- United States

- /

- Banks

- /

- NYSE:NIC

Three Insider-Owned Growth Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market grapples with concerns over AI valuations and mixed earnings reports, investors are keenly assessing the implications of these developments on broader economic trends. In this environment, companies with high insider ownership often stand out as they may signal strong confidence from those most familiar with their operations, making them intriguing options for growth-focused portfolios.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Enovix (ENVX) | 12% | 42.7% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.1% |

| Celsius Holdings (CELH) | 10.8% | 31.8% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 27.1% |

| AppLovin (APP) | 27.5% | 25.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

FirstSun Capital Bancorp (FSUN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: FirstSun Capital Bancorp, with a market cap of $923.94 million, operates as the bank holding company for Sunflower Bank, National Association, offering commercial and consumer banking and financial services to small and medium-sized businesses across several states including Texas, Kansas, and Colorado.

Operations: Revenue Segments (in millions of $): Commercial banking services generated $450 million, consumer banking contributed $300 million, and financial services added $150 million.

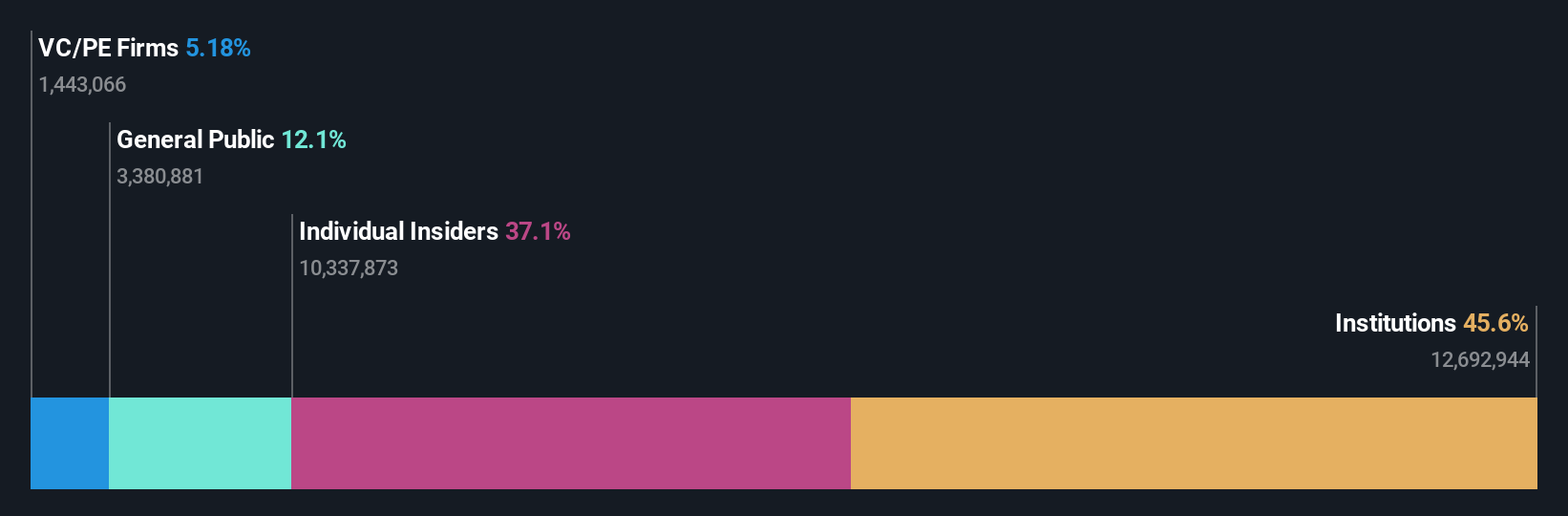

Insider Ownership: 37.1%

Earnings Growth Forecast: 43% p.a.

FirstSun Capital Bancorp, with strong insider ownership, is poised for significant growth. The company forecasts earnings to grow 43% annually and revenue by 33.3%, outpacing the broader US market. Recent merger plans with First Foundation could enhance its strategic position, though net charge-offs have increased notably. Despite this, FirstSun trades at a substantial discount to fair value estimates and analysts predict a potential stock price increase of 27.4%.

- Click here to discover the nuances of FirstSun Capital Bancorp with our detailed analytical future growth report.

- Our valuation report unveils the possibility FirstSun Capital Bancorp's shares may be trading at a discount.

Accelerant Holdings (ARX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Accelerant Holdings operates a data-driven risk exchange connecting specialty insurance underwriters with risk capital partners and has a market cap of $2.66 billion.

Operations: The company's revenue is derived from three main segments: Underwriting ($345.30 million), MGA Operations ($190.80 million), and Exchange Services ($281.40 million).

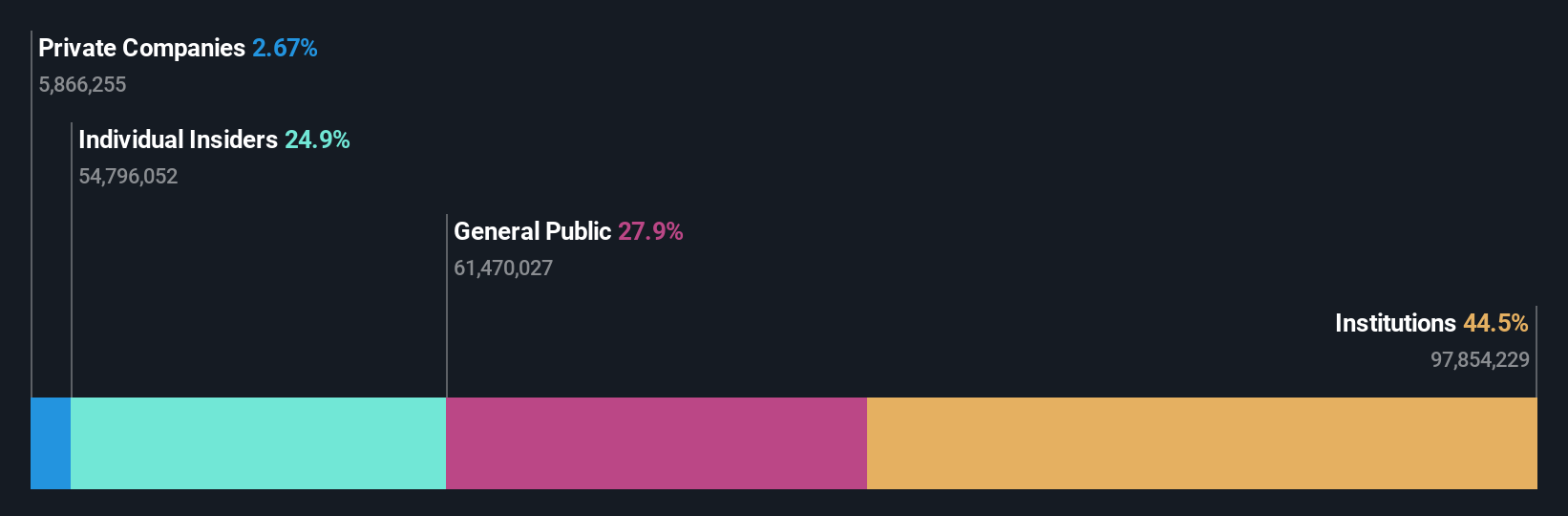

Insider Ownership: 24.9%

Earnings Growth Forecast: 66.1% p.a.

Accelerant Holdings is positioned for robust growth, with earnings forecasted to rise significantly at 66.1% annually, surpassing the US market's growth rate. Revenue is also expected to grow rapidly at 20.3% per year. The recent partnership with AF Specialty enhances its risk capital capacity and access to a strong AM Best rating, potentially bolstering its strategic capabilities in the market. No substantial insider trading activity was reported over the past three months.

- Click to explore a detailed breakdown of our findings in Accelerant Holdings' earnings growth report.

- In light of our recent valuation report, it seems possible that Accelerant Holdings is trading beyond its estimated value.

Nicolet Bankshares (NIC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nicolet Bankshares, Inc. is the bank holding company for Nicolet National Bank, offering banking products and services to businesses and individuals in Wisconsin, Michigan, and Minnesota with a market cap of $1.78 billion.

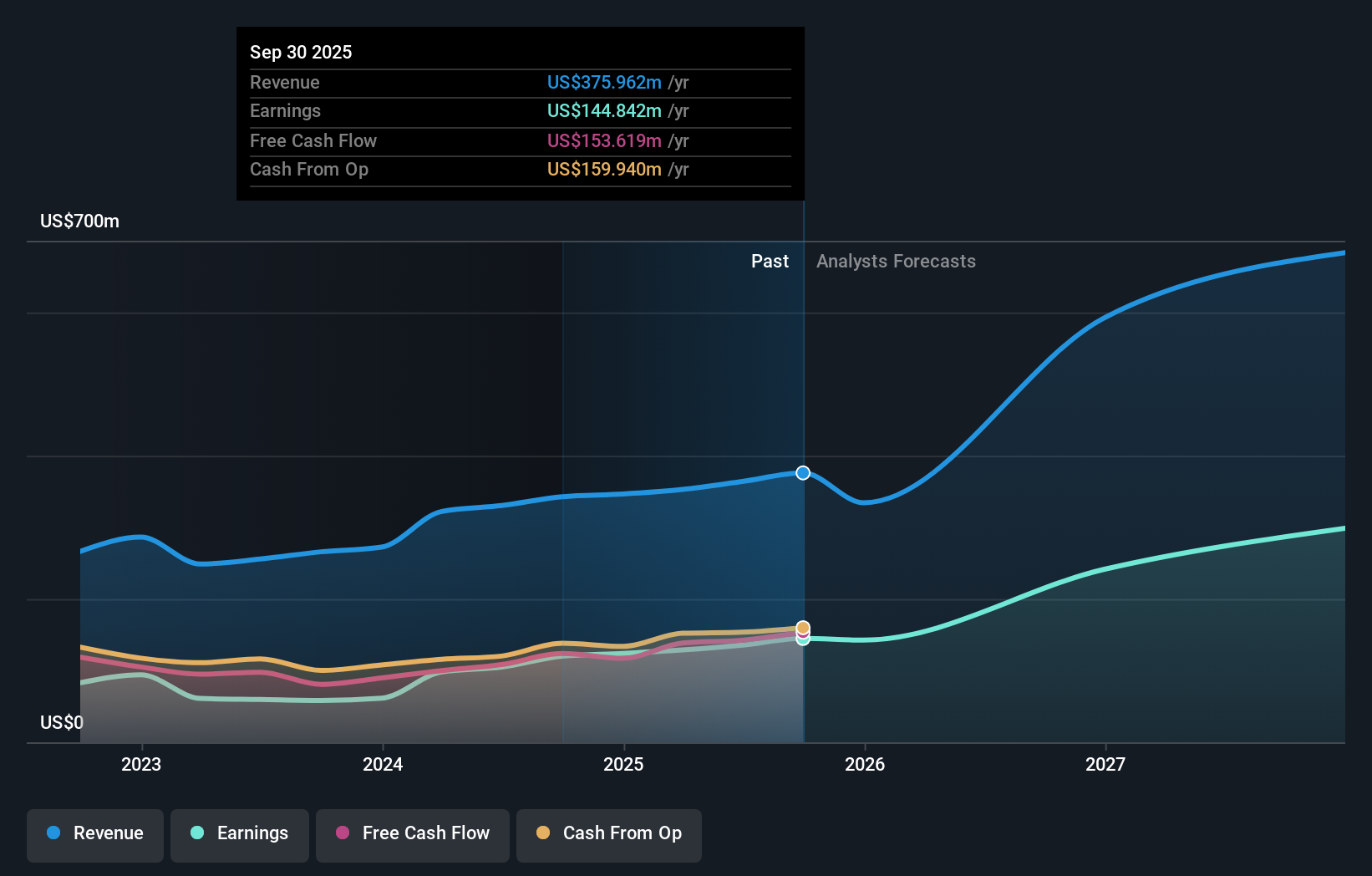

Operations: The company generates revenue of $375.96 million from its Consumer and Commercial Banking Services segment, catering to clients in Wisconsin, Michigan, and Minnesota.

Insider Ownership: 11.8%

Earnings Growth Forecast: 35.7% p.a.

Nicolet Bankshares shows promising growth potential with earnings expected to grow significantly at 35.7% annually, outpacing the US market. Revenue is forecasted to rise by 31.9% per year, also exceeding market averages. Recent earnings reports highlight increased net income and interest income, while insider activity shows more buying than selling in recent months. The company is trading below fair value estimates and has announced a merger with MidWestOne, potentially enhancing its strategic position.

- Take a closer look at Nicolet Bankshares' potential here in our earnings growth report.

- Our expertly prepared valuation report Nicolet Bankshares implies its share price may be lower than expected.

Summing It All Up

- Navigate through the entire inventory of 198 Fast Growing US Companies With High Insider Ownership here.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nicolet Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIC

Nicolet Bankshares

Operates as the bank holding company for Nicolet National Bank that provides banking products and services for businesses and individuals in Wisconsin, Michigan, and Minnesota.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives