- United States

- /

- Banks

- /

- NasdaqCM:FMNB

Farmers National Banc (FMNB): Net Margins Hold Steady, Value Narrative Reinforced by Discounted Shares

Reviewed by Simply Wall St

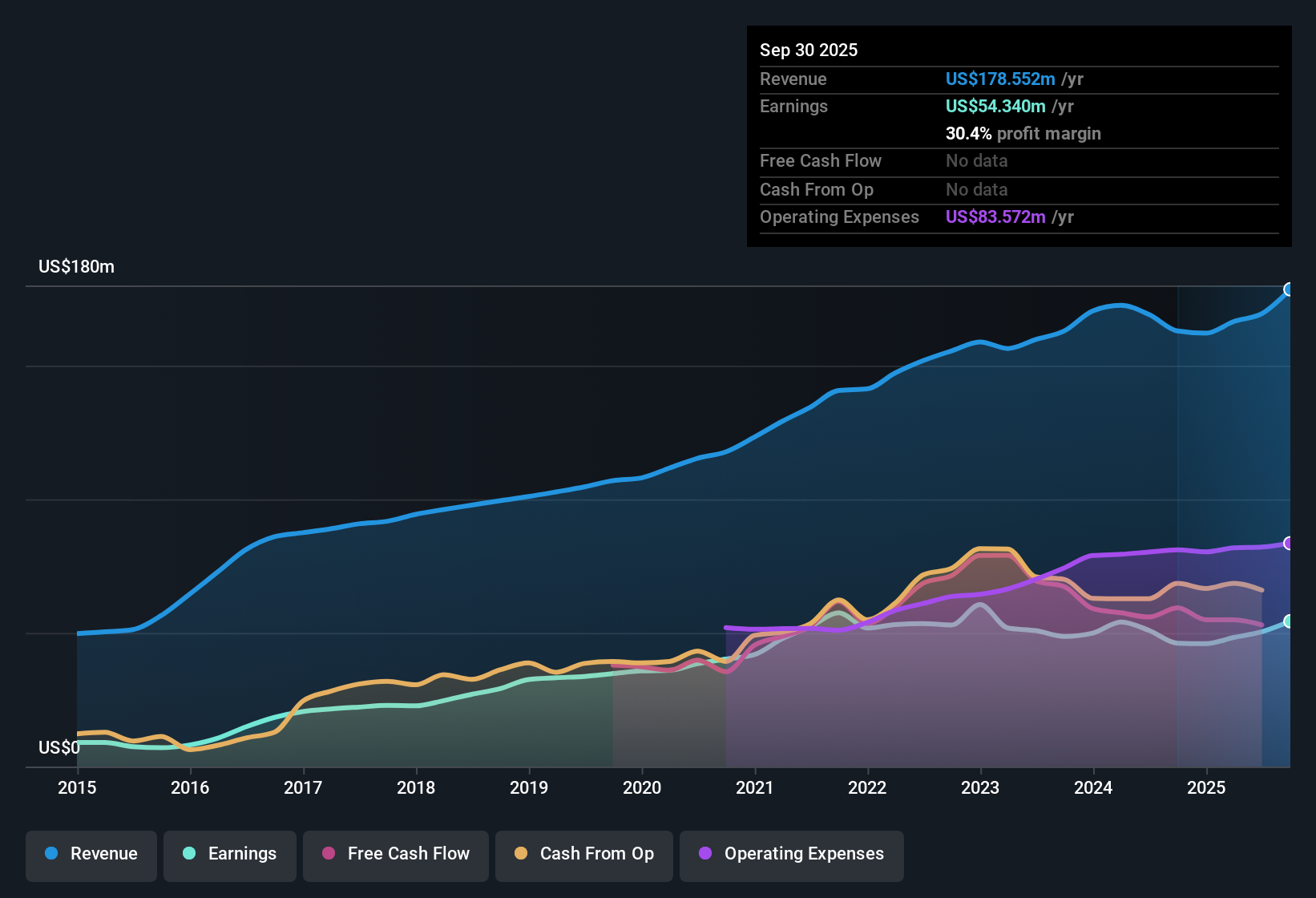

Farmers National Banc (FMNB) delivered net profit margins of 29.8%, holding steady compared to the prior 30.1%. Despite negative earnings growth over the last year and just 0.5% average annual growth over the past five years, the company is trading at a Price-to-Earnings ratio of 9.9x. This is well below both the peer average of 16.9x and the US Banks industry average of 11.2x. With shares priced at $13.28, notably under the estimated fair value of $30.57, investors are drawn to FMNB’s high quality earnings and the appeal of its attractive dividend alongside strong value metrics.

See our full analysis for Farmers National Banc.Next, let's see how these headline results hold up against the popular narratives. Some beliefs may be confirmed, while others could be put to the test as we dig into the story behind the numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Stay High Even as Growth Slows

- Net profit margin remains strong at 29.8%, only a slight decrease from 30.1% previously, reflecting continued operational efficiency despite recent negative profit growth.

- What is notable is that, while the headline margin is stable, average annual earnings growth over the last five years is just 0.5%, creating tension for investors who prioritize durability.

- This margin resilience, combined with minimal flagged risks in the filings, supports the idea that FMNB’s “high quality” earnings, often cited by optimists, are not merely the result of favorable market swings but point to operational reliability even in less robust markets.

- However, the muted topline expansion means bulls hoping for compounding upside may need to temper expectations for aggressive growth while steady margins protect the downside.

Dividend Appeal Adds to Valuation Case

- FMNB’s combination of an attractive dividend and a current Price-to-Earnings ratio of 9.9x stands out, especially when this multiple is well below both the peer group’s 16.9x and the industry’s 11.2x.

- Investors focused on value and steady income find the evidence sharply in their favor.

- The marked discount in valuation multiples, paired with FMNB’s consistent dividend, brings the bullish argument clearly into view, presenting a strong income stream at an unusually low entry price.

- No flagged risk factors in the latest filings means there is little in the recent data to undermine the appeal of this dividend and value mix right now.

Shares Trade at a Deep Discount to DCF Fair Value

- The current share price of $13.28 trades at more than a 55% discount to the DCF fair value of $30.57, making valuation the central talking point for those weighing FMNB’s upside.

- For investors parsing the big picture, the prevailing analysis highlights an unusual setup:

- Keeping net margins strong with almost no flagged risks, while trading at such a steep discount to DCF fair value and to peer multiples, positions FMNB as a stock whose valuation gap could close even if growth does not reaccelerate.

- Strong earnings quality plus a marked value gap leads many to focus less on recent slow growth and more on the potential for mean reversion should sentiment or sector momentum turn upward.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Farmers National Banc's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Farmers National Banc boasts resilient margins and value pricing, its near-flat average annual earnings growth highlights a lack of meaningful expansion for long-term investors.

If steady profit growth matters to you, focus on companies consistently building momentum by searching with our stable growth stocks screener (2093 results) screen instead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FMNB

Farmers National Banc

Operates as a bank holding company for The Farmers National Bank of Canfield that engages in the banking, trust, retirement consulting, insurance, and financial management businesses.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives