- United States

- /

- Banks

- /

- NasdaqCM:FMAO

Farmers & Merchants Bancorp (FMAO) Profit Margins Improve, Reinforcing Value Narrative

Reviewed by Simply Wall St

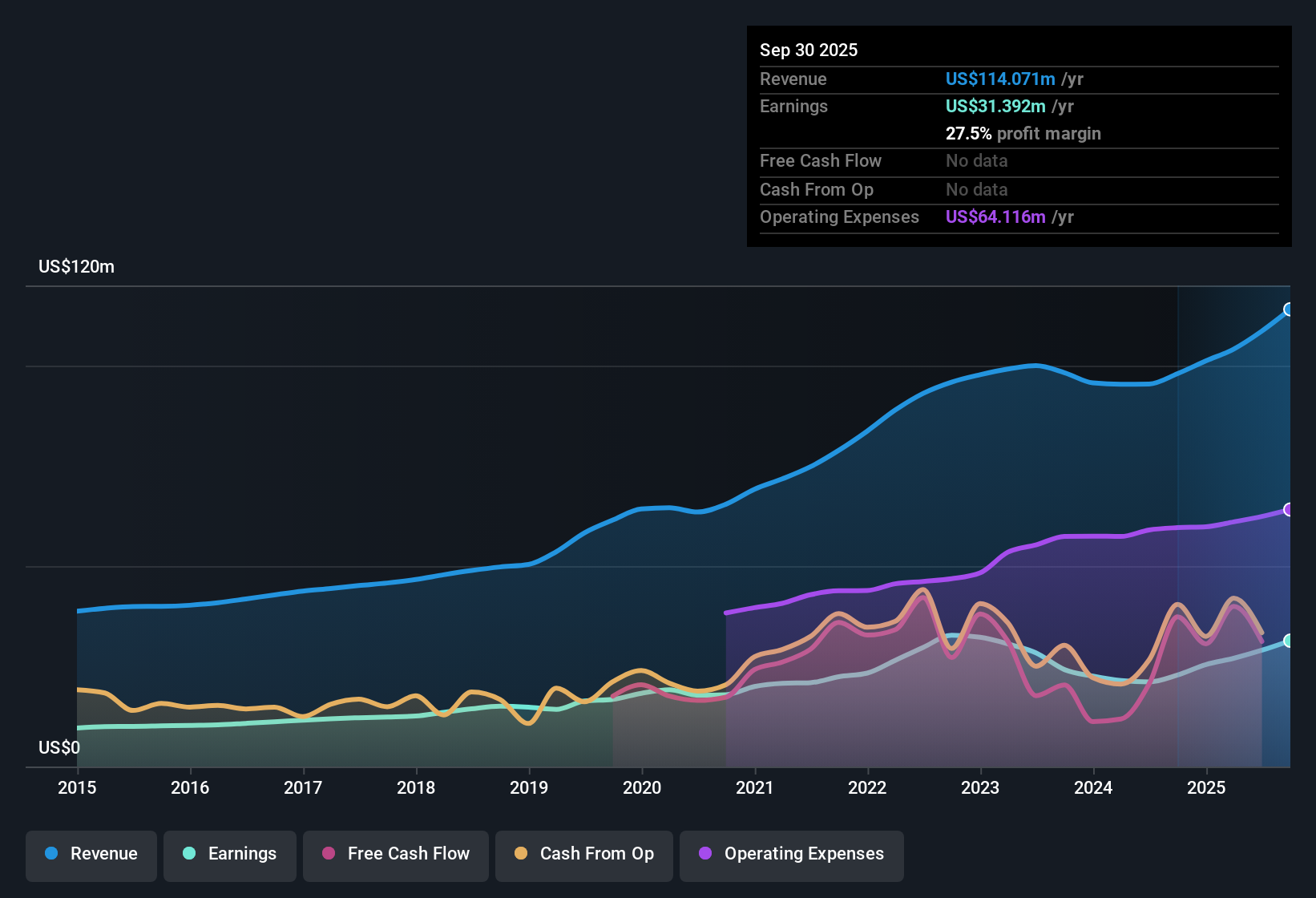

Farmers & Merchants Bancorp (FMAO) grew EPS by 37.5% over the past year, outpacing its 4.7% five-year annual average. Net profit margins improved to 27.5%, well above last year’s 23.3%. The company’s price-to-earnings ratio of 10.3x continues to sit below both peer and industry averages. Investors are likely watching as high quality earnings, attractive dividends, and solid margins position Farmers & Merchants Bancorp as a value standout, even as forecasted revenue and earnings growth trail the broader US market.

See our full analysis for Farmers & Merchants Bancorp.Up next, we’ll see how these results hold up against the current market narratives. Sometimes the story matches the numbers, but sometimes expectations get shaken up.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Beat Last Year's Levels

- Net profit margins have risen to 27.5%, higher than the prior year's 23.3%, showing improved profitability relative to recent history.

- What’s surprising is how this margin strength heavily supports the argument that Farmers & Merchants Bancorp stands out for earnings quality, even while annual revenue growth is forecast at just 2.3% per year, well below the broader US market’s 10.1%.

- Higher margins, paired with slow revenue growth, reinforce its reputation as a potential “conservative income play” rather than a growth story.

- This gap highlights the bank’s resilience in maintaining core profitability in a sector where many peers have come under pressure from policy and credit risks.

Dividend Appeal Underpins Value Case

- The company maintains an attractive dividend policy, explicitly cited as a reward factor alongside high-quality earnings and ongoing profit growth.

- The analysis notes that steady or growing dividends resonate with investors seeking yield, especially because the stock’s valuation, 10.3x price-to-earnings and below both peer and industry averages, makes the income attractive, not just the growth prospect.

- This combination of low valuation with an ongoing dividend dramatically bolsters the view that FMAO offers a defensive haven in today’s banking sector.

- Bulls point to the stock’s performance in delivering both income and capital stability as a key differentiator, even with muted growth expectations.

Share Price Lags DCF Fair Value by Over $13

- The current share price of $23.90 trades materially below discounted cash flow (DCF) fair value, which stands at $37.47, implying a theoretical upside of more than 55% if the DCF assumptions play out.

- Market watchers highlight that such a gap may indicate undervaluation, especially as the price-to-earnings ratio of 10.3x is below its peer (12.9x) and US Banks industry (11.2x) averages, further supporting the idea that the stock’s value drivers are not yet recognized by the broader market.

- However, the slow-forward growth profile, 8% earnings growth forecast vs. 15.6% for the US market, casts caution on how quickly that gap might close.

- This tension positions FMAO as a potential value play for patient investors looking for margin safety and upside, rather than rapid gains.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Farmers & Merchants Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite attractive margins and dividends, Farmers & Merchants Bancorp’s slow revenue and earnings growth forecast falls behind stronger US market peers.

If you want to target companies offering more consistent expansion, check out stable growth stocks screener (2117 results) that are delivering steady growth across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FMAO

Farmers & Merchants Bancorp

Operates as the bank holding company for The Farmers & Merchants State Bank that provides commercial banking services to individuals and small businesses in Northwest Ohio, Northeast Indiana, and Southeast Michigan.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives