- United States

- /

- Banks

- /

- NasdaqCM:GLBZ

How Is Glen Burnie Bancorp's (NASDAQ:GLBZ) CEO Paid Relative To Peers?

This article will reflect on the compensation paid to John Long who has served as CEO of Glen Burnie Bancorp (NASDAQ:GLBZ) since 2016. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Glen Burnie Bancorp.

See our latest analysis for Glen Burnie Bancorp

How Does Total Compensation For John Long Compare With Other Companies In The Industry?

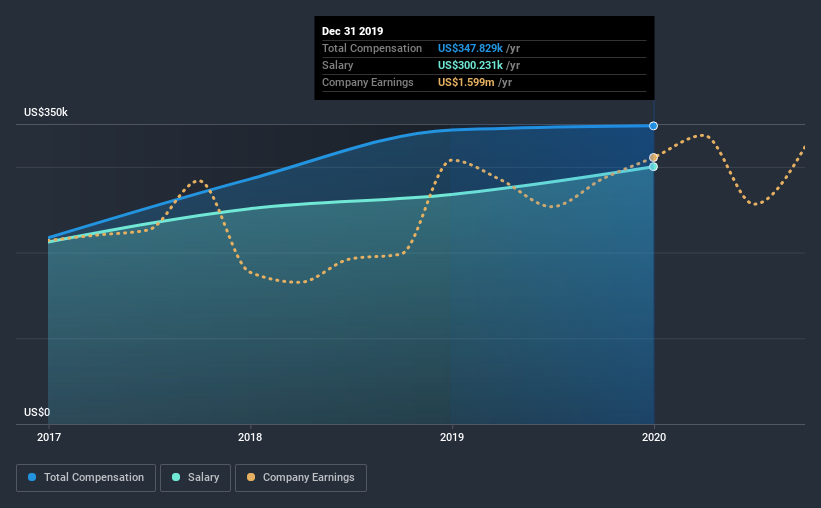

According to our data, Glen Burnie Bancorp has a market capitalization of US$27m, and paid its CEO total annual compensation worth US$348k over the year to December 2019. That's mostly flat as compared to the prior year's compensation. In particular, the salary of US$300.2k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$626k. In other words, Glen Burnie Bancorp pays its CEO lower than the industry median. Moreover, John Long also holds US$73k worth of Glen Burnie Bancorp stock directly under their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$300k | US$268k | 86% |

| Other | US$48k | US$75k | 14% |

| Total Compensation | US$348k | US$343k | 100% |

On an industry level, around 43% of total compensation represents salary and 57% is other remuneration. It's interesting to note that Glen Burnie Bancorp pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Glen Burnie Bancorp's Growth Numbers

Glen Burnie Bancorp's earnings per share (EPS) grew 3.9% per year over the last three years. Revenue was pretty flat on last year.

We're not particularly impressed by the revenue growth, but it is good to see modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Glen Burnie Bancorp Been A Good Investment?

With a three year total loss of 6.4% for the shareholders, Glen Burnie Bancorp would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As previously discussed, John is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. But the company isn't growing and total shareholder returns have been disappointing. We're not critical of the remuneration John receives, but it would be good to see improved returns to shareholders before compensation grows too much.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Glen Burnie Bancorp that investors should look into moving forward.

Important note: Glen Burnie Bancorp is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Glen Burnie Bancorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:GLBZ

Glen Burnie Bancorp

Operates as the bank holding company for The Bank of Glen Burnie that provides commercial and retail banking services to individuals, associations, partnerships, and corporations.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026