- United States

- /

- Banks

- /

- NYSE:GNTY

The Guaranty Bancshares (NASDAQ:GNTY) Share Price Has Gained 13% And Shareholders Are Hoping For More

On average, over time, stock markets tend to rise higher. This makes investing attractive. But not every stock you buy will perform as well as the overall market. Over the last year the Guaranty Bancshares, Inc. (NASDAQ:GNTY) share price is up 13%, but that's less than the broader market return. Having said that, the longer term returns aren't so impressive, with stock gaining just 1.5% in three years.

See our latest analysis for Guaranty Bancshares

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

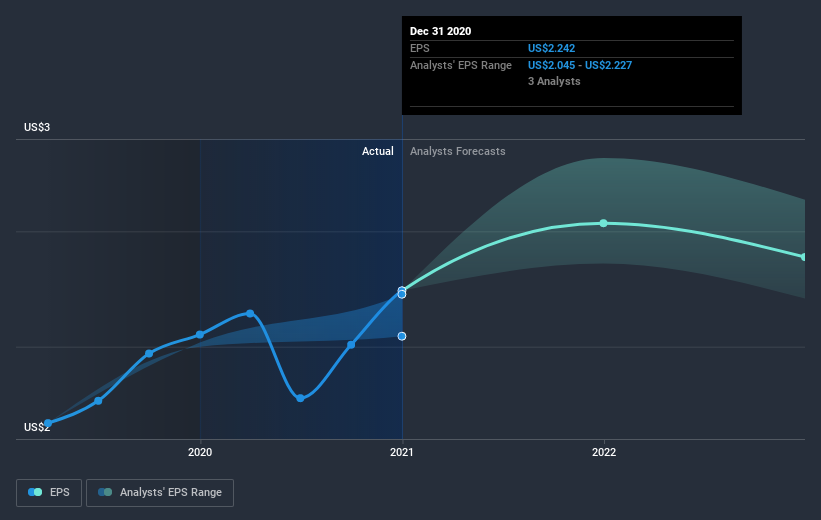

During the last year Guaranty Bancshares grew its earnings per share (EPS) by 9.2%. The share price gain of 13% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on Guaranty Bancshares' earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Guaranty Bancshares, it has a TSR of 16% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Over the last year Guaranty Bancshares shareholders have received a TSR of 16%. While you don't go broke making a profit, this return was actually lower than the average market return of about 35%. On the bright side that gain is actually better than the average return of 2.9% over the last three years, implying that the company is doing better recently. If the share price is up as a result of improved business performance, then this kind of improvement may be sustained. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Guaranty Bancshares that you should be aware of.

Guaranty Bancshares is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Guaranty Bancshares, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:GNTY

Guaranty Bancshares

Operates as the bank holding company for Guaranty Bank & Trust, N.A.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives