- United States

- /

- Banks

- /

- NasdaqGS:HBCP

Home Bancorp, Inc. Just Recorded A 33% EPS Beat: Here's What Analysts Are Forecasting Next

Home Bancorp, Inc. (NASDAQ:HBCP) defied analyst predictions to release its quarterly results, which were ahead of market expectations. It was overall a positive result, with revenues beating expectations by 3.6% to hit US$25m. Home Bancorp also reported a statutory profit of US$1.41, which was an impressive 33% above what the analysts had forecast. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for Home Bancorp

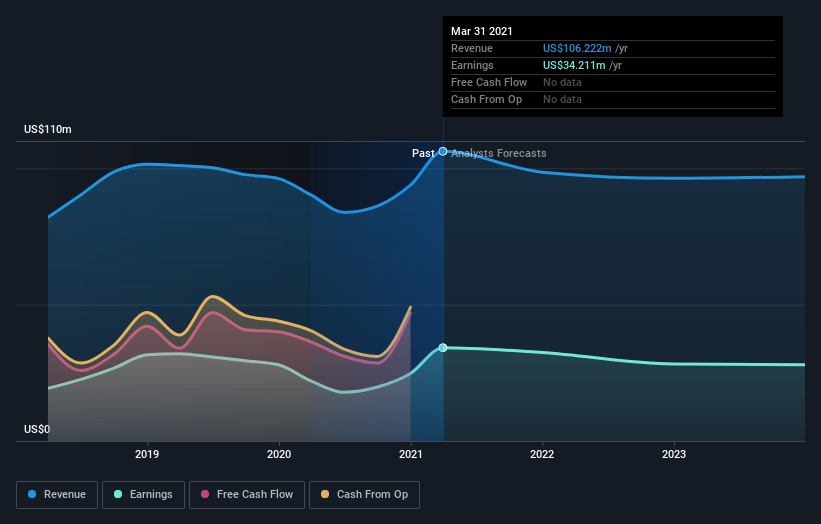

After the latest results, the consensus from Home Bancorp's four analysts is for revenues of US$98.6m in 2021, which would reflect a small 7.2% decline in sales compared to the last year of performance. Statutory earnings per share are forecast to shrink 4.0% to US$3.84 in the same period. In the lead-up to this report, the analysts had been modelling revenues of US$94.7m and earnings per share (EPS) of US$3.65 in 2021. It looks like there's been a modest increase in sentiment following the latest results, withthe analysts becoming a bit more optimistic in their predictions for both revenues and earnings.

With these upgrades, we're not surprised to see that the analysts have lifted their price target 7.7% to US$41.83per share. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Home Bancorp, with the most bullish analyst valuing it at US$45.00 and the most bearish at US$40.00 per share. With such a narrow range of valuations, the analysts apparently share similar views on what they think the business is worth.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 9.5% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 8.1% over the last five years. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 4.4% per year. So it's pretty clear that Home Bancorp's revenues are expected to shrink faster than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Home Bancorp following these results. Fortunately, they also upgraded their revenue estimates, although Home Bancorp'srevenues are still expected to trail the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Home Bancorp going out to 2023, and you can see them free on our platform here.

However, before you get too enthused, we've discovered 3 warning signs for Home Bancorp (1 is a bit concerning!) that you should be aware of.

When trading Home Bancorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Home Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:HBCP

Home Bancorp

Operates as the bank holding company for Home Bank, National Association that provides various banking products and services in Louisiana, Mississippi, and Texas.

Very undervalued with flawless balance sheet and pays a dividend.