- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:BZ

3 US Stocks That May Be Undervalued By Up To 48.9%

Reviewed by Simply Wall St

As 2024 comes to a close, the U.S. stock market has experienced a mixed year-end performance, with major indices such as the Dow Jones Industrial Average and S&P 500 posting their largest monthly losses in over two years despite achieving notable annual gains. In this environment of fluctuating market dynamics, identifying undervalued stocks can be crucial for investors seeking potential opportunities amidst broader economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Camden National (NasdaqGS:CAC) | $42.74 | $84.44 | 49.4% |

| SideChannel (OTCPK:SDCH) | $0.034 | $0.066 | 48.5% |

| Ally Financial (NYSE:ALLY) | $36.01 | $71.77 | 49.8% |

| HealthEquity (NasdaqGS:HQY) | $95.95 | $189.22 | 49.3% |

| Kanzhun (NasdaqGS:BZ) | $13.80 | $27.00 | 48.9% |

| LifeMD (NasdaqGM:LFMD) | $4.95 | $9.79 | 49.4% |

| Mr. Cooper Group (NasdaqCM:COOP) | $96.01 | $189.50 | 49.3% |

| Progress Software (NasdaqGS:PRGS) | $65.15 | $129.87 | 49.8% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.94 | $30.95 | 48.5% |

| Repligen (NasdaqGS:RGEN) | $143.94 | $281.09 | 48.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Kanzhun (NasdaqGS:BZ)

Overview: Kanzhun Limited, with a market cap of approximately $5.99 billion, offers online recruitment services in the People's Republic of China through its subsidiaries.

Operations: The company generates its revenue primarily from its Internet Information Providers segment, which amounted to CN¥7.11 billion.

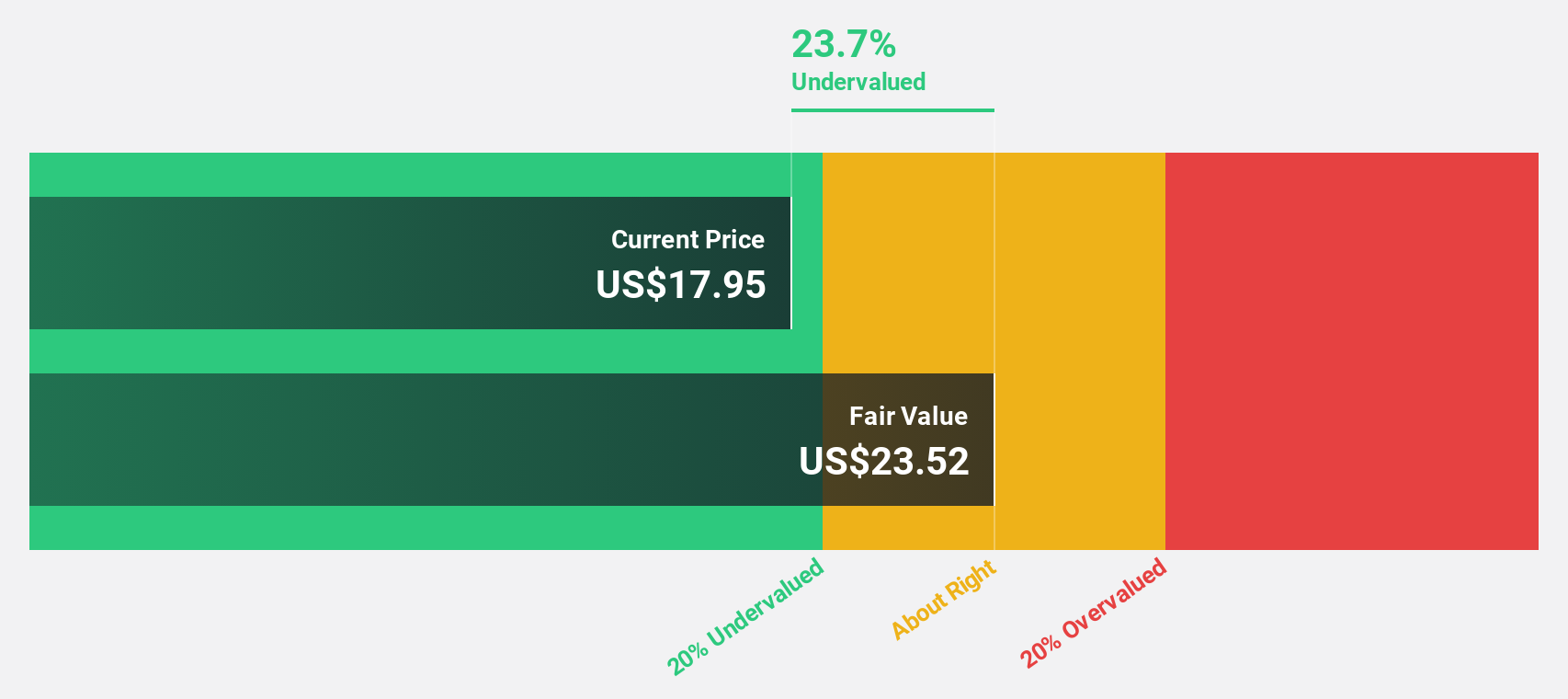

Estimated Discount To Fair Value: 48.9%

Kanzhun appears undervalued based on cash flow analysis, trading at US$13.8 compared to an estimated fair value of US$27. Its earnings grew significantly by 151.4% over the past year and are forecast to grow 25.31% annually, outpacing the broader U.S. market's expected growth rate of 14.9%. Despite a recent buyback completing with no further shares repurchased, revenue for Q3 increased from CNY 1,606.64 million to CNY 1,911.58 million year-on-year.

- In light of our recent growth report, it seems possible that Kanzhun's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Kanzhun stock in this financial health report.

Heritage Financial (NasdaqGS:HFWA)

Overview: Heritage Financial Corporation is the bank holding company for Heritage Bank, offering a range of financial services to small and medium-sized businesses and individuals in the United States, with a market cap of $836.76 million.

Operations: The company's revenue is primarily derived from its banking segment, which generated $203.99 million.

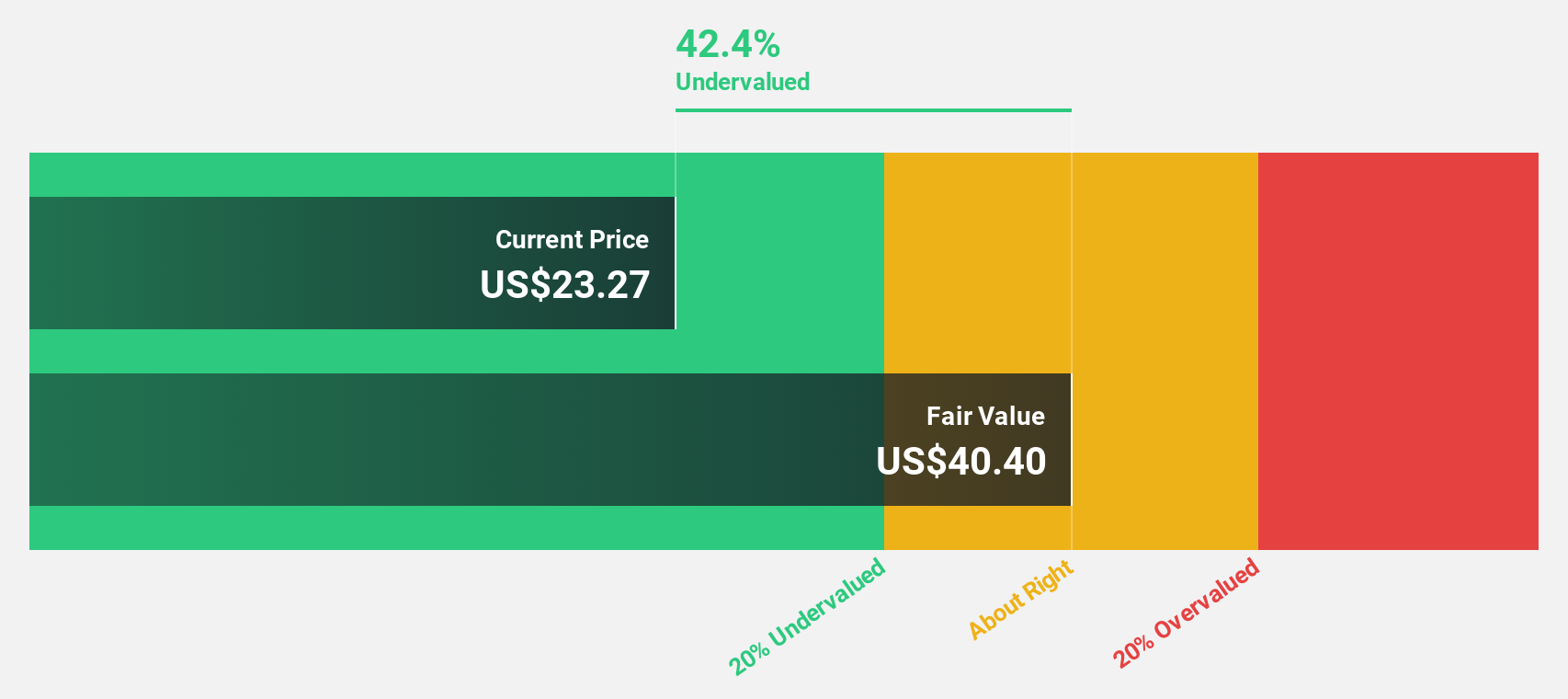

Estimated Discount To Fair Value: 39.3%

Heritage Financial is trading at US$24.5, significantly below its estimated fair value of US$40.37, suggesting it may be undervalued based on cash flows. Despite a decline in profit margins from 30.2% to 18.4% and net income dropping to US$11.42 million for Q3, earnings are forecasted to grow at 29.4% annually over the next three years, surpassing the U.S market's growth rate of 14.9%. Recent leadership changes could impact future strategies positively.

- Upon reviewing our latest growth report, Heritage Financial's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Heritage Financial's balance sheet health report.

Bridge Investment Group Holdings (NYSE:BRDG)

Overview: Bridge Investment Group Holdings Inc. operates in the real estate investment management sector in the United States with a market cap of approximately $1.02 billion.

Operations: The company generates revenue primarily from its role as a fully integrated real estate investment manager, amounting to $404.93 million.

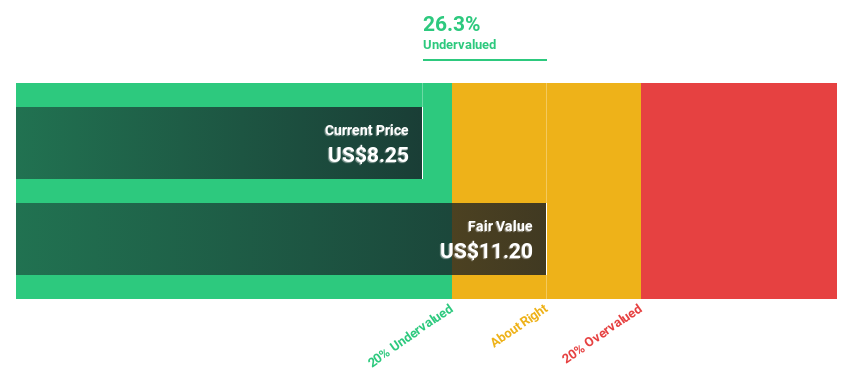

Estimated Discount To Fair Value: 26%

Bridge Investment Group Holdings, trading at US$8.4, is highly undervalued with a fair value estimate of US$11.35. Despite high debt levels and shareholder dilution over the past year, the company has seen significant profit growth and became profitable this year. Its earnings are expected to grow significantly at 51.4% annually over three years, outpacing the U.S market average. Recent earnings results showed improved net income despite a slight revenue decline in Q3 2024.

- Our comprehensive growth report raises the possibility that Bridge Investment Group Holdings is poised for substantial financial growth.

- Click here to discover the nuances of Bridge Investment Group Holdings with our detailed financial health report.

Make It Happen

- Navigate through the entire inventory of 173 Undervalued US Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kanzhun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BZ

Kanzhun

Provides online recruitment services in the People’s Republic of China.

Flawless balance sheet with solid track record.