- United States

- /

- Banks

- /

- NasdaqGS:FHB

A Look at First Hawaiian (FHB) Valuation After Strong Q3 Earnings Beat and Operational Momentum

Reviewed by Simply Wall St

First Hawaiian (FHB) delivered stronger than expected third-quarter results, with revenue and profit both topping forecasts. Management credited effective cost control and healthy deposit trends for the improved performance.

See our latest analysis for First Hawaiian.

First Hawaiian's upbeat Q3 results, along with news of a fresh share buyback and dividend affirmation, help explain the recent pick-up in its stock price. While the share price return for 2025 remains slightly negative, strong earnings have boosted sentiment and contributed to a one-year total shareholder return of 4.4%. Long-term holders are still well ahead, with total return topping 12% over three years and 71% over five years. This demonstrates resilience and steady value creation even as market momentum ebbs and flows.

If you’re looking to widen your search beyond the usual names, consider exploring fast growing stocks with high insider ownership for discovery opportunities in companies with standout growth and engaged leadership.

With earnings and deposits trending positively, and shares still trading below analyst price targets, the key question now is whether First Hawaiian remains undervalued or if the market has already priced in future growth. Is there a real buying opportunity here?

Most Popular Narrative: 4.3% Undervalued

First Hawaiian's most widely followed narrative points to a fair value just above the recent closing price, suggesting a modest upside potential for investors. The narrative hinges on Hawaii’s favorable macro trends and how these are shaping the bank’s outlook.

The ongoing expansion in Hawaii's population and consistently rising tourism spending are supporting stable to growing demand for loans and banking services, which should lead to gradually increasing loan balances and higher fee-based revenue over time. Strategic investments and progress in digital banking adoption are enabling First Hawaiian to maintain expense discipline, streamline operations, and attract and retain younger customers. This combination will likely support margin improvement and cost-to-income ratio reduction.

Curious about the secret sauce behind this valuation? One set of bullish assumptions combines local economic tailwinds and digital transformation to drive the case. Want to uncover the crucial forecasts that tip the scales? Explore the full story to see what makes this price target tick.

Result: Fair Value of $26.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent deposit declines or increased competition for loans could challenge the case for further upside in First Hawaiian shares.

Find out about the key risks to this First Hawaiian narrative.

Another View: Market Ratios Tell a Different Story

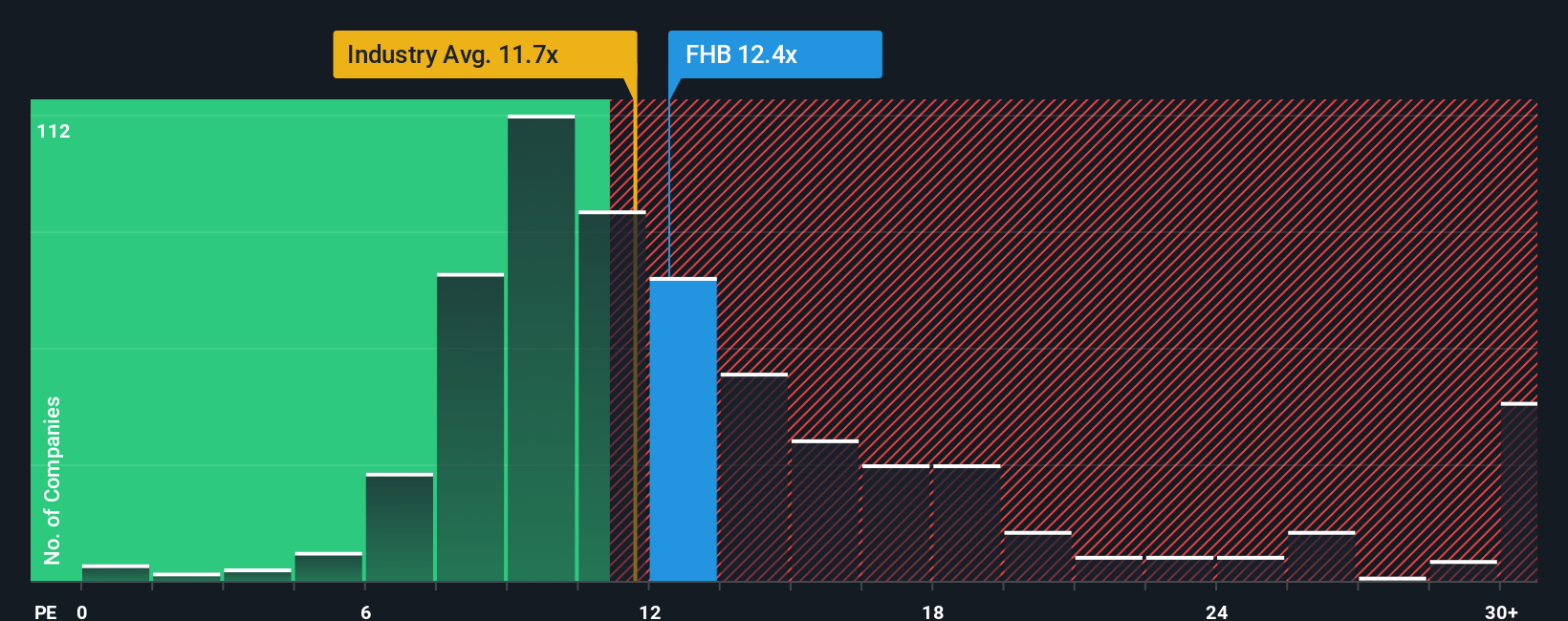

Despite the narrative suggesting First Hawaiian is modestly undervalued, a look at its price-to-earnings ratio paints a more cautionary picture. The company trades at 12x earnings, making it pricier than both its industry peers (11.2x) and even its fair ratio of 11.4x. This means investors today are paying more for each dollar of earnings than they would for similar banks, raising questions about valuation risk if expectations fall short. Is the premium justified? Could a reversion to the mean set in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Hawaiian Narrative

If you see things differently or want to dig deeper into the data yourself, you can craft your own analysis in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding First Hawaiian.

Looking for More Investment Ideas?

Don’t let the next wave of market leaders pass you by. Uncover fresh opportunities that align with your financial goals using these powerful screeners from Simply Wall St.

- Unlock high yields and beat low-rate savings by reviewing these 19 dividend stocks with yields > 3%, which offers reliable income potential and proven payout histories.

- Jump ahead of market trends by targeting innovation-driven growth in these 27 AI penny stocks, which may benefit from artificial intelligence breakthroughs.

- Position yourself for big moves by tracking these 3554 penny stocks with strong financials, designed to highlight rapid gains and hidden value in overlooked corners of the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FHB

First Hawaiian

Operates as a bank holding company for First Hawaiian Bank that provides a range of banking products and services to consumer and commercial customers in the United States.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives