- United States

- /

- Banks

- /

- NasdaqGS:INDB

Independent Bank (INDB): Revenue Forecasts and Margin Outlook Ahead of Upcoming Earnings

Reviewed by Simply Wall St

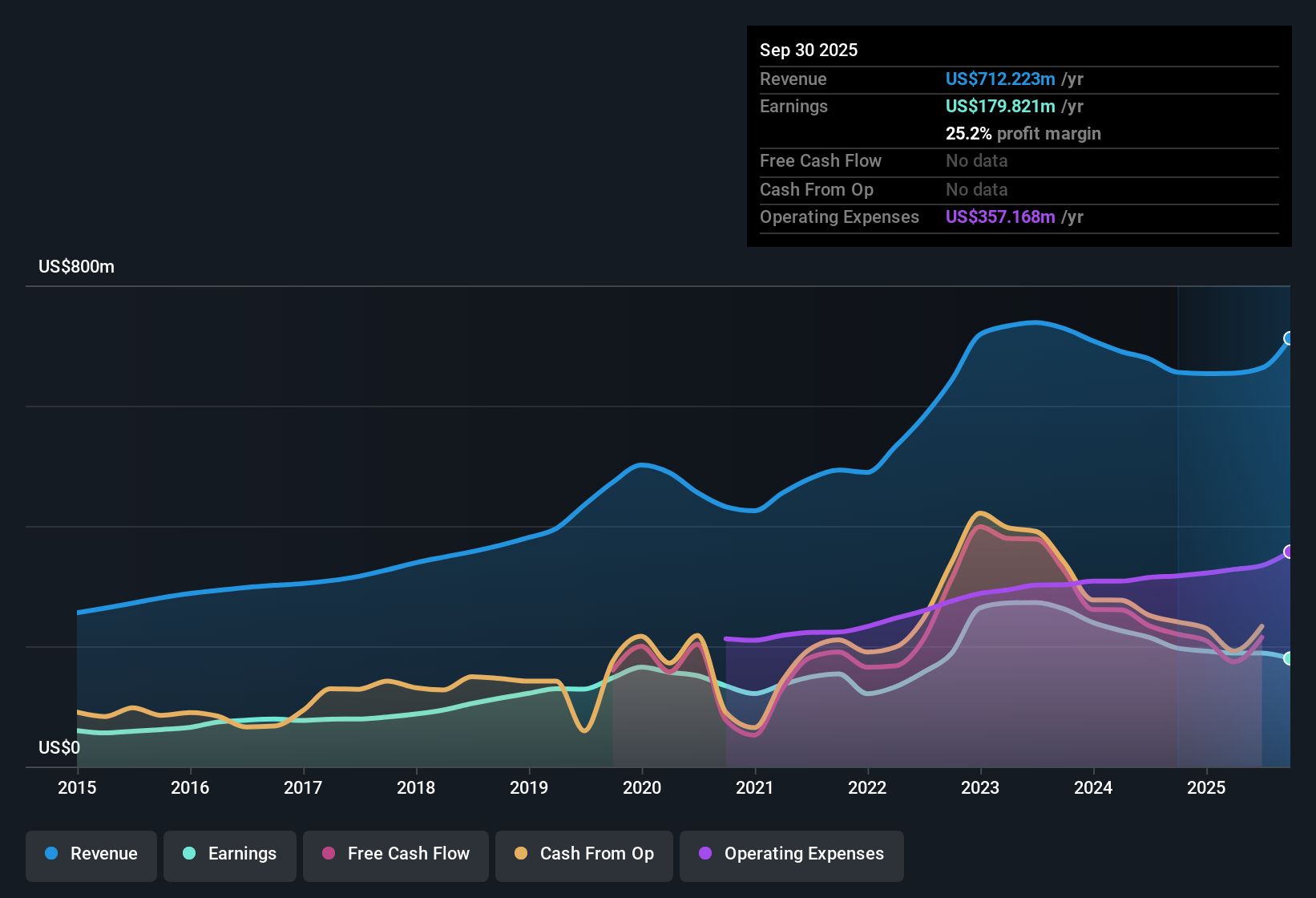

Independent Bank (INDB) recently issued updates that leave investors without key metrics, such as revenue or EPS, to assess its latest quarterly performance. The available disclosures do not provide concrete figures or insights into risk events or new growth drivers for this period, so it is difficult to draw firm conclusions about the bank's current operating momentum or earnings quality.

See our full analysis for Independent Bank.Next up, we will see how these numbers, or lack thereof, stack up against the most widely followed narratives in the market. This is where the stories behind the numbers can get both confirmed and questioned.

See what the community is saying about Independent Bank

Margin Expansion Projected With Strategic Moves

- Analysts project that profit margins at Independent Bank will climb from 28.4% today to 38.9% over the next three years, which represents a sizeable increase for a regional bank.

- According to analysts' consensus view, the bank's investments in tech upgrades and operational efficiency are expected to drive these margin gains.

- The planned FIS IBS core conversion and digital delivery focus are designed to lower costs and increase scalability. Together, these factors would support better net margins.

- Efficient integration of the Enterprise Bank acquisition is another pillar supporting higher profitability, as cost synergies are targeted at about 30% of the combined expense base by 2026.

- In the eyes of consensus analysts, these wide-ranging initiatives could cement a durable advantage against regional competitors. See how the full narrative frames this margin story. 📊 Read the full Independent Bank Consensus Narrative.

Rapid Revenue Growth Outlook Lifts Long-Term Potential

- Revenue is forecast by analysts to grow at an impressive 32.9% annually through 2028, with earnings expected to reach $604.7 million and EPS hitting $11.23 by September 2028.

- The consensus narrative credits this acceleration to a pivot toward community banking and lending to small businesses, coupled with a larger, more diversified loan and deposit base following the Enterprise Bank deal.

- Ongoing U.S. migration trends and small business formation in key markets are expected to drive outsized loan and deposit growth. This gives Independent Bank a unique regional growth engine.

- Analysts also cite cross-sell opportunities and increased non-interest revenue from the expanded footprint, which should bolster top-line gains well beyond the initial post-acquisition period.

Valuation Discount Points to Potential Upside

- With Independent Bank shares recently trading at $66.23, they sit at a 17% discount to the analyst price target of $80.25 and a 26% discount to the DCF fair value of $89.21.

- The consensus narrative maintains that, for investors to buy into this upside, the optimistic earnings projections must materialize. Specifically, the bank would need to deliver $1.6 billion in annual revenues and a sustainable PE multiple of 9.8x in 2028.

- Share count is also expected to increase by 7% per year, a factor that could moderate per-share upside unless earnings growth outpaces dilution.

- This valuation gap reflects both opportunities and execution risk, underscoring the importance of watching margin, growth, and integration progress over the next several years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Independent Bank on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the data others might have missed? It only takes a few minutes to shape your own investment perspective, so Do it your way

See What Else Is Out There

Independent Bank’s growth story still depends on optimistic targets, management’s execution, and overcoming potential dilution. This leaves investors exposed to possible underperformance.

If you’d rather target more reliably valued opportunities, use these 870 undervalued stocks based on cash flows to focus on companies with attractive upside based on their proven fundamentals and price gaps.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives