- United States

- /

- Banks

- /

- NasdaqGS:HBAN

What Does Recent Earnings Growth Mean for Huntington Bancshares Valuation in 2025?

Reviewed by Bailey Pemberton

Trying to make sense of what Huntington Bancshares stock is really worth? You are not alone. Investors have been keeping a close eye on this regional banking leader, especially after seeing its solid long-term performance. The stock is up 25.0% over the past year and has achieved an impressive 112.8% gain in five years. Even after a modest dip of 3.6% in the last month, some see it as a sign of healthy market rebalancing rather than trouble. The company’s resilience through shifting interest rate expectations and broader bank sector moves has only added fuel to the debate about whether Huntington is undervalued or if its run might just be getting started.

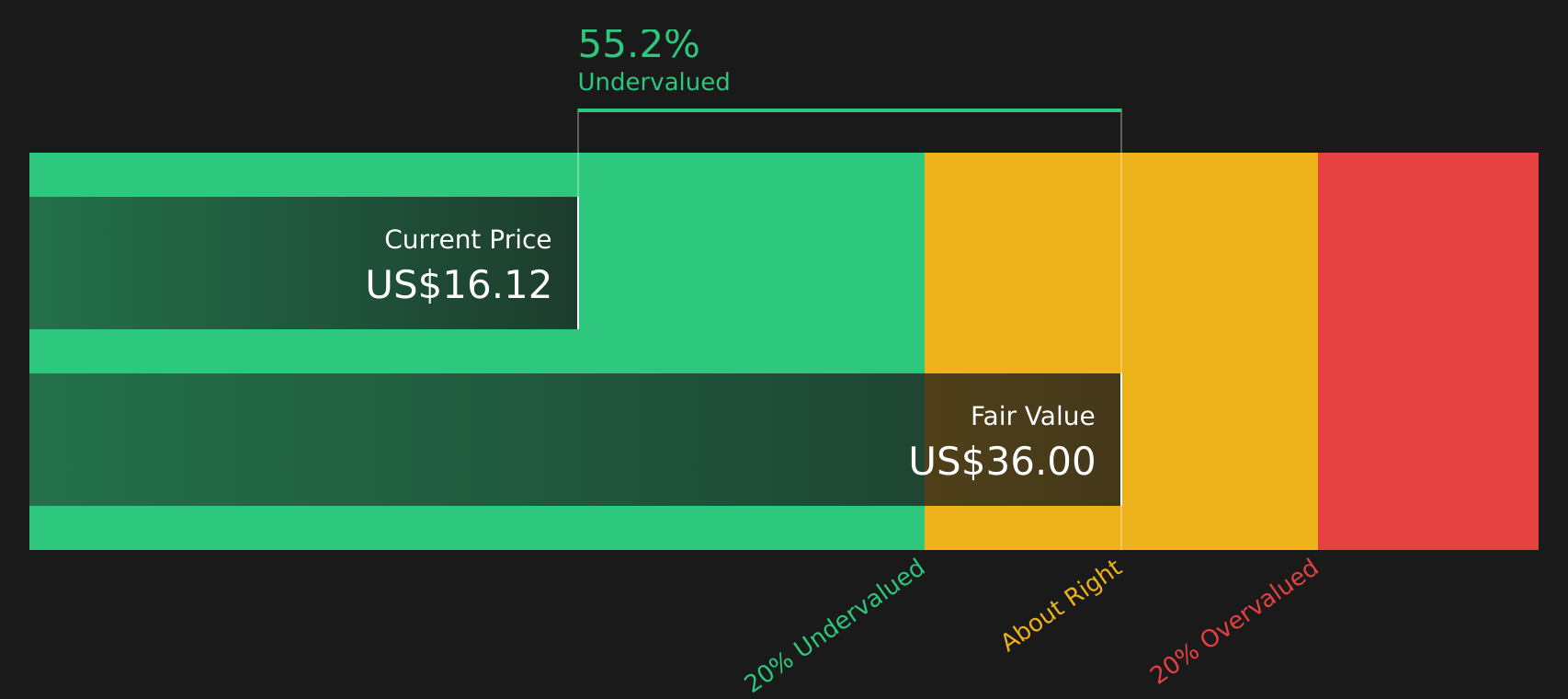

Of course, with a value score of 4 out of 6 based on key financial checks, Huntington Bancshares stands out as undervalued in most areas analysts care about. But valuation in real-life stock markets is rarely straightforward, and the story does not end with a simple score. Let’s take a closer look at the popular methods for valuing a bank like Huntington Bancshares, and stay tuned to see the approach that might shed even more light on whether the stock is a buy, sell, or hold.

Why Huntington Bancshares is lagging behind its peers

Approach 1: Huntington Bancshares Excess Returns Analysis

The Excess Returns model focuses on how much profit a company can generate over and above the required cost of equity, using the shareholder’s capital. This approach is especially useful for banks like Huntington Bancshares, where traditional cash flow models are less relevant due to unique regulatory and capital requirements.

For Huntington Bancshares, here are the key figures influencing valuation:

- Book Value: $12.98 per share

- Stable EPS: $1.58 per share (Source: Weighted future Return on Equity estimates from 11 analysts.)

- Cost of Equity: $1.02 per share

- Excess Return: $0.55 per share

- Average Return on Equity: 11.19%

- Stable Book Value: $14.11 per share (Source: Weighted future Book Value estimates from 10 analysts.)

By analyzing the difference between returns generated and those required by shareholders, the Excess Returns model estimates Huntington Bancshares’ intrinsic value at $27.36 per share. This figure is significantly higher than its recent share price. This suggests a 37.7% discount to fair value. In other words, the stock is currently undervalued from an excess returns perspective, implying that investors are not fully recognizing the strength of the bank’s future profitability.

Result: UNDERVALUED

Our Excess Returns analysis suggests Huntington Bancshares is undervalued by 37.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Huntington Bancshares Price vs Earnings

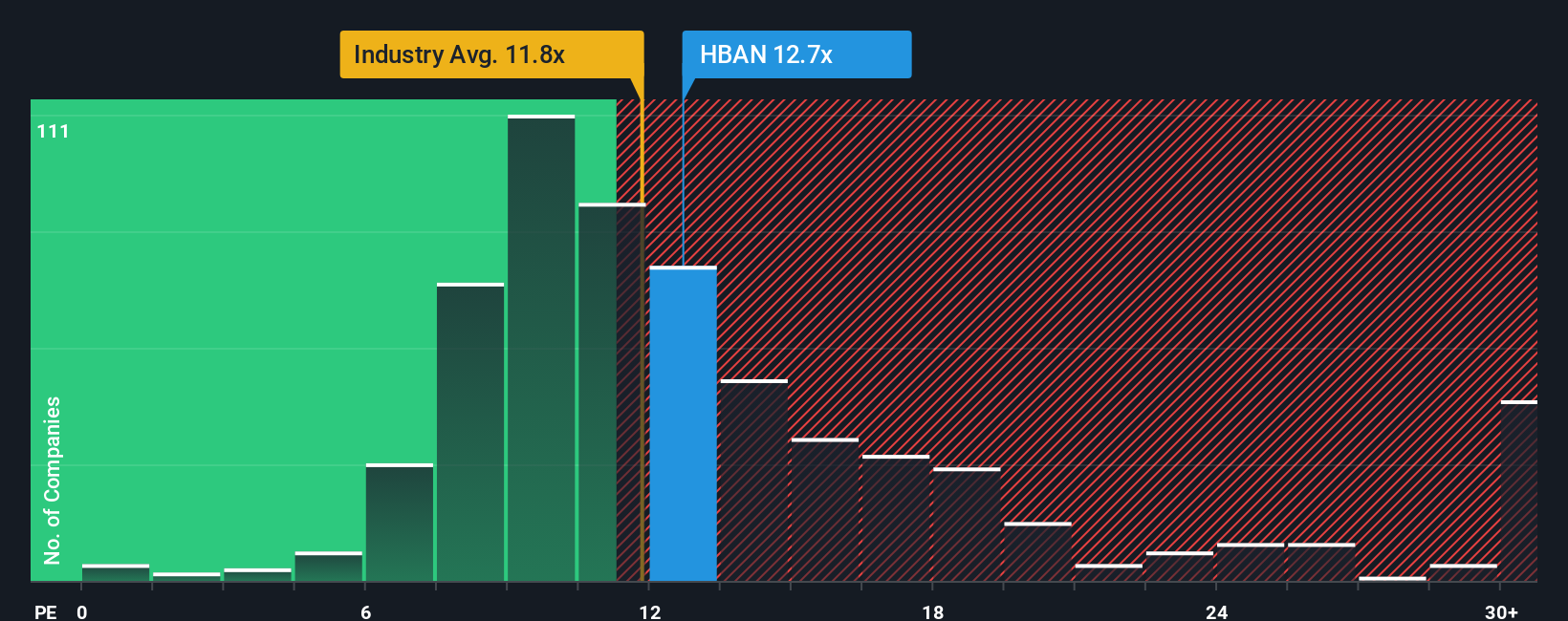

For profitable companies such as Huntington Bancshares, the Price-to-Earnings (PE) ratio is often the go-to valuation tool. This is because the PE ratio directly reflects what investors are paying for each dollar of a company’s earnings, making it particularly useful for banks and other businesses with steady profitability.

However, what counts as a “normal” or “fair” PE ratio can change, depending on several factors. Companies with stronger growth prospects or lower risks typically justify a higher PE ratio, while slower growers or riskier firms trade at lower multiples. Similarly, industry trends and market confidence also play pivotal roles in shaping these expectations.

Currently, Huntington Bancshares trades at a PE ratio of 12.56x. To put this in context, the average PE ratio across its industry peers is 12.97x, and the broader banking sector averages 11.68x. These benchmarks suggest that Huntington Bancshares is valued roughly in line with its direct competitors and the wider banking landscape.

This is where Simply Wall St’s “Fair Ratio” provides deeper context. The Fair Ratio, calculated at 13.82x for Huntington Bancshares, estimates the right PE based on an objective view of the company’s earnings growth, profit margin, industry, market cap, and risk factors. Compared to simple peer or industry averages, the Fair Ratio is more dynamic and tailored, making it a more meaningful benchmark for investors.

Looking at the numbers, Huntington Bancshares’ current PE ratio of 12.56x is just below its Fair Ratio. The small difference suggests the market is valuing the stock about right, given its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your Huntington Bancshares Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story about a company, connecting the real-world business outlook, the numbers you believe in (like fair value, future revenue, earnings, and profit margins), and your own expectations for where the company is headed. Narratives give you the power to move beyond what analysts or ratios say, letting you link Huntington Bancshares’ unique situation with a financial forecast and resulting fair value. They are easy to create and update on the Simply Wall St Community page, trusted by millions of investors, where you can compare your Narrative to others and track market-moving events in real time.

By updating your Narrative whenever news, results, or forecasts change, you can see at a glance whether Huntington Bancshares appears undervalued, overvalued, or fairly priced based on your assumptions. For example, some investors build a bullish Narrative, expecting recent Texas and Carolinas expansion to unlock double-digit earnings growth, resulting in a fair value of $21.0 per share. Others see risk from digital competition and margin pressure, leading to a more cautious estimate of $15.4. Narratives put you in control, so your investment decision—buy, sell, or hold—is always aligned with your story and the latest facts.

Do you think there's more to the story for Huntington Bancshares? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HBAN

Huntington Bancshares

Operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives