- United States

- /

- Banks

- /

- NasdaqGS:IBOC

We Discuss Why International Bancshares Corporation's (NASDAQ:IBOC) CEO May Deserve A Higher Pay Packet

Shareholders will probably not be disappointed by the robust results at International Bancshares Corporation (NASDAQ:IBOC) recently and they will be keeping this in mind as they go into the AGM on 17 May 2021. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

View our latest analysis for International Bancshares

How Does Total Compensation For Dennis Nixon Compare With Other Companies In The Industry?

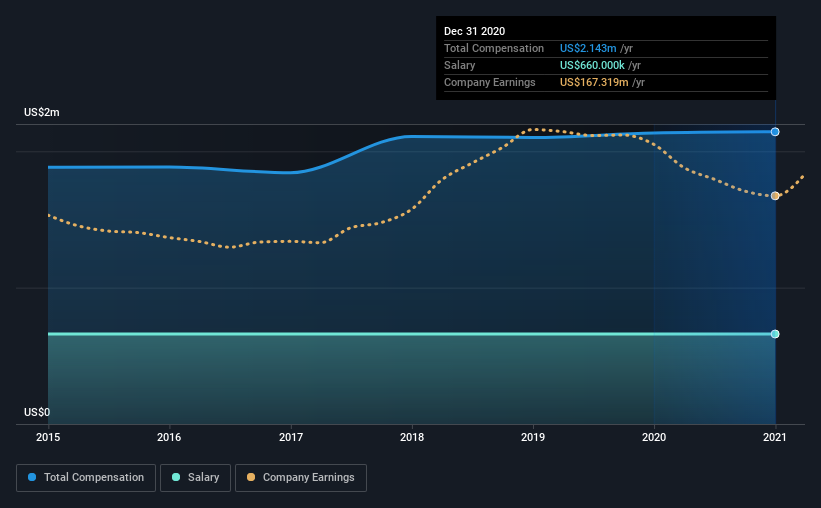

Our data indicates that International Bancshares Corporation has a market capitalization of US$3.1b, and total annual CEO compensation was reported as US$2.1m for the year to December 2020. That is, the compensation was roughly the same as last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$660k.

On examining similar-sized companies in the industry with market capitalizations between US$2.0b and US$6.4b, we discovered that the median CEO total compensation of that group was US$3.4m. That is to say, Dennis Nixon is paid under the industry median. Moreover, Dennis Nixon also holds US$115m worth of International Bancshares stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$660k | US$660k | 31% |

| Other | US$1.5m | US$1.5m | 69% |

| Total Compensation | US$2.1m | US$2.1m | 100% |

On an industry level, roughly 42% of total compensation represents salary and 58% is other remuneration. In International Bancshares' case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at International Bancshares Corporation's Growth Numbers

International Bancshares Corporation has seen its earnings per share (EPS) increase by 2.3% a year over the past three years. In the last year, its revenue is down 9.9%.

We would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see a modest EPS growth at least. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has International Bancshares Corporation Been A Good Investment?

With a total shareholder return of 28% over three years, International Bancshares Corporation shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

Shareholders may want to check for free if International Bancshares insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading International Bancshares or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:IBOC

International Bancshares

A multibank financial holding company, provides a range of commercial and retail banking services in Texas and the State of Oklahoma.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives