Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like HomeStreet (NASDAQ:HMST), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for HomeStreet

How Fast Is HomeStreet Growing Its Earnings Per Share?

Over the last three years, HomeStreet has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, HomeStreet's EPS shot from US$3.50 to US$5.98, over the last year. You don't see 71% year-on-year growth like that, very often.

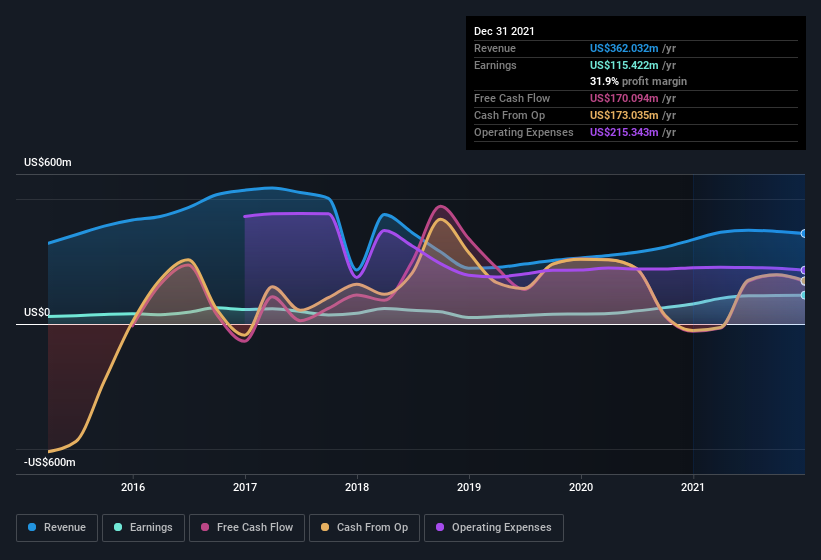

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that HomeStreet's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note HomeStreet's EBIT margins were flat over the last year, revenue grew by a solid 7.3% to US$362m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for HomeStreet?

Are HomeStreet Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold -US$150k worth of shares. But that's far less than the US$1.1m insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the HomeStreet's future. We also note that it was the Independent Director, Douglas Smith, who made the biggest single acquisition, paying US$389k for shares at about US$38.46 each.

On top of the insider buying, it's good to see that HomeStreet insiders have a valuable investment in the business. Indeed, they hold US$45m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 4.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does HomeStreet Deserve A Spot On Your Watchlist?

HomeStreet's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe HomeStreet deserves timely attention. What about risks? Every company has them, and we've spotted 3 warning signs for HomeStreet (of which 1 shouldn't be ignored!) you should know about.

As a growth investor I do like to see insider buying. But HomeStreet isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if HomeStreet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HMST

HomeStreet

Operates as the bank holding company for HomeStreet Bank that provides commercial, mortgage, and consumer/retail banking services in the Western United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives