- United States

- /

- Banks

- /

- NasdaqGS:FITB

Fifth Third Bancorp (NasdaqGS:FITB) Reports US$515 Million Net Income for First Quarter

Reviewed by Simply Wall St

Fifth Third Bancorp (NasdaqGS:FITB) reported a 4% decline in its share price over the past week, coinciding with the announcement of its Q1 2025 earnings. The company showed an increase in net interest income, reaching USD 1,437 million, although its net income slightly decreased to USD 515 million. Despite stability in earnings, broader market dynamics, including a 3% drop in major indexes, contributed to the decline. Concerns over economic conditions and lingering market volatility likely added to the downward pressure on the stock, as investors assessed potential headwinds across the financial sector.

You should learn about the 1 warning sign we've spotted with Fifth Third Bancorp.

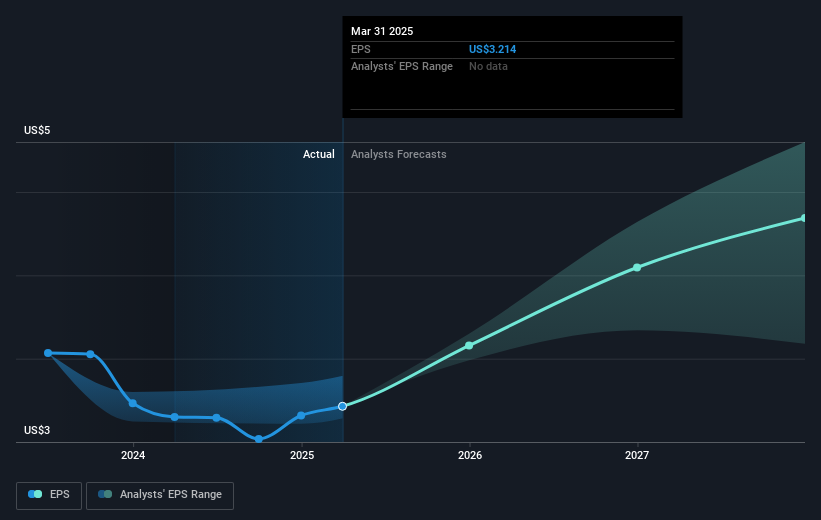

The recent 4% decline in Fifth Third Bancorp's share price following its Q1 2025 earnings announcement may influence investors' perceptions as they assess the company's narrative of growth through branch expansion and fintech partnerships. While the company's net interest income rose to US$1.44 billion, the slight decrease in net income to US$515 million raises questions about the potential impact on future revenue and earnings forecasts. This earnings performance occurs amidst broader market volatility, which likely compounds investor caution about the company's financial sector exposure.

Over a longer-term period of five years, Fifth Third Bancorp has achieved a total return of 153.72% when including share price gains and dividends, showcasing significant shareholder value creation. However, for the past year, the company's performance underperformed relative to both the US market and the US Banks industry, which returned 5.9% and 14.9% respectively. This context emphasizes the challenges the bank faces compared to the broader market and industry.

Despite the short-term decline, the current share price of US$33.42 remains 28.5% below the analyst consensus price target of US$46.74. This discount suggests potential upside if the company's strategic initiatives in fintech and branch expansion materialize as anticipated. However, fluctuations in interest rates and rising expenses from expansion could temper these prospects, necessitating a careful evaluation of the bank’s capacity to align its operational improvements with financial performance.

Evaluate Fifth Third Bancorp's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fifth Third Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FITB

Fifth Third Bancorp

Operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives