- United States

- /

- Banks

- /

- NasdaqCM:JMSB

John Marshall Bancorp's (NASDAQ:JMSB) Dividend Will Be Increased To $0.30

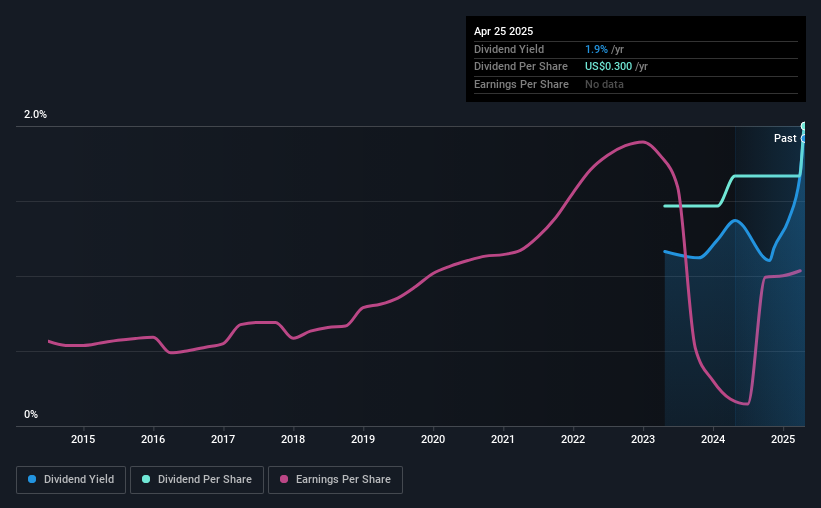

John Marshall Bancorp, Inc.'s (NASDAQ:JMSB) dividend will be increasing from last year's payment of the same period to $0.30 on 7th of July. Despite this raise, the dividend yield of 1.9% is only a modest boost to shareholder returns.

Our free stock report includes 1 warning sign investors should be aware of before investing in John Marshall Bancorp. Read for free now.John Marshall Bancorp's Dividend Forecasted To Be Well Covered By Earnings

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable.

John Marshall Bancorp is just starting to establish itself as being able to pay dividends to shareholders, given its short 2-year history of distributing earnings. Based on its last earnings report however, the payout ratio is at a comfortable 20%, meaning that John Marshall Bancorp may be able to sustain this dividend for future years if it continues on this earnings trend.

EPS is set to fall by 0.6% over the next 12 months if recent trends continue. If the dividend continues along recent trends, we estimate the future payout ratio could be 24%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

See our latest analysis for John Marshall Bancorp

John Marshall Bancorp Is Still Building Its Track Record

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. The annual payment during the last 2 years was $0.22 in 2023, and the most recent fiscal year payment was $0.30. This implies that the company grew its distributions at a yearly rate of about 17% over that duration. John Marshall Bancorp has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

John Marshall Bancorp May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Although it's important to note that John Marshall Bancorp's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

Our Thoughts On John Marshall Bancorp's Dividend

In summary, while it's always good to see the dividend being raised, we don't think John Marshall Bancorp's payments are rock solid. While John Marshall Bancorp is earning enough to cover the dividend, we are generally unimpressed with its future prospects. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for John Marshall Bancorp that investors should know about before committing capital to this stock. Is John Marshall Bancorp not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:JMSB

John Marshall Bancorp

Operates as the bank holding company for John Marshall Bank that provides banking products and financial services in the United States.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026