Those following along with Farmers National Banc Corp. (NASDAQ:FMNB) will no doubt be intrigued by the recent purchase of shares by Edward Muransky, Independent Director of the company, who spent a stonking US$999k on stock at an average price of US$13.59. Aside from being a solid chunk in its own right, the deft move also saw their holding increase by some 39%.

The Last 12 Months Of Insider Transactions At Farmers National Banc

In fact, the recent purchase by Edward Muransky was the biggest purchase of Farmers National Banc shares made by an insider individual in the last twelve months, according to our records. That means that an insider was happy to buy shares at above the current price of US$12.94. It's very possible they regret the purchase, but it's more likely they are bullish about the company. We always take careful note of the price insiders pay when purchasing shares. Generally speaking, it catches our eye when insiders have purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price.

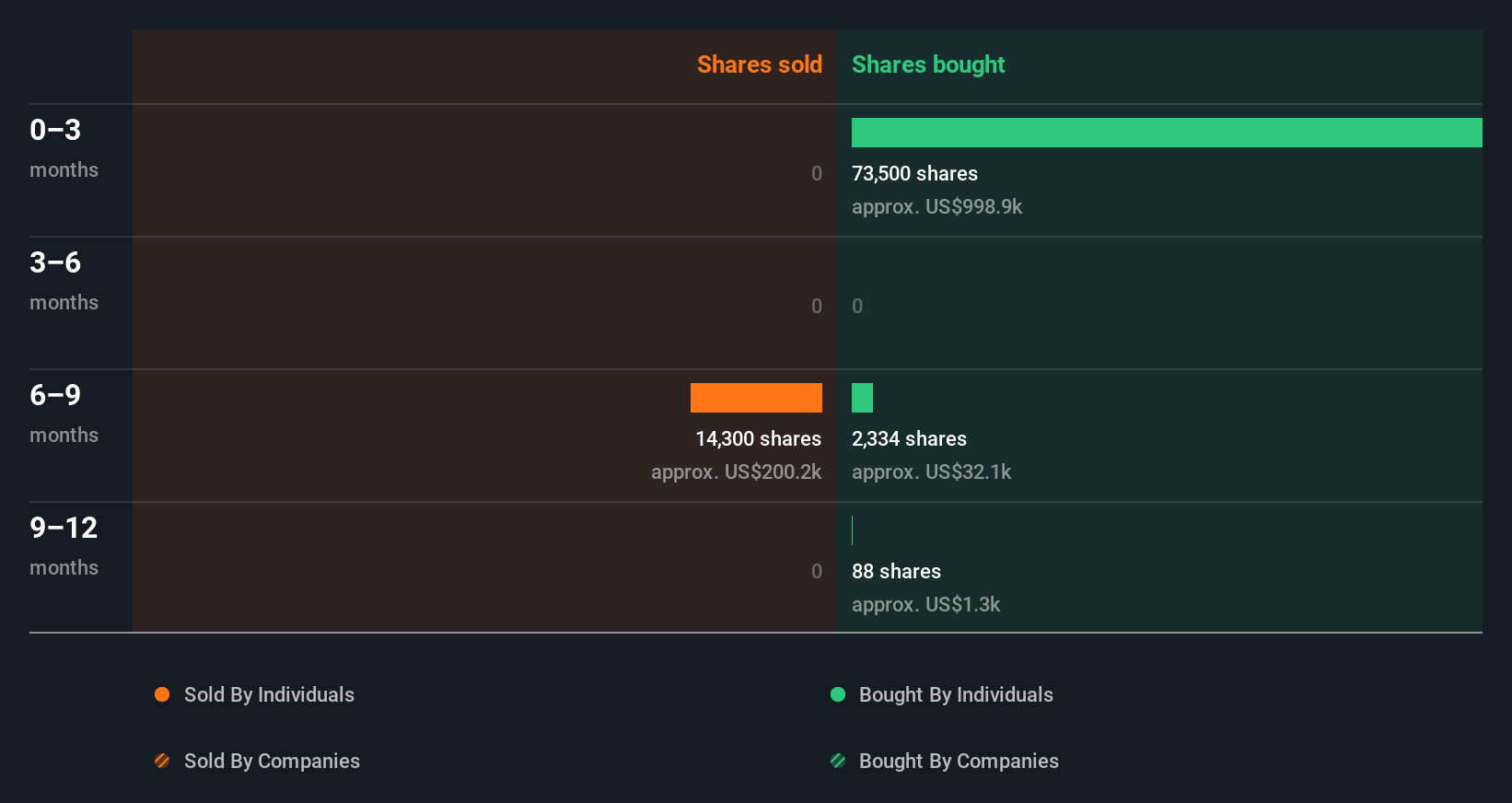

Over the last year, we can see that insiders have bought 75.92k shares worth US$1.0m. On the other hand they divested 14.30k shares, for US$200k. Overall, Farmers National Banc insiders were net buyers during the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

View our latest analysis for Farmers National Banc

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It appears that Farmers National Banc insiders own 4.1% of the company, worth about US$21m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Farmers National Banc Insiders?

It is good to see the recent insider purchase. And the longer term insider transactions also give us confidence. When combined with notable insider ownership, these factors suggest Farmers National Banc insiders are well aligned, and that they may think the share price is too low. Of course, the future is what matters most. So if you are interested in Farmers National Banc, you should check out this free report on analyst forecasts for the company.

Of course Farmers National Banc may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FMNB

Farmers National Banc

Operates as a bank holding company for The Farmers National Bank of Canfield that engages in the banking, trust, retirement consulting, insurance, and financial management businesses.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives