- United States

- /

- Banks

- /

- NasdaqGS:FHB

First Hawaiian (FHB): Exploring Valuation Perspectives After Recent Share Movement

Reviewed by Simply Wall St

First Hawaiian (FHB) shares have seen some movement lately, with their price changing by about 4% over the past month. Investors are now looking at how recent trends might impact the bank’s value in today’s environment.

See our latest analysis for First Hawaiian.

After a modest uptick over the last month, First Hawaiian’s recent momentum stands in contrast with its longer-term results. The bank’s 1-year total shareholder return sits at -7.17%, yet investors who stuck around for the past three or five years are still comfortably up, with gains of 7.04% and 38.40% respectively. The latest share price of $24.25 reflects a period where sentiment has bounced between heightened caution and renewed optimism, a pattern not uncommon for regional banks navigating today’s shifting landscape.

If you’re interested in discovering where else momentum and ownership trends are intersecting, it’s worth exploring fast growing stocks with high insider ownership

With shares now trading at a noticeable discount to analyst targets, but with recent gains already factored in, the key question stands: Is First Hawaiian undervalued, or are markets already pricing in any future growth?

Most Popular Narrative: 11.3% Undervalued

The narrative points to a fair value of $27.33 for First Hawaiian, noticeably above the last close price of $24.25. The narrative’s numbers rest on key assumptions about loan demand and profit margins in Hawaii’s unique banking landscape.

The bank's robust deposit franchise, underpinned by a strong local brand and deep customer relationships, has allowed for stable deposit growth and maintained a high proportion of noninterest-bearing deposits. This puts First Hawaiian in a favorable position to benefit from net interest margin expansion as interest rates normalize.

Curious about what’s powering this valuation? Analysts are betting on the endurance of strong margins and deposit trends, anchored by ambitious forecasts for future growth and profitability. What surprising metrics set this price apart from the market’s? Uncover the numbers and logic that could reshape your perspective on First Hawaiian’s upside.

Result: Fair Value of $27.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as potential declines in deposits or greater competition in Hawaii. Both of these factors could weigh on margins and future earnings.

Find out about the key risks to this First Hawaiian narrative.

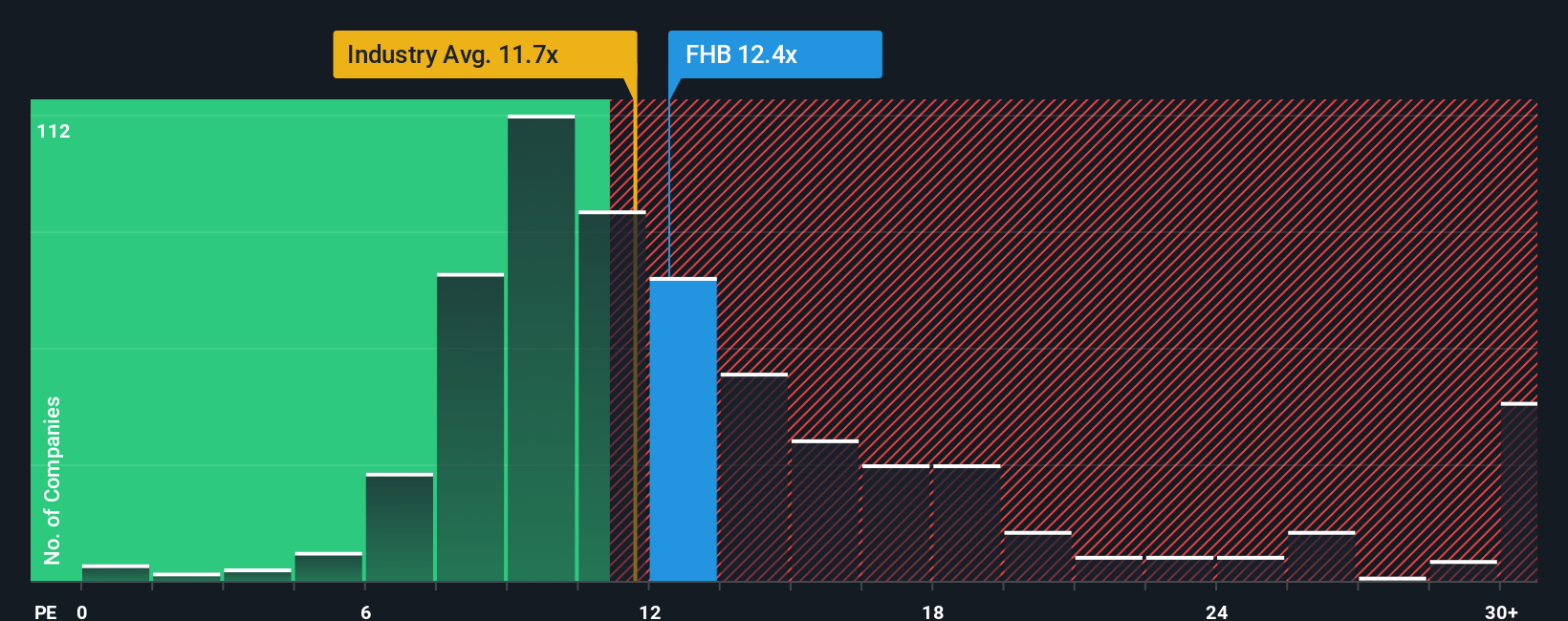

Another View: Industry Price Ratio Perspective

Looking beyond growth forecasts, First Hawaiian is currently priced at 11.6 times earnings, which is higher than both the US Banks industry average of 11.2x and the fair ratio of 10.4x. This suggests investors might be paying up for perceived stability; however, it introduces valuation risk if market sentiment shifts. Could these market comparisons signal more limited upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Hawaiian Narrative

If the current analysis doesn’t fully capture your own view or you’re curious to dive into the underlying data, you can put together your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Hawaiian.

Looking for more smart investment ideas?

Don’t leave opportunity on the table. The market is full of exciting trends and overlooked gems. Use these focused ideas to sharpen your watchlist and outpace the crowd.

- Grow your portfolio’s income by targeting reliable yield with these 16 dividend stocks with yields > 3%, offering strong returns above 3%.

- Tap into innovation early by spotting breakthroughs with these 25 AI penny stocks, leaders in AI and automation advancements.

- Maximize potential value with these 886 undervalued stocks based on cash flows, which screens for companies trading below what their fundamentals suggest they’re worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FHB

First Hawaiian

Operates as a bank holding company for First Hawaiian Bank that provides a range of banking products and services to consumer and commercial customers in the United States.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives