- United States

- /

- Banks

- /

- NasdaqGS:HAFC

Discover 3 Top US Dividend Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a post-election rally, with major indices like the Dow Jones and S&P 500 reaching all-time highs, investors are increasingly looking to dividend stocks as a way to capitalize on this optimistic climate. In such an environment, selecting dividend stocks with strong fundamentals and consistent payout histories can be a prudent strategy for those seeking steady income alongside potential capital gains.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.86% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.46% | ★★★★★★ |

| BCB Bancorp (NasdaqGM:BCBP) | 4.89% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.57% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.41% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.54% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.52% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

| Heritage Commerce (NasdaqGS:HTBK) | 4.79% | ★★★★★★ |

Click here to see the full list of 132 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

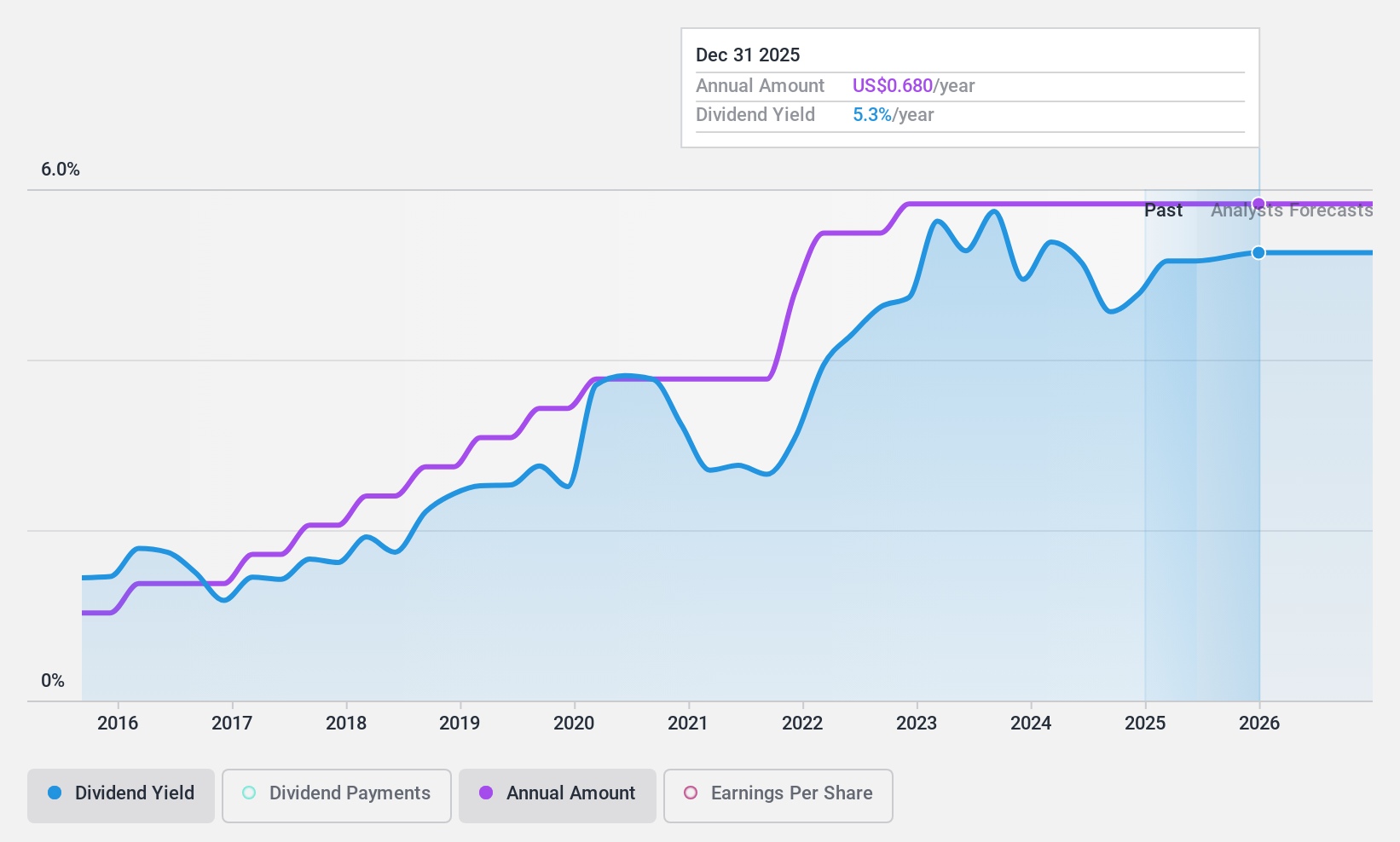

Farmers National Banc (NasdaqCM:FMNB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Farmers National Banc Corp., with a market cap of $578.85 million, operates as a bank holding company for The Farmers National Bank of Canfield, providing banking, trust, retirement consulting, insurance, and financial management services.

Operations: Farmers National Banc Corp. generates revenue through its Bank Segment, which accounts for $155.28 million, and its Trust Segment, including retirement consulting services, contributing $12.78 million.

Dividend Yield: 4.3%

Farmers National Banc's dividends have been stable and growing over the past decade, with a current yield of 4.27%, slightly below the top 25% in the US market. The dividend is well-covered by earnings, maintaining a payout ratio of 55%, forecasted to improve to 44.9% in three years. Despite recent declines in net income and increased net charge-offs, the company continues its dividend payments and has completed a share buyback program worth US$6.57 million.

- Take a closer look at Farmers National Banc's potential here in our dividend report.

- According our valuation report, there's an indication that Farmers National Banc's share price might be on the cheaper side.

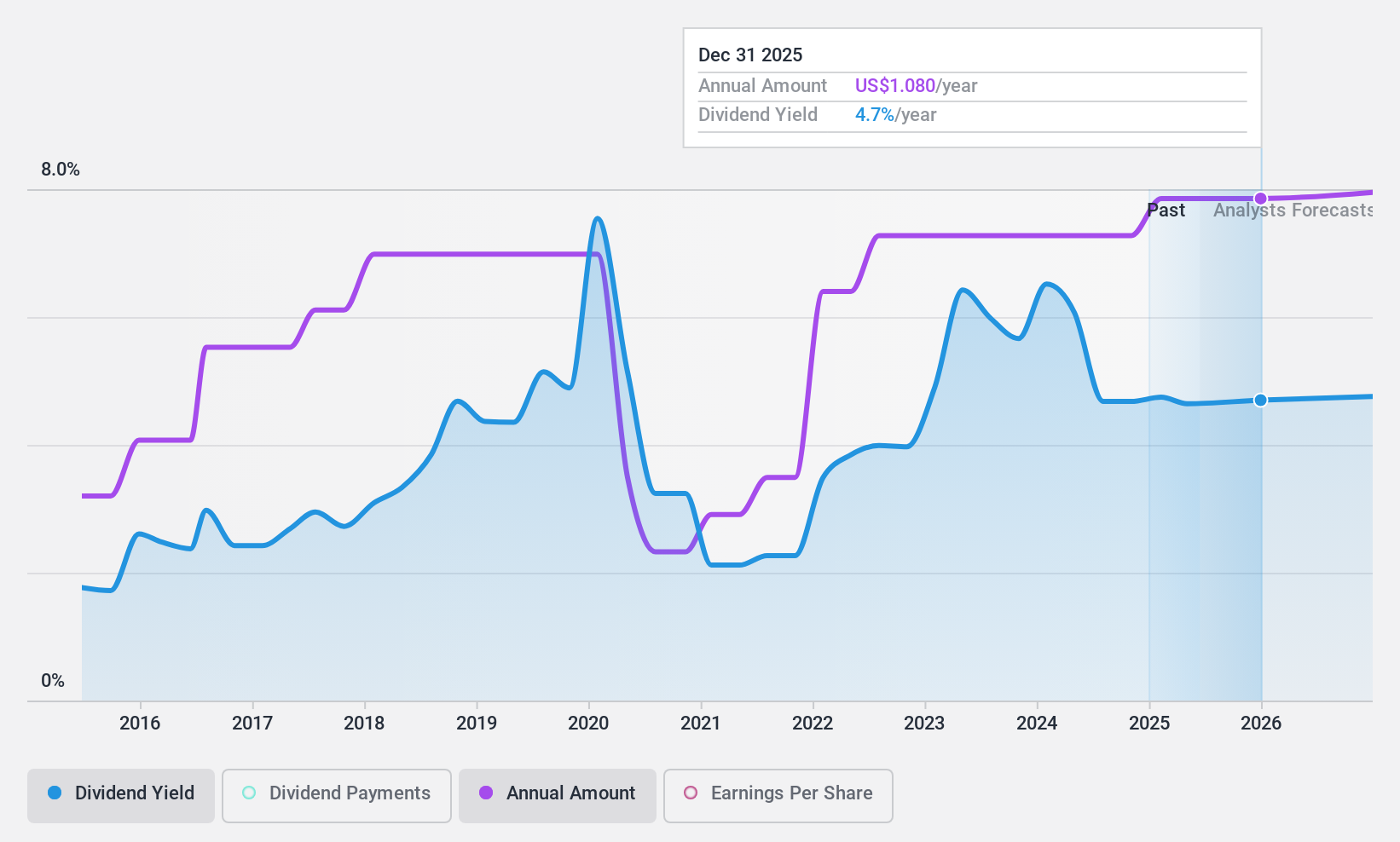

Hanmi Financial (NasdaqGS:HAFC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanmi Financial Corporation, with a market cap of $746.70 million, operates as the holding company for Hanmi Bank, offering business banking products and services in the United States.

Operations: Hanmi Financial Corporation generates revenue primarily from its Financial Services segment, amounting to $232.77 million.

Dividend Yield: 3.9%

Hanmi Financial's dividend, currently at US$0.25 per share for Q4 2024, is covered by a payout ratio of 48%, expected to improve to 43% in three years. Despite its volatile history and a yield of 3.86% below top-tier US dividend stocks, the company maintains payments amid declining earnings and net interest income. Recent buybacks totaling US$4.16 million reflect confidence in value, though past dividend reliability issues persist.

- Delve into the full analysis dividend report here for a deeper understanding of Hanmi Financial.

- In light of our recent valuation report, it seems possible that Hanmi Financial is trading behind its estimated value.

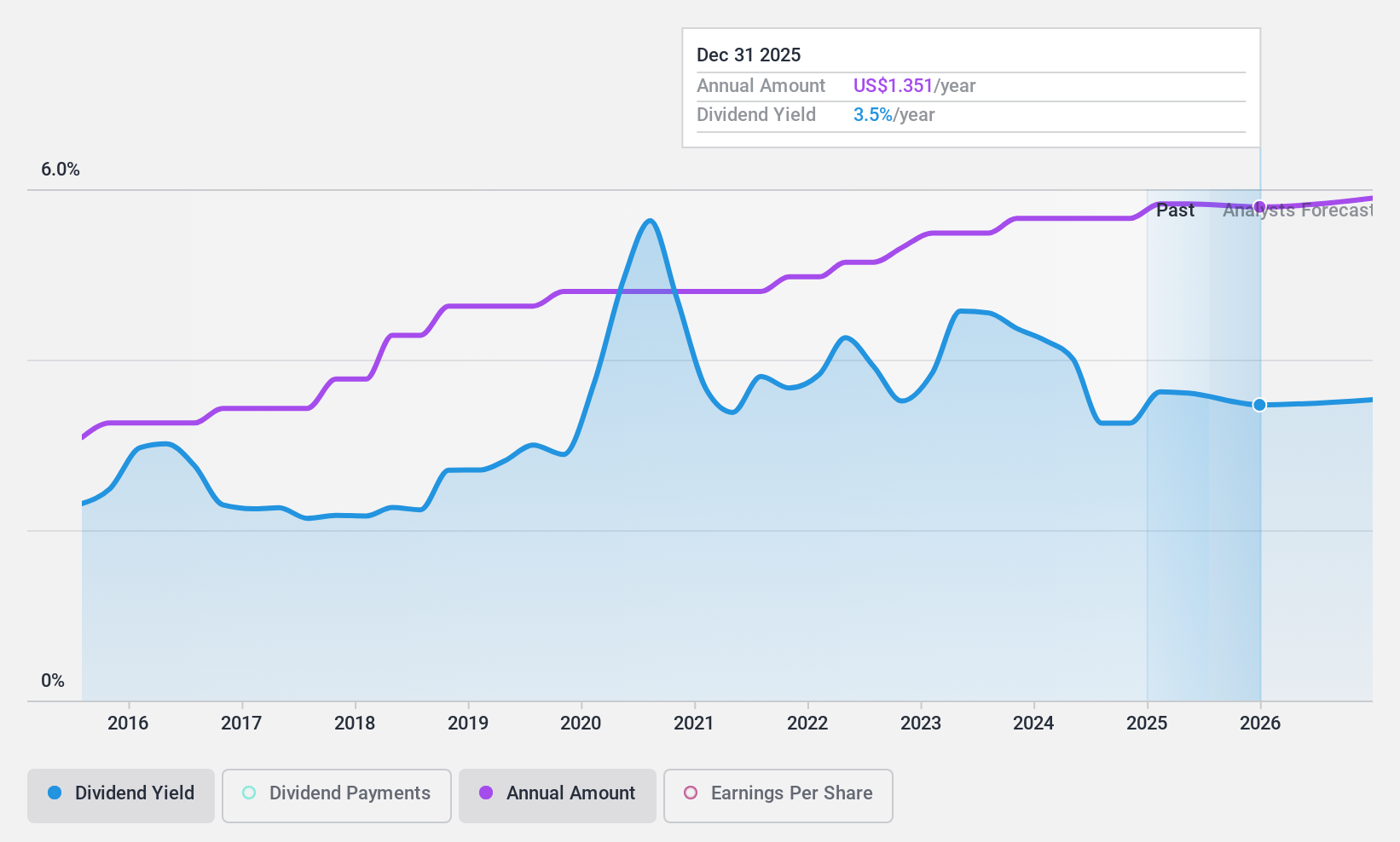

S&T Bancorp (NasdaqGS:STBA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: S&T Bancorp, Inc. is the bank holding company for S&T Bank, offering retail and commercial banking products and services, with a market cap of approximately $1.61 billion.

Operations: S&T Bancorp, Inc. generates revenue primarily through its Community Banking segment, which accounted for $386.29 million.

Dividend Yield: 3%

S&T Bancorp's dividend of US$0.34 per share, increased by 3.03%, is well-covered by a low payout ratio of 9.3%, ensuring sustainability despite declining net interest income and earnings. The dividend yield stands at 3.04%, below the top-tier US market average, but it remains stable and reliable over the past decade. Recent earnings reports indicate a slight decrease in net income, yet dividends are projected to stay covered with a future payout ratio of 44.1%.

- Click to explore a detailed breakdown of our findings in S&T Bancorp's dividend report.

- Upon reviewing our latest valuation report, S&T Bancorp's share price might be too pessimistic.

Make It Happen

- Embark on your investment journey to our 132 Top US Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanmi Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HAFC

Hanmi Financial

Operates as the holding company for Hanmi Bank that provides business banking products and services in the United States.

Flawless balance sheet, undervalued and pays a dividend.