- United States

- /

- Banks

- /

- NasdaqGS:INDB

Independent Bank (INDB) Is Up 5.3% After Q2 Results and $150M Stock Buyback Announcement - What's Changed

Reviewed by Simply Wall St

- Independent Bank Corp. recently announced second quarter 2025 financial results, highlighting net interest income of US$147.5 million and the commencement of a US$150 million stock repurchase program, authorized through July 2026.

- Net charge-offs decreased substantially compared to the previous quarter, indicating an improvement in loan quality and a potential easing of credit concerns for the company.

- We will explore what the new stock repurchase plan means for the company’s investment case and analyst outlook.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Independent Bank Investment Narrative Recap

To be a shareholder in Independent Bank Corp., an investor needs conviction in the bank’s ability to manage credit risk, sustain growth from acquisitions like Enterprise Bancorp, and generate reliable earnings, even as loan performance and integration risks persist. The sharp decline in net charge-offs in the recent quarter offers reassurance around one of the biggest short-term risks, credit quality, but doesn’t materially lighten major catalysts like successful integration of Enterprise Bancorp, which remains crucial for future growth. The newly announced US$150 million share repurchase program stands out as the most relevant recent event, signaling confidence from management and potentially supporting the stock in the near term. While the buyback could affect share supply and possibly shareholder returns, it does not directly address the most important operational catalyst, the successful realization of synergies from the Enterprise acquisition. In contrast, investors should also be aware of the possible impact if integration costs or complications unexpectedly...

Read the full narrative on Independent Bank (it's free!)

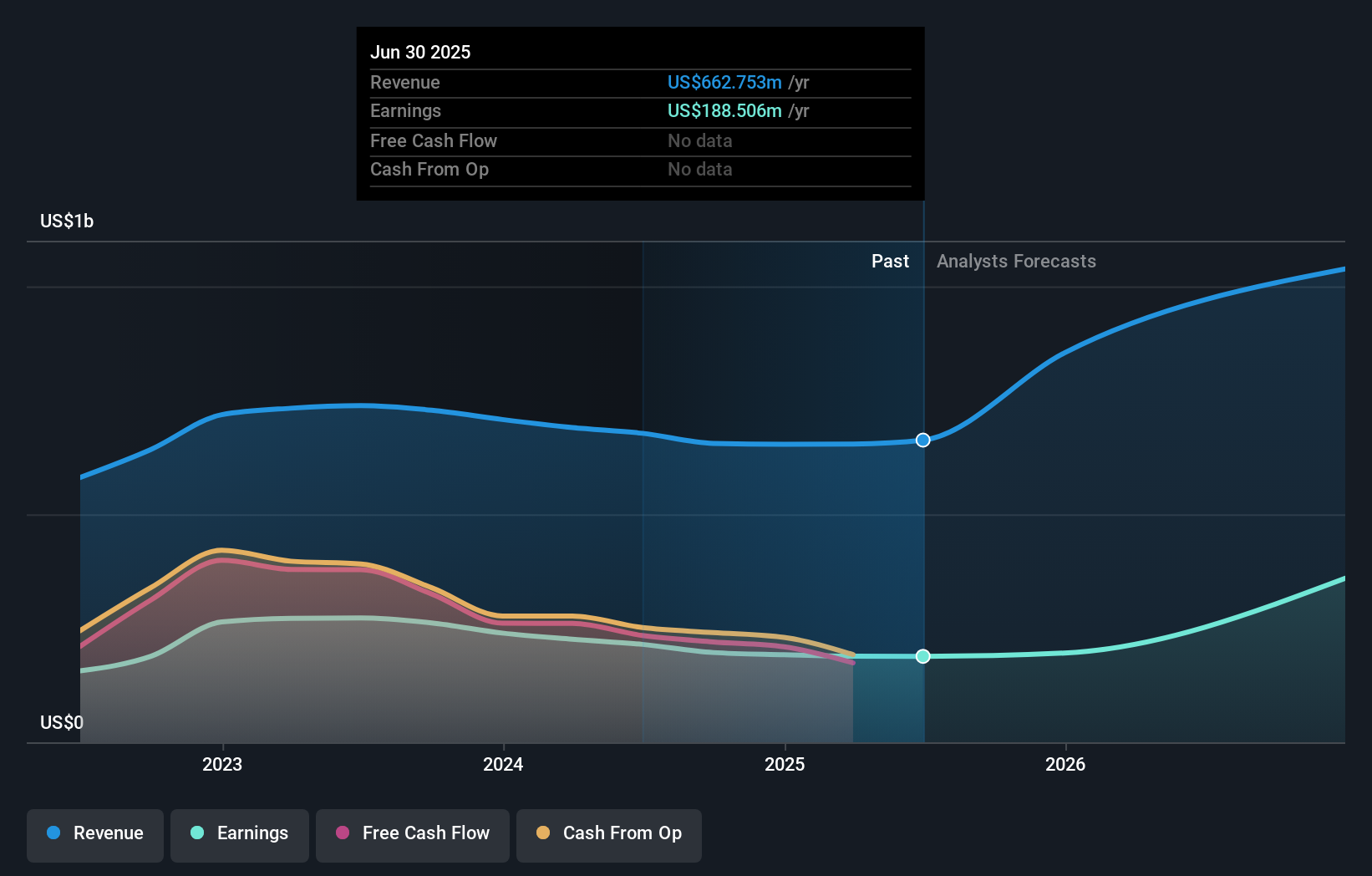

Independent Bank's outlook anticipates $1.4 billion in revenue and $438.0 million in earnings by 2028. This implies a 27.8% annual revenue growth rate and a $249.3 million increase in earnings from the current $188.7 million.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for Independent Bank Corp. from US$73.41 to US$97.70, based on two independent valuations. While views range widely, the risk of elevated integration costs remains a top concern and may influence future sentiment and performance.

Build Your Own Independent Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Independent Bank research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Independent Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Independent Bank's overall financial health at a glance.

No Opportunity In Independent Bank?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives