- United States

- /

- Banks

- /

- NasdaqGS:INDB

Will a Predicted Revenue Rebound Reshape Independent Bank's (INDB) Investment Narrative?

Reviewed by Sasha Jovanovic

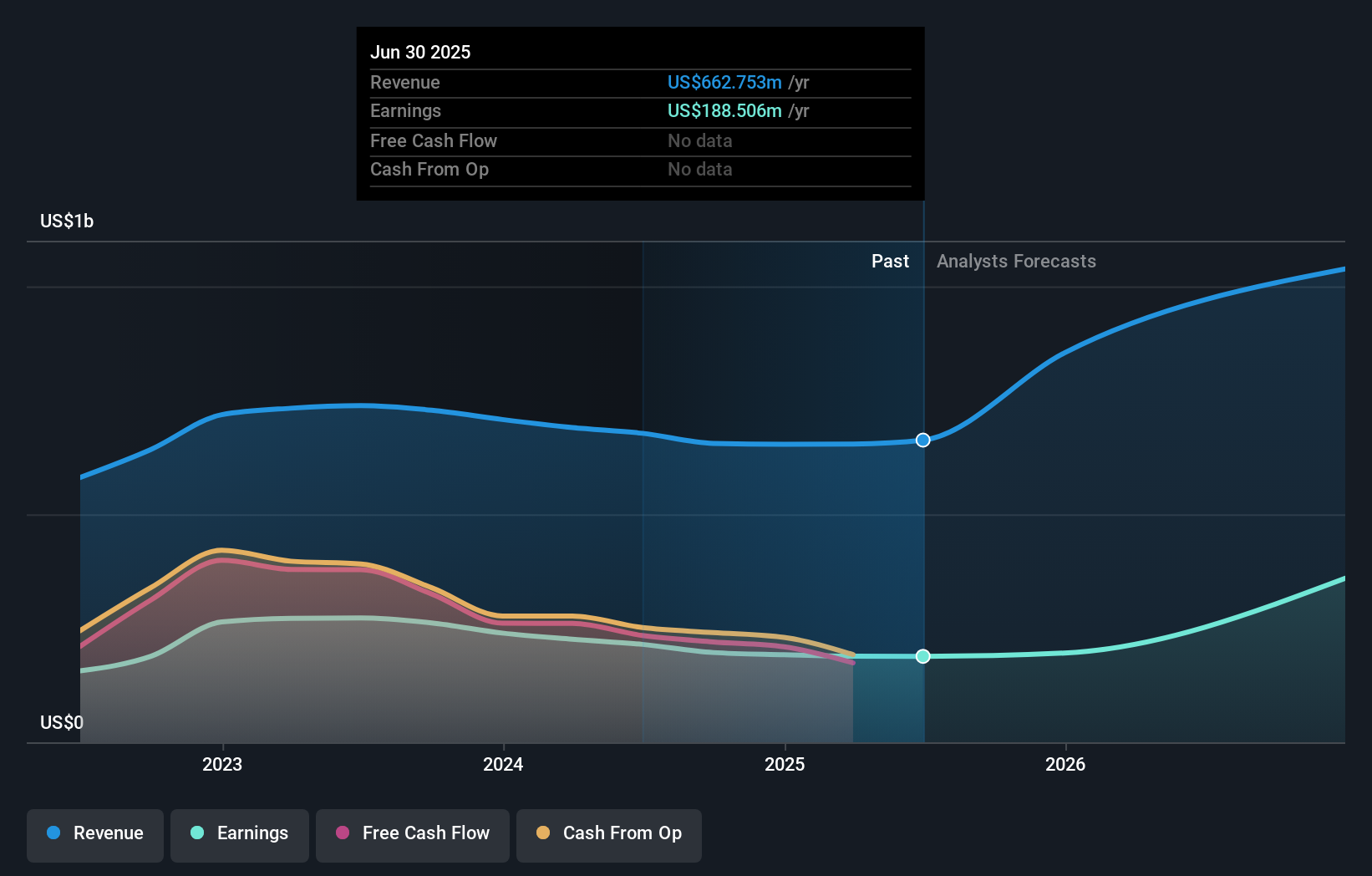

- Independent Bank (NASDAQ:INDB) is set to announce its quarterly earnings this Thursday, with analysts expecting revenue to reach US$243.6 million, up 39% year over year and marking a reversal from last year's decline.

- Continuity in analyst estimates over the past month highlights stable expectations and puts a spotlight on whether the anticipated revenue rebound will materialize.

- We'll look at how expectations for a sharp revenue recovery might influence Independent Bank's investment narrative and longer-term outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Independent Bank Investment Narrative Recap

To be a shareholder in Independent Bank, you need to believe in the company's ability to drive consistent revenue growth in community and small business banking, backed by technology upgrades and expanding deposit relationships. The upcoming earnings report, with analyst consensus holding firm on a sharp revenue recovery to US$243.6 million, places short-term focus on the execution of recent business improvements. However, this report is unlikely to immediately resolve the central risk: heavy exposure to commercial real estate (CRE), especially office loans, which continues to present credit quality concerns. Among recent announcements, Independent Bank's expanded share repurchase program, authorizing up to US$150 million in stock buybacks, draws attention. While this move underscores management’s focus on shareholder returns, it is most relevant when set against the backdrop of earnings momentum, as any material change in revenue performance or credit costs could impact the bank's ability to sustain such capital returns in the near term. Yet, against expectations of a revenue rebound, investors should not overlook the continuing uncertainty around maturing office loans and higher future credit costs that could...

Read the full narrative on Independent Bank (it's free!)

Independent Bank's outlook anticipates $1.6 billion in revenue and $604.7 million in earnings by 2028. This implies a 32.9% annual revenue growth rate and a $416.2 million earnings increase from the current $188.5 million.

Uncover how Independent Bank's forecasts yield a $79.50 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community members range from US$79.50 to US$87.77, reflecting differing views on Independent Bank's growth prospects. As you compare this variety of perspectives, keep in mind that ongoing concerns about CRE concentration could have broader effects on future profitability.

Explore 2 other fair value estimates on Independent Bank - why the stock might be worth just $79.50!

Build Your Own Independent Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Independent Bank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Independent Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Independent Bank's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives