- United States

- /

- Banks

- /

- NasdaqGS:IBOC

Did a Dividend Hike and Analyst Optimism Just Shift International Bancshares' (IBOC) Investment Narrative?

Reviewed by Sasha Jovanovic

- International Bancshares recently raised its semi-annual dividend from $0.66 to $0.70 per share and received reaffirmed "buy" ratings from analysts including Weiss Ratings.

- This dividend hike comes alongside increased investment from institutional firms, reflecting ongoing confidence in the company's outlook.

- We'll explore how International Bancshares' dividend increase may influence its long-term investment story for shareholders.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is International Bancshares' Investment Narrative?

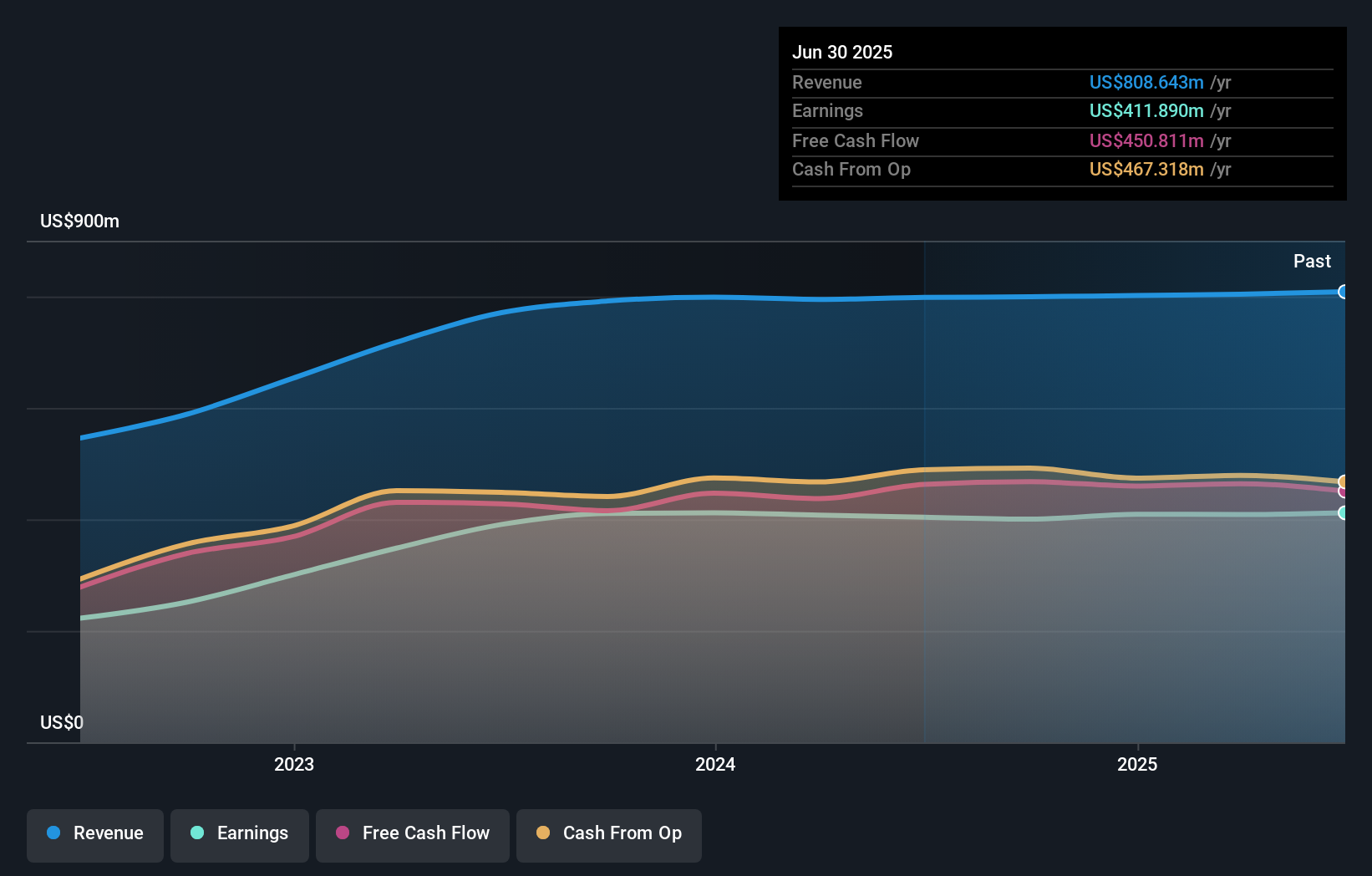

To be a shareholder in International Bancshares, you have to believe in the long-term steadiness of a regional banking model that values both disciplined capital management and ongoing shareholder returns. The dividend increase to $0.70 per share signals increased confidence from management, and the fact that institutional investors have recently raised their stakes adds a layer of validation to this outlook. While this dividend hike and reaffirmed buy ratings may boost sentiment, the move itself is incremental and likely won’t meaningfully shift short term catalysts or address the key risks highlighted earlier, such as slower earnings growth compared to peers and recent insider selling. The share price slide over the last quarter suggests the market remains cautious, and while strong capital returns will attract some investors, it won’t resolve concerns around accelerating growth or appointment of new board members. On the flip side, insider selling remains something investors should watch closely.

Despite retreating, International Bancshares' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on International Bancshares - why the stock might be worth just $69.69!

Build Your Own International Bancshares Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free International Bancshares research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Bancshares' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBOC

International Bancshares

A multibank financial holding company, provides a range of commercial and retail banking services in Texas and the State of Oklahoma.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives