primarily from the sale of diesel and natural gas engines across various applications. The company's financial performance is influenced by its ability to manage production costs, which impacts its net profit margin.

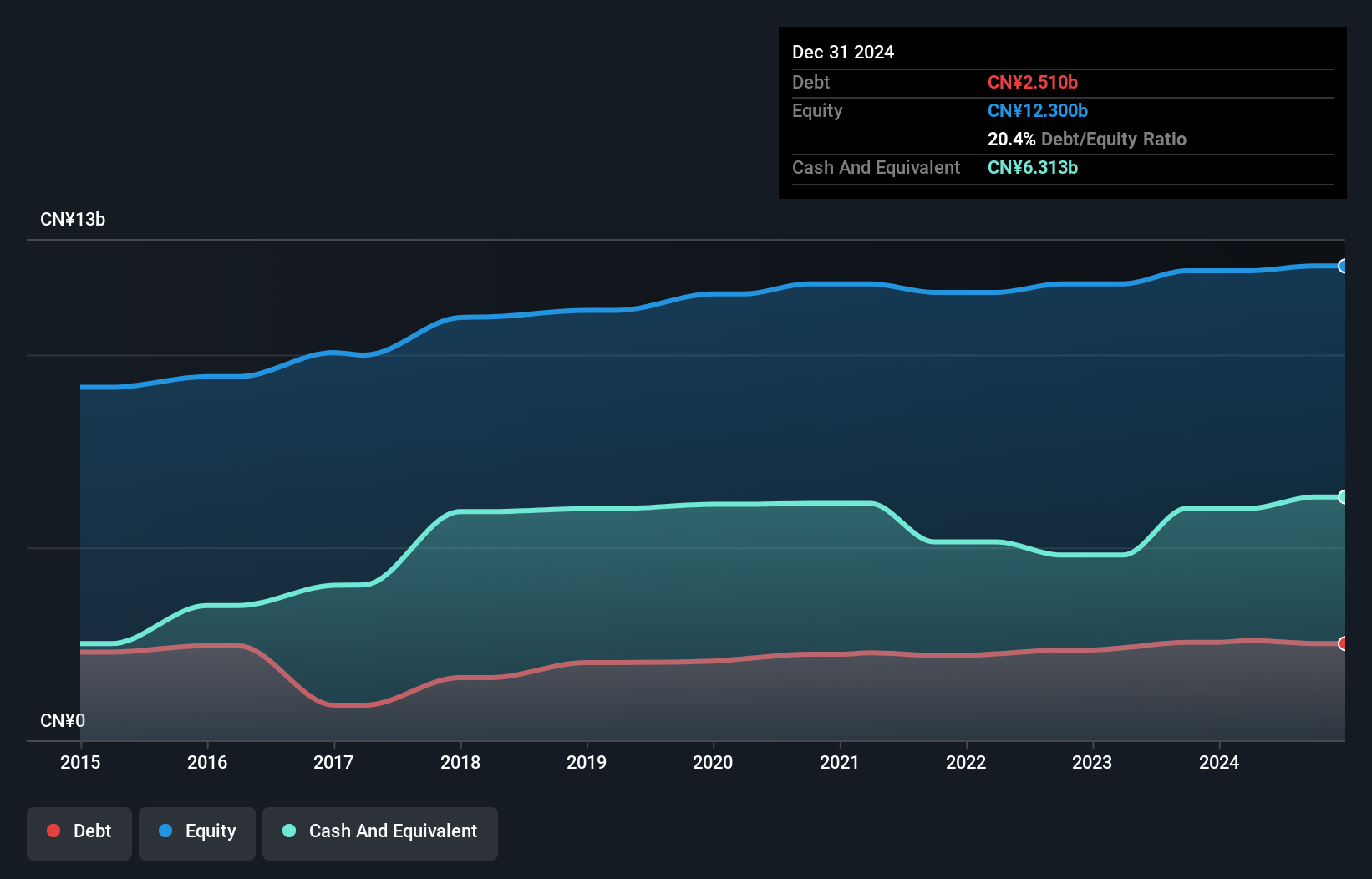

China Yuchai International, a notable player in the machinery sector, showcases robust financial health with cash reserves surpassing total debt. Earnings have grown by 14.6% over the past year, outpacing the industry average of 10.2%. The company is trading at a significant discount of 55.6% below its estimated fair value, suggesting potential undervaluation. Recent activities include repurchasing 3.23 million shares for $38.5 million and declaring a dividend of USD 0.38 per share for fiscal year-end December 2023, indicating shareholder-friendly policies and confidence in future prospects despite an increased debt-to-equity ratio from 18.1% to 21.3% over five years.

Where To Now?

- Delve into our full catalog of 219 US Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:JMSB

John Marshall Bancorp

Operates as the bank holding company for John Marshall Bank that provides banking products and financial services.

Proven track record with adequate balance sheet.